Answered step by step

Verified Expert Solution

Question

1 Approved Answer

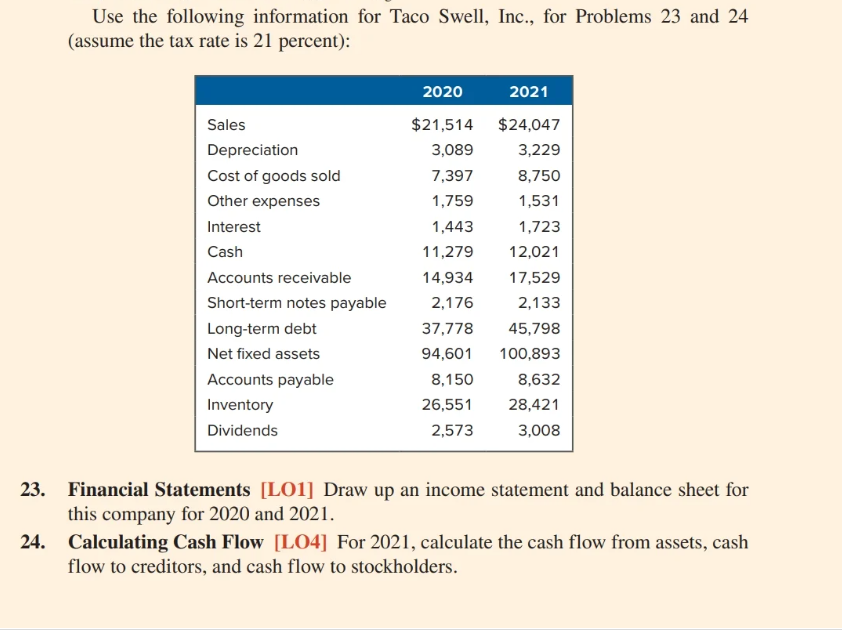

Question 24! please Use the following information for Taco Swell, Inc., for Problems 23 and 24 (assume the tax rate is 21 percent): begin{tabular}{|lrr|} hline

Question 24! please

Use the following information for Taco Swell, Inc., for Problems 23 and 24 (assume the tax rate is 21 percent): \begin{tabular}{|lrr|} \hline & 2020 & \multicolumn{1}{c|}{2021} \\ \hline Sales & $21,514 & $24,047 \\ Depreciation & 3,089 & 3,229 \\ Cost of goods sold & 7,397 & 8,750 \\ Other expenses & 1,759 & 1,531 \\ Interest & 1,443 & 1,723 \\ Cash & 11,279 & 12,021 \\ Accounts receivable & 14,934 & 17,529 \\ Short-term notes payable & 2,176 & 2,133 \\ Long-term debt & 37,778 & 45,798 \\ Net fixed assets & 94,601 & 100,893 \\ Accounts payable & 8,150 & 8,632 \\ Inventory & 26,551 & 28,421 \\ Dividends & 2,573 & 3,008 \\ \hline \end{tabular} 23. Financial Statements [LO1] Draw up an income statement and balance sheet for this company for 2020 and 2021. 24. Calculating Cash Flow [LO4] For 2021, calculate the cash flow from assets, cash flow to creditors, and cash flow to stockholdersStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started