Answered step by step

Verified Expert Solution

Question

1 Approved Answer

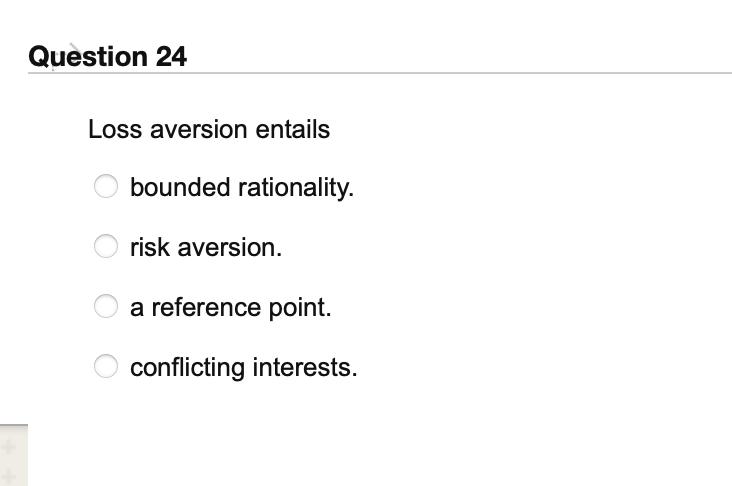

Question 24 Loss aversion entails bounded rationality. risk aversion. a reference point. conflicting interests. 10 points Save Ans The board of ABC firm voted

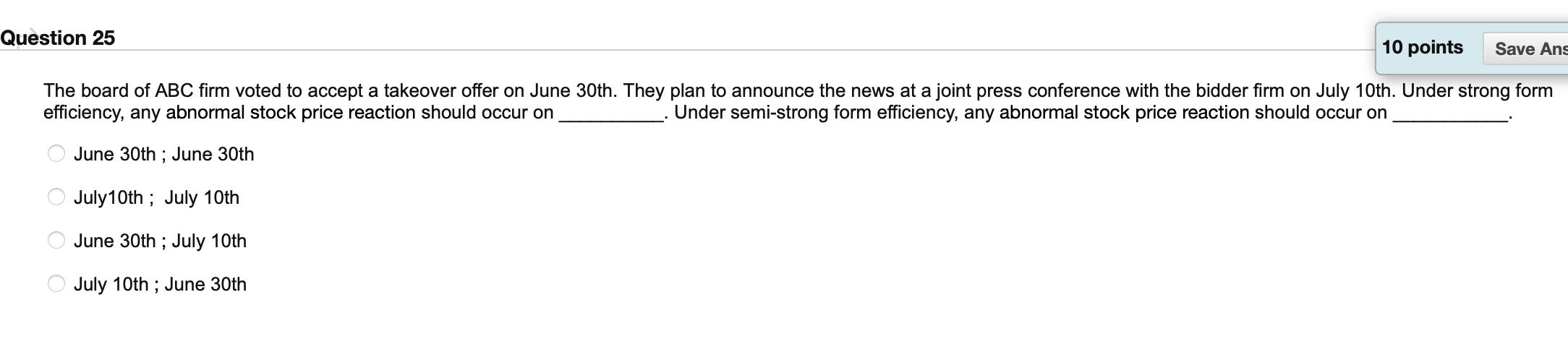

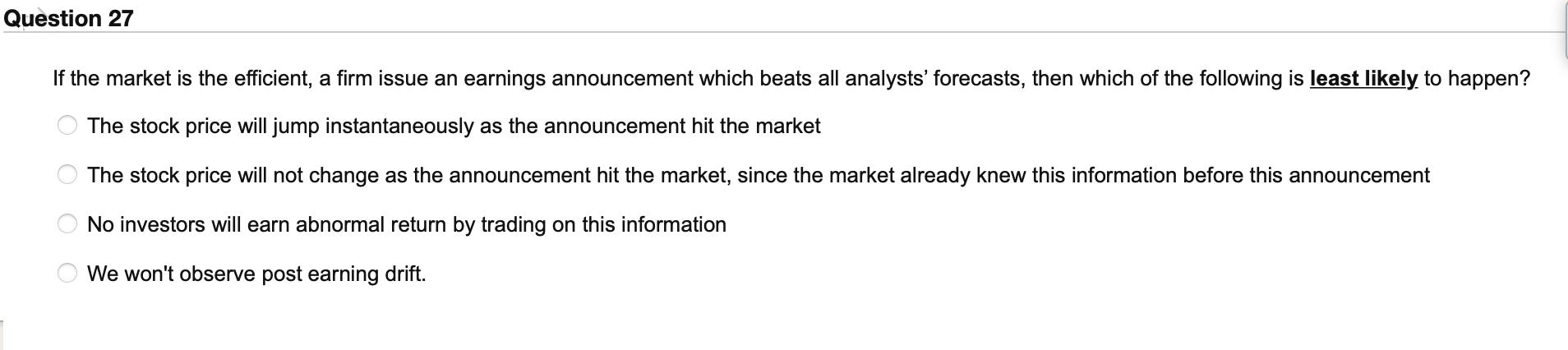

Question 24 Loss aversion entails bounded rationality. risk aversion. a reference point. conflicting interests. 10 points Save Ans The board of ABC firm voted to accept a takeover offer on June 30th. They plan to announce the news at a joint press conference with the bidder firm on July 10th. Under strong form efficiency, any abnormal stock price reaction should occur on Under semi-strong form efficiency, any abnormal stock price reaction should occur on June 30th ; June 30th Question 25 July 10th; July 10th June 30th ; July 10th July 10th ; June 30th Question 27 If the market is the efficient, a firm issue an earnings announcement which beats all analysts' forecasts, then which of the following is least likely to happen? The stock price will jump instantaneously as the announcement hit the market The stock price will not change as the announcement hit the market, since the market already knew this information before this announcement No investors will earn abnormal return by trading on this information We won't observe post earning drift. OOO

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Answers and Explanations Question 24 Loss aversion entails The correct answer is a refere...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started