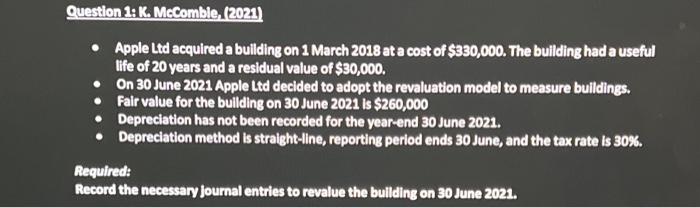

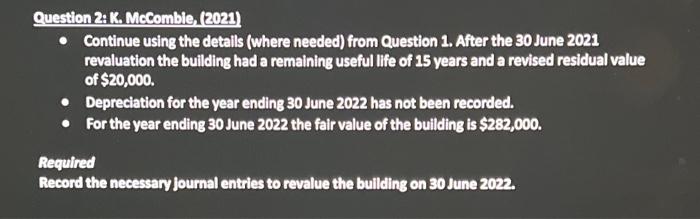

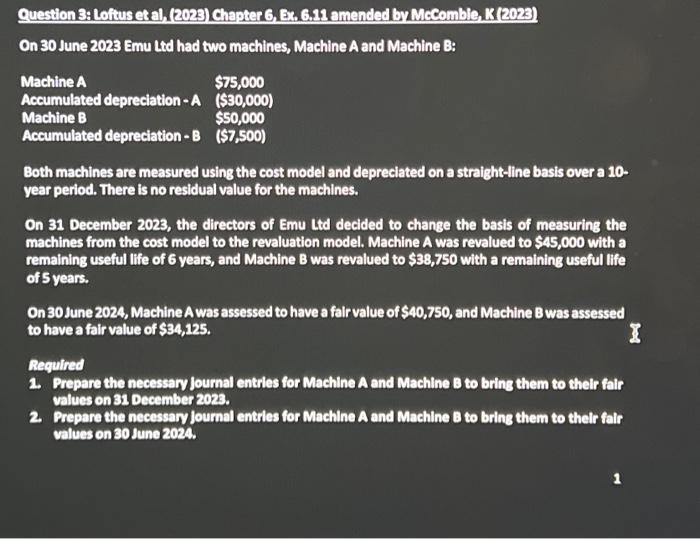

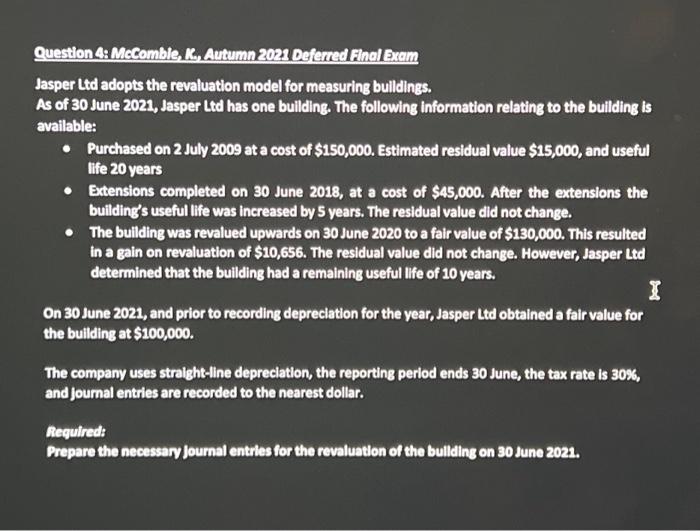

Question 24 M. Macombie, (2021) - Apple Ltd acquired a bullding on 1 March 2018 at a cost of $330,000. The building had a useful life of 20 years and a residual value of $30,000. - On 30 June 2021 Apple Ltd decided to adopt the revaluation model to measure buildings. - Fair value for the bullding on 30 June 2021 is $260,000 - Depreciation has not been recorded for the year-end 30 June 2021. - Depreciation method is straight-line, reporting period ends 30 June, and the tax rate is 30%. Required: Record the necessary journal entries to revalue the bullding on 30 June 2021 . Question 24 K. Mocomble, (2023) - Continue using the detalls (where needed) from Question 1. After the 30 June 2021 revaluation the building had a remaining useful life of 15 years and a revised residual value of $20,000. - Depreciation for the year ending 30 June 2022 has not been recorded. - For the year ending 30 June 2022 the fair value of the building is $282,000. Required Record the necessary Journal entries to revalue the bullding on 30 June 2022. Question 3: loftus et al, (2023) Chapter.6, Ex, 6.11 amended by Mrcomble, (Z(2023) On 30 June 2023 Emu Ltd had two machines, Machine A and Machine B: Both machines are measured using the cost model and depreciated on a straight-line basis over a 10year period. There is no residual value for the machines. On 31 December 2023, the directors of Emu Ltd decided to change the basis of measuring the machines from the cost model to the revaluation model. Machine A was revalued to $45,000 with a remaining useful life of 6 years, and Machine B was revalued to $38,750 with a remaining useful life of 5 years. On 30 June 2024, Machine A was assessed to have a fair value of $40,750, and Machine Bwas assessed to have a fair value of $34,125. Required 1. Prepare the necessary Joumal entrles for Machine A and Machine B to bring them to thelr falr values on 31 December 2023. 2. Prepare the necessary Journal entrles for Machline A and Machine B to bring them to their falr values on 30 June 2024 . 1 Quetion 4: Mocomble, L. A trumn 2021 Deferced Elacl Sxom Jasper Ltd adopts the revaluation model for measuring bulldings. As of 30 June 2021, Jasper Ltd has one building. The following information relating to the building is available: - Purchased on 2 July 2009 at a cost of $150,000. Estimated residual value $15,000, and useful life 20 years - Extensions completed on 30 June 2018, at a cost of $45,000. After the extensions the building's useful life was increased by 5 years. The residual value did not change. - The building was revalued upwards on 30 June 2020 to a fair value of $130,000. This resulted in a gain on revaluation of $10,656. The residual value did not change. However, Jasper Ltd determined that the building had a remaining useful life of 10 years. On 30 June 2021, and prior to recording depreciation for the year, Jasper Ltd obtained a fair value for the buliding at $100,000. The company uses straight-line depreclation, the reporting period ends 30 June, the tax rate is 30%, and joumal entries are recorded to the nearest dollar. Required Prepare the necessary Journal entrles for the revaluation of the bullding on 30 June 2021