Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2377 pomy Maya and Stephan have saved over $300,000 in each of their RRSPs. They are tuning 71 this year and the RRSPs must

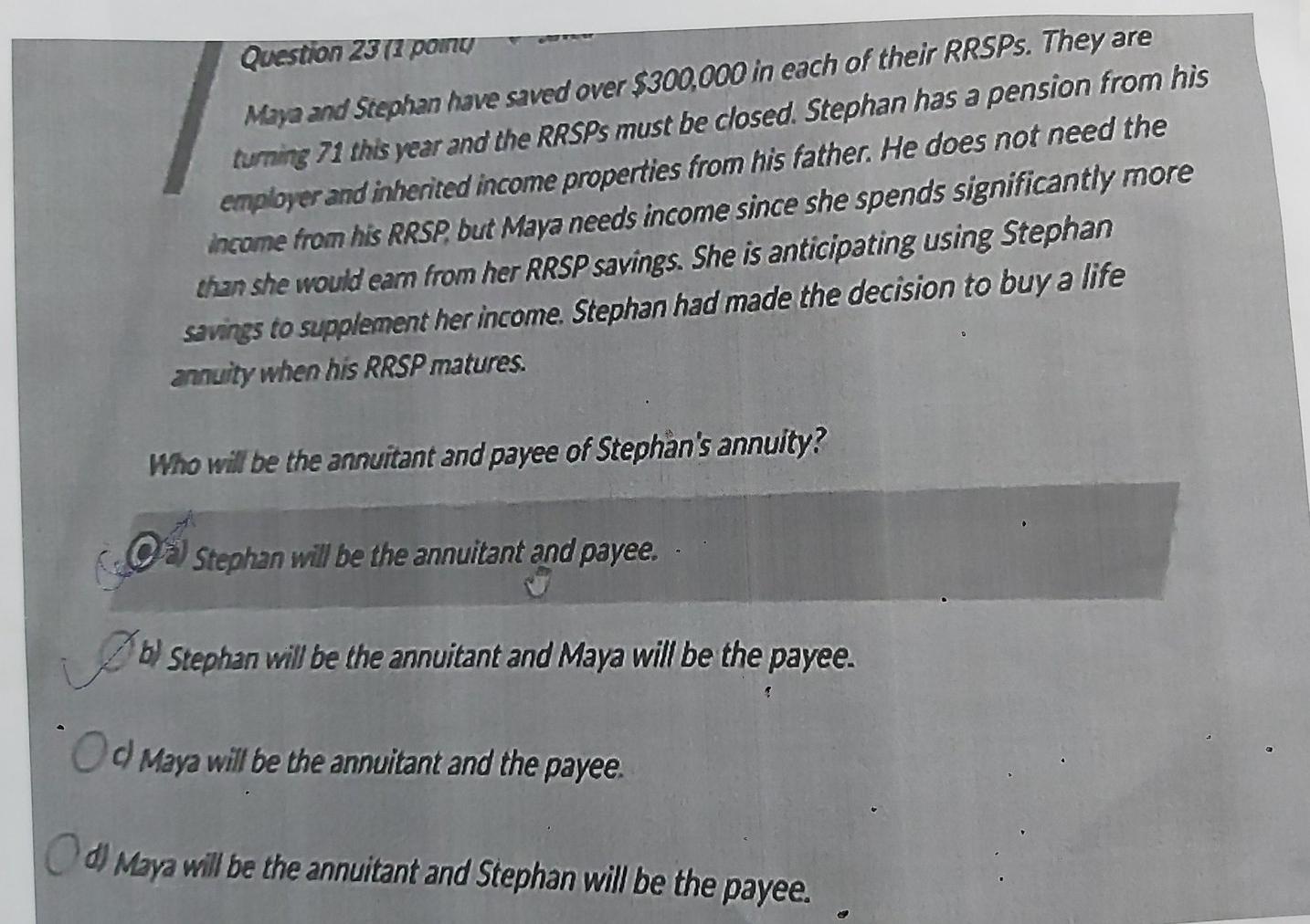

Question 2377 pomy Maya and Stephan have saved over $300,000 in each of their RRSPs. They are tuning 71 this year and the RRSPs must be closed. Stephan has a pension from his employer and inherited income properties from his father. He does not need the income from his RRSP, but Maya needs income since she spends significantly more than she would eam from her RRSP savings. She is anticipating using Stephan savings to supplement her income. Stephan had made the decision to buy a life amuity when his RRSP matures. Who will be the annuitant and payee of Stephan's annuity? ) Stephan will be the annuitant and payee. b) Stephan will be the annuitant and Maya will be the payee. Od Maya will be the annuitant and the payee. d) Maya will be the annuitant and Stephan will be the payee

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started