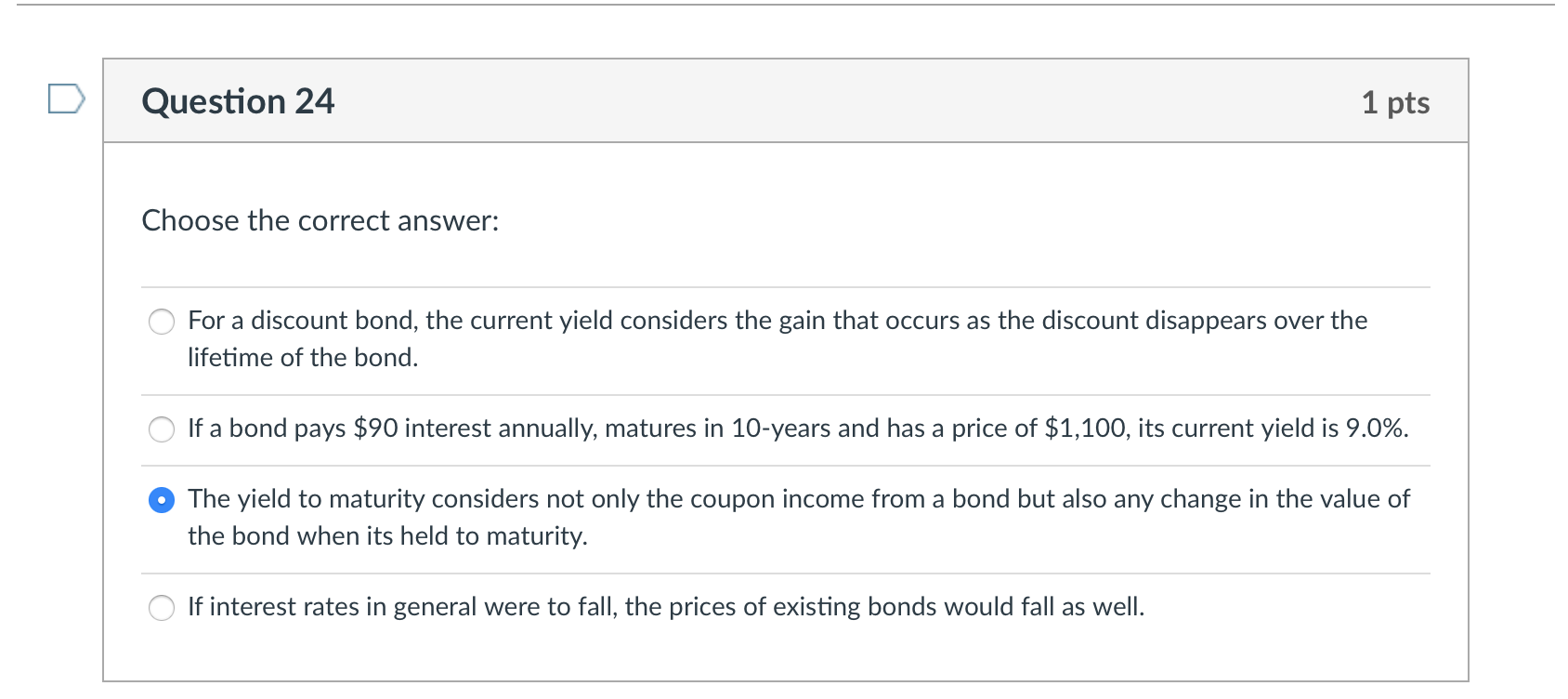

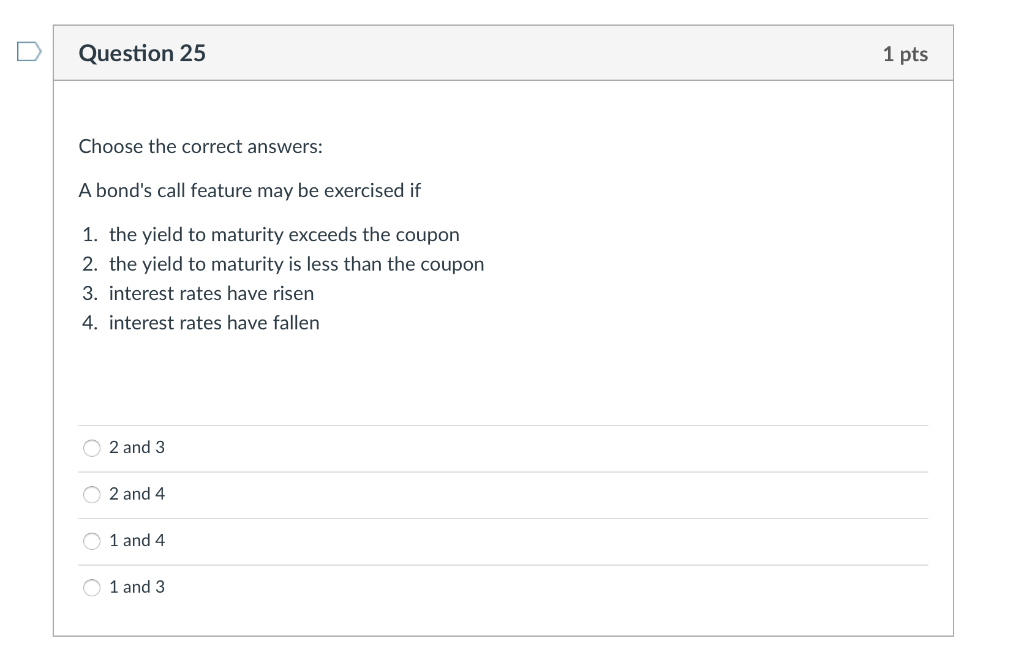

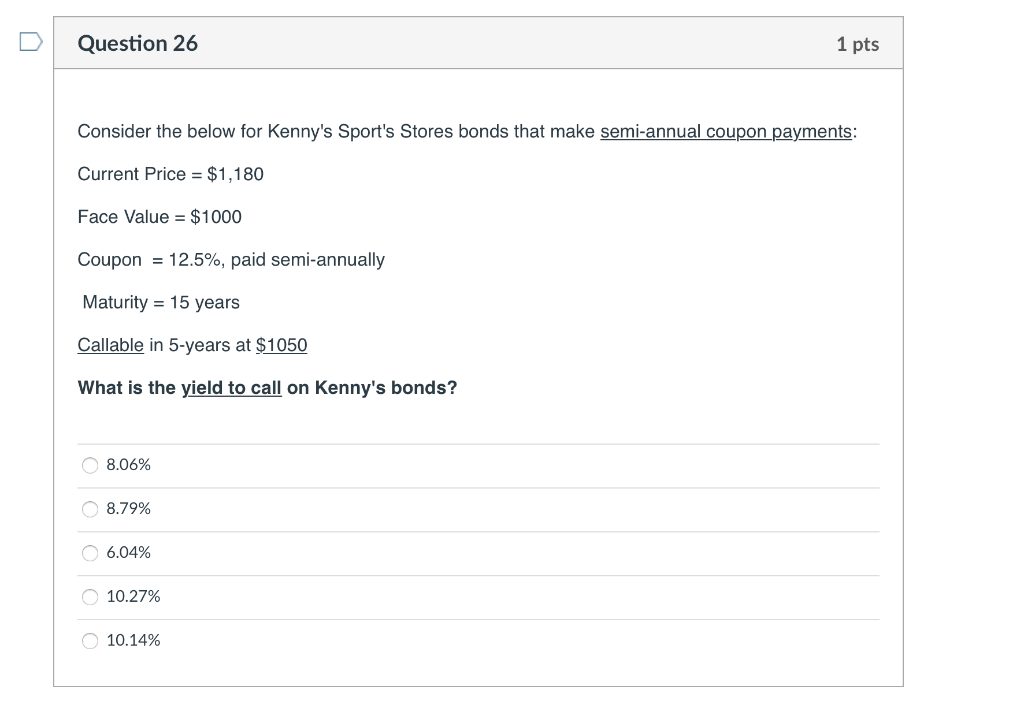

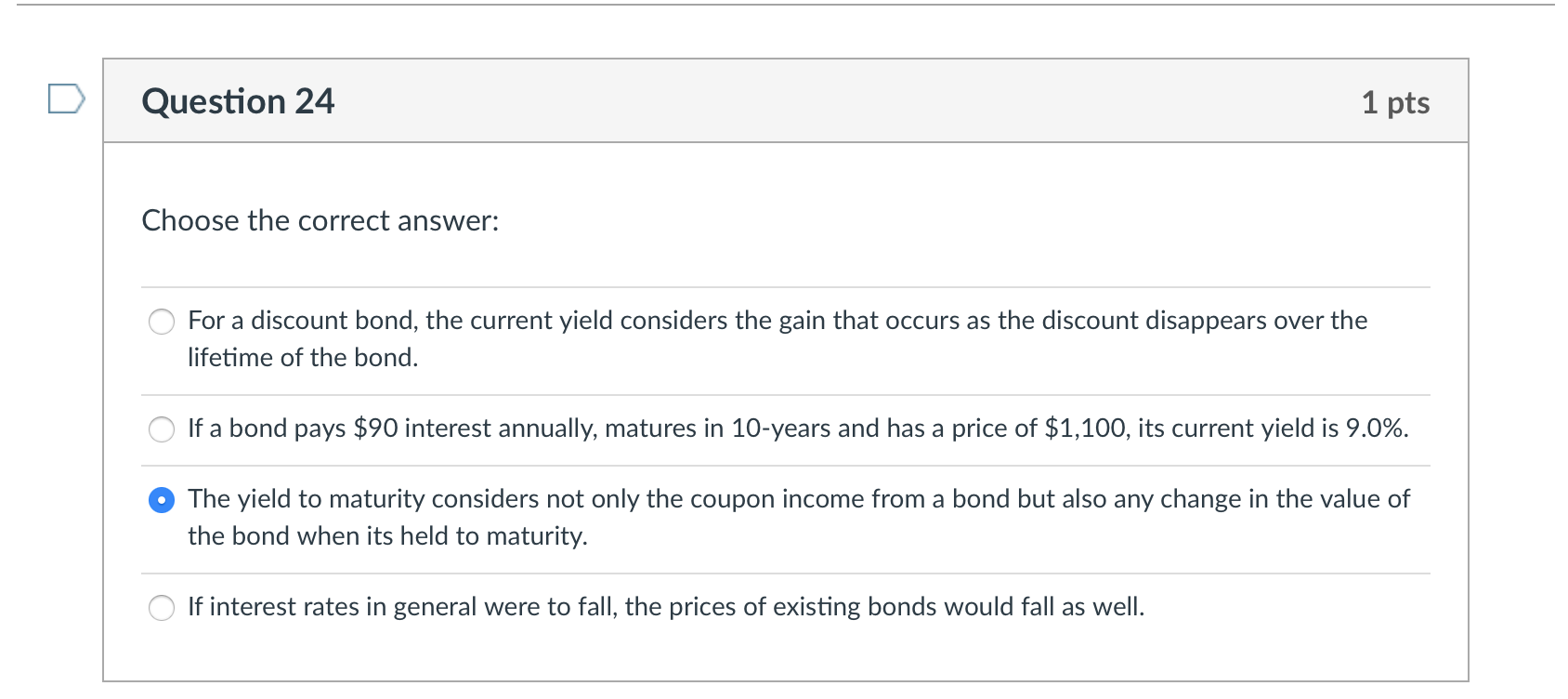

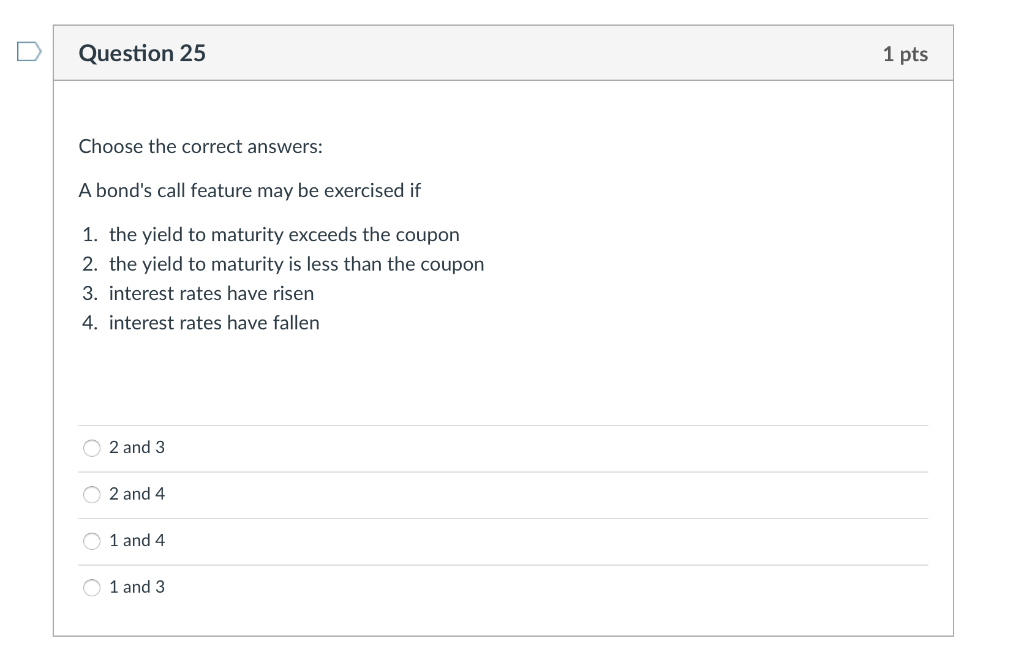

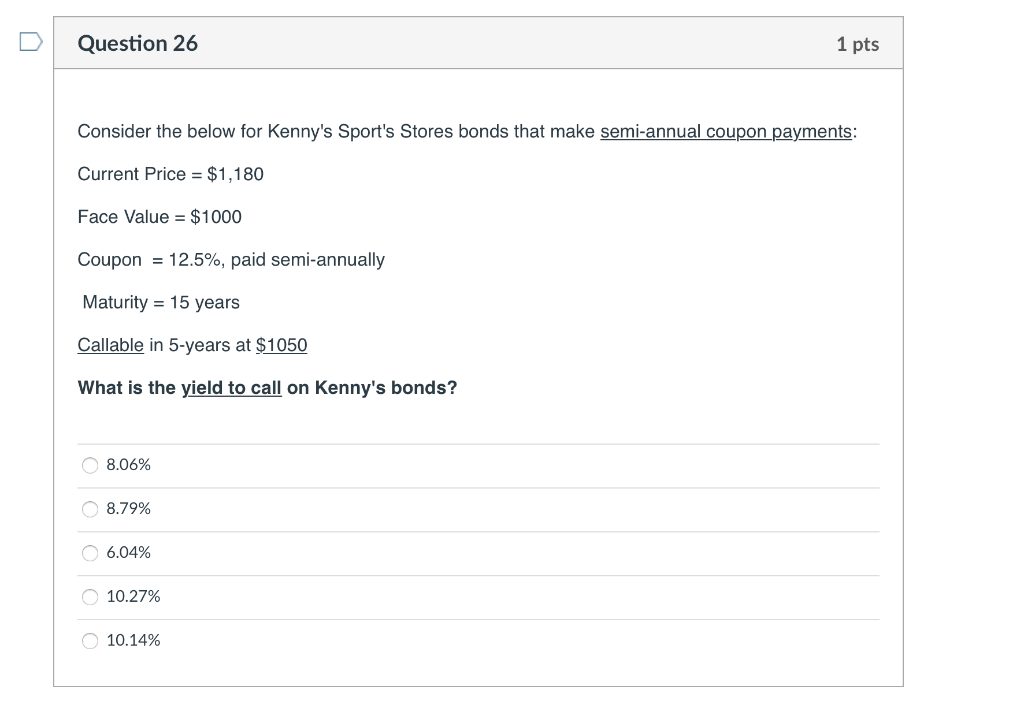

Question 24 1 pts Choose the correct answer: For a discount bond, the current yield considers the gain that occurs as the discount disappears over the lifetime of the bond. If a bond pays $90 interest annually, matures in 10-years and has a price of $1,100, its current yield is 9.0%. The yield to maturity considers not only the coupon income from a bond but also any change in the value of the bond when its held to maturity. If interest rates in general were to fall, the prices of existing bonds would fall as well. Question 25 1 pts Choose the correct answers: A bond's call feature may be exercised if 1. the yield to maturity exceeds the coupon 2. the yield to maturity is less than the coupon 3. interest rates have risen 4. interest rates have fallen 2 and 3 2 and 4 O1 and 4 0 1 and 3 Question 26 1 pts Consider the below for Kenny's Sport's Stores bonds that make semi-annual coupon payments: Current Price = $1,180 Face Value = $1000 Coupon = 12.5%, paid semi-annually Maturity = 15 years Callable in 5-years at $1050 What is the yield to call on Kenny's bonds? 8.06% 8.79% 6.04% 10.27% 10.14% Question 24 1 pts Choose the correct answer: For a discount bond, the current yield considers the gain that occurs as the discount disappears over the lifetime of the bond. If a bond pays $90 interest annually, matures in 10-years and has a price of $1,100, its current yield is 9.0%. The yield to maturity considers not only the coupon income from a bond but also any change in the value of the bond when its held to maturity. If interest rates in general were to fall, the prices of existing bonds would fall as well. Question 25 1 pts Choose the correct answers: A bond's call feature may be exercised if 1. the yield to maturity exceeds the coupon 2. the yield to maturity is less than the coupon 3. interest rates have risen 4. interest rates have fallen 2 and 3 2 and 4 O1 and 4 0 1 and 3 Question 26 1 pts Consider the below for Kenny's Sport's Stores bonds that make semi-annual coupon payments: Current Price = $1,180 Face Value = $1000 Coupon = 12.5%, paid semi-annually Maturity = 15 years Callable in 5-years at $1050 What is the yield to call on Kenny's bonds? 8.06% 8.79% 6.04% 10.27% 10.14%