Answered step by step

Verified Expert Solution

Question

1 Approved Answer

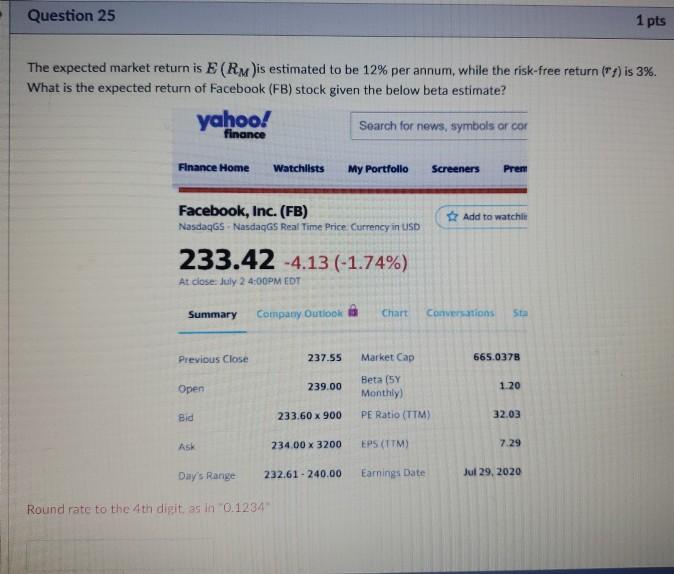

Question 25 1 pts The expected market return is E (RM)is estimated to be 12% per annum, while the risk-free return (f) is 3%. What

Question 25 1 pts The expected market return is E (RM)is estimated to be 12% per annum, while the risk-free return ("f) is 3%. What is the expected return of Facebook (FB) stock given the below beta estimate? yahoo! finance Search for news, symbols or cor Finance Home Watchlists My Portfolio Screeners Prem Add to watchin Facebook, Inc. (FB) NasdaqGS - Nasdaqos Real Time Price Currency in USD 233.42 -4.13 (-1.74%) At close: July 2 4:00PM EDT Summary Company Outlook Chart Conversations 5t Previous Close 237.55 Market Cap 665.0378 Open 239.00 Beta (5Y Monthly) 120 Bid 233.60 x 900 PE Ratio (TTM) 32.03 ASH 234.00 x 3200 EPS (TTM) 7.29 Day's Range 232.61 - 240.00 Earnings Date Jul 29, 2020 Round rate to the 4th digitas in 0.1234

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started