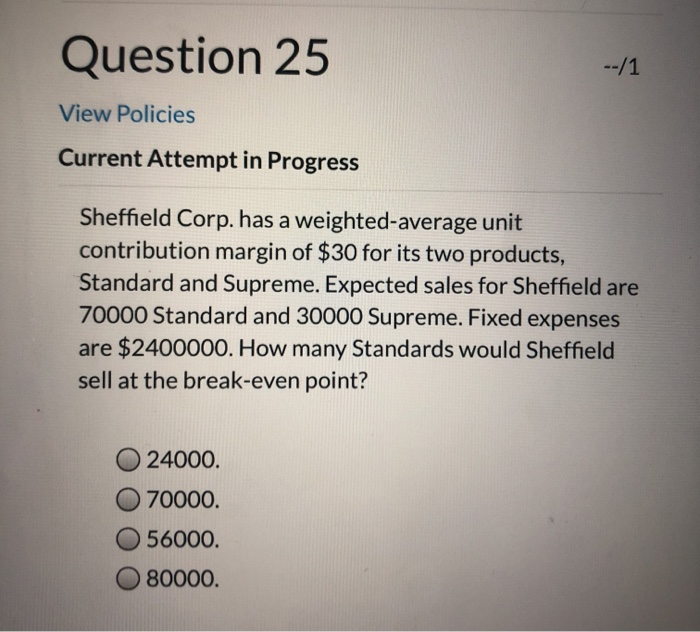

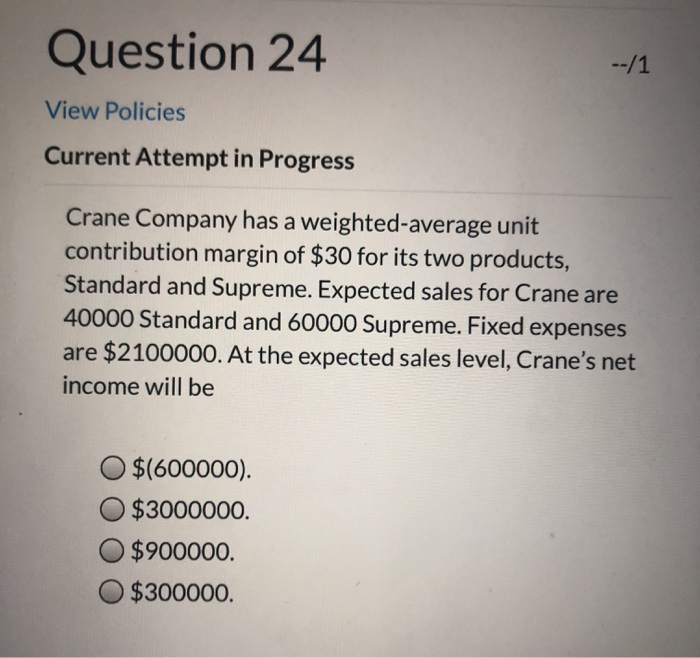

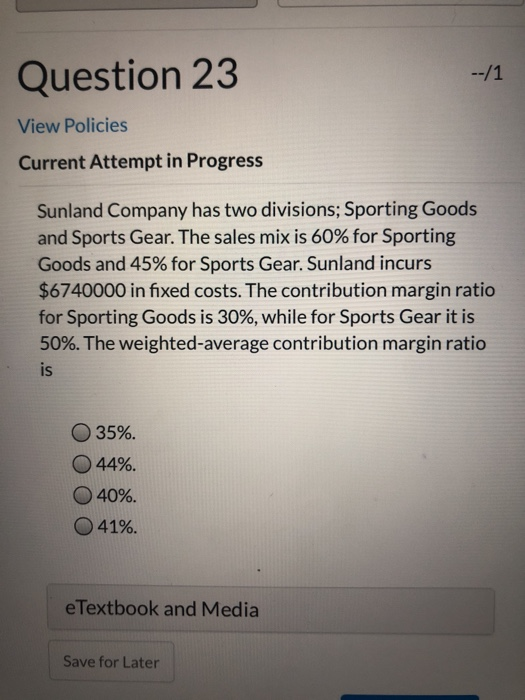

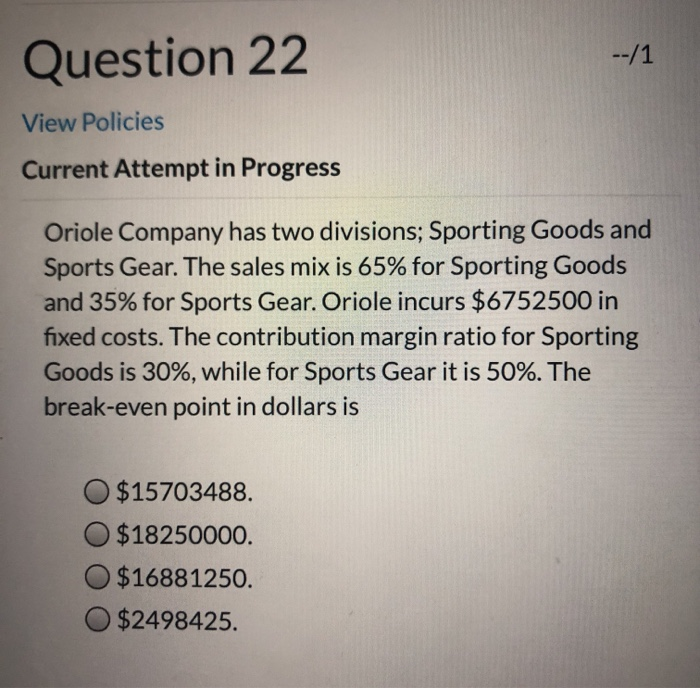

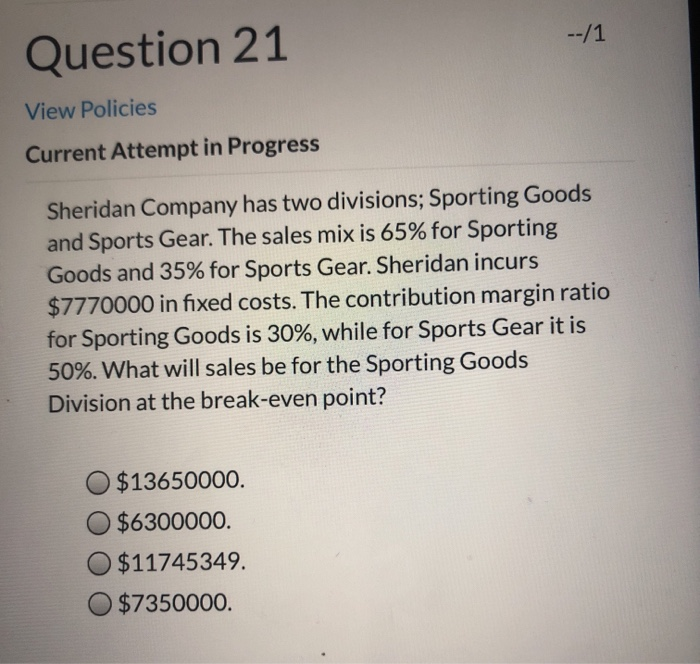

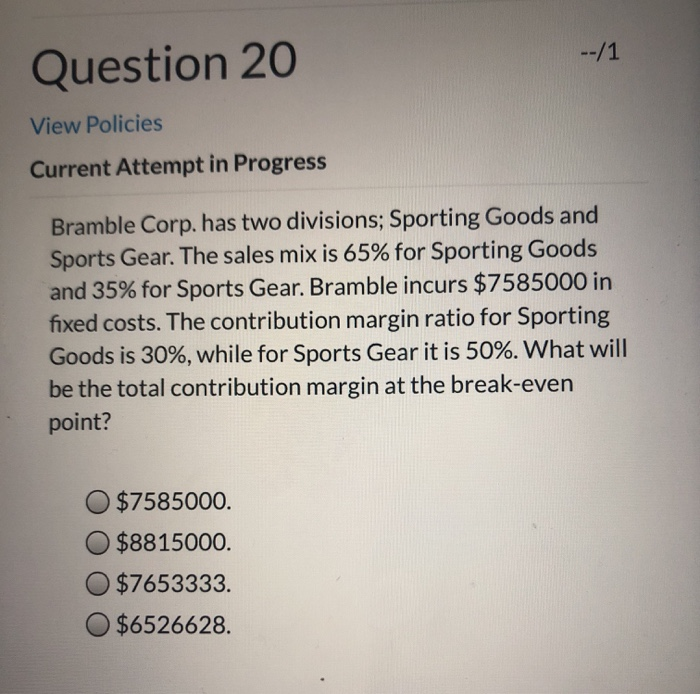

Question 25 --/1 View Policies Current Attempt in Progress Sheffield Corp. has a weighted-average unit contribution margin of $30 for its two products, Standard and Supreme. Expected sales for Sheffield are 70000 Standard and 30000 Supreme. Fixed expenses are $2400000. How many Standards would Sheffield sell at the break-even point? 24000. O 70000. 56000. O 80000. Question 24 --11 View Policies Current Attempt in Progress Crane Company has a weighted-average unit contribution margin of $30 for its two products, Standard and Supreme. Expected sales for Crane are 40000 Standard and 60000 Supreme. Fixed expenses are $2100000. At the expected sales level, Crane's net! income will be O $(600000). $3000000 O$900000. O $300000. Question 23 --/1 View Policies Current Attempt in Progress Sunland Company has two divisions; Sporting Goods and Sports Gear. The sales mix is 60% for Sporting Goods and 45% for Sports Gear. Sunland incurs $6740000 in fixed costs. The contribution margin ratio for Sporting Goods is 30%, while for Sports Gear it is 50%. The weighted average contribution margin ratio 35%. 44%. O 40% 41%. e Textbook and Media Save for Later Question 22 View Policies Current Attempt in Progress Oriole Company has two divisions; Sporting Goods and Sports Gear. The sales mix is 65% for Sporting Goods and 35% for Sports Gear. Oriole incurs $6752500 in fixed costs. The contribution margin ratio for Sporting Goods is 30%, while for Sports Gear it is 50%. The break-even point in dollars is $15703488 $18250000. $16881250. O $2498425. --/1 Question 21 View Policies Current Attempt in Progress Sheridan Company has two divisions; Sporting Goods and Sports Gear. The sales mix is 65% for Sporting Goods and 35% for Sports Gear. Sheridan incurs $7770000 in fixed costs. The contribution margin ratio for Sporting Goods is 30%, while for Sports Gear it is 50%. What will sales be for the Sporting Goods Division at the break-even point? O $13650000. O $6300000. O $11745349. $7350000. --/1 Question 20 View Policies Current Attempt in Progress Bramble Corp. has two divisions; Sporting Goods and Sports Gear. The sales mix is 65% for Sporting Goods and 35% for Sports Gear. Bramble incurs $7585000 in fixed costs. The contribution margin ratio for Sporting Goods is 30%, while for Sports Gear it is 50%. What will be the total contribution margin at the break-even point? O $7585000. O $8815000. $7653333 O $6526628