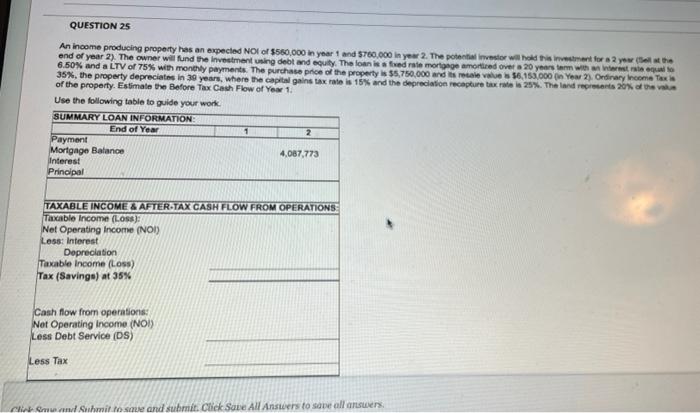

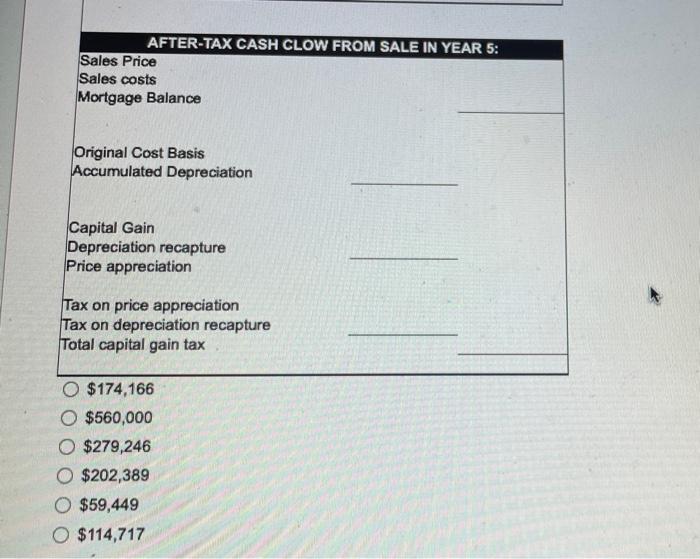

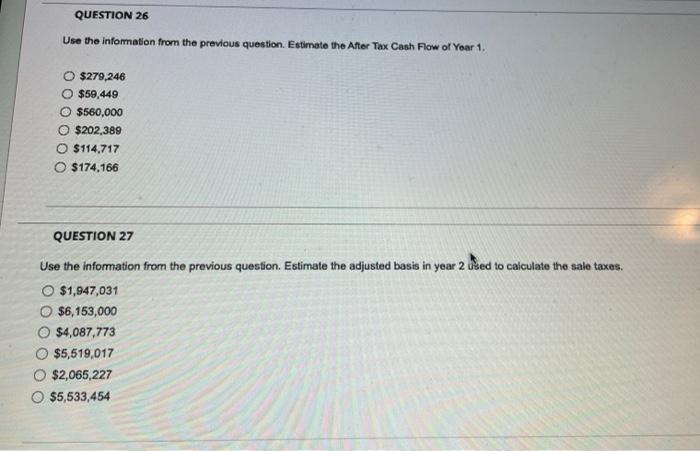

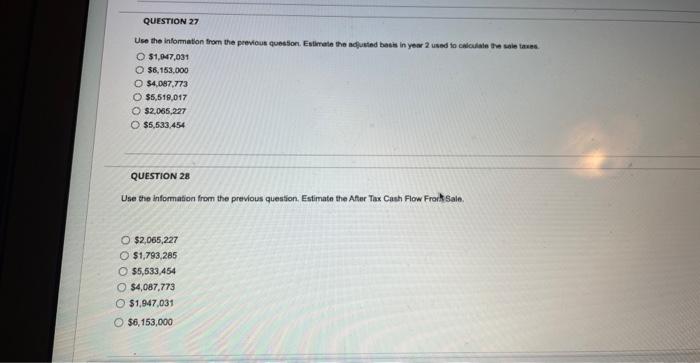

QUESTION 25 An income producing propery has an expected NOI of $560,000 in year 1 and 5760.000 in yeu 2 . The potectial imvestor wam hald this invisument for a 2 yes (Ifell at hi 6.50% and a LTV of 75% with monthly payments. The purchase price of the property is 55,750,000 and its recale value is 56,153 , 000 (in Yoar 2 , Ondinary hoome Tax is of the property. Estimale the Before Tax Cash Flow of Year 1. Use the following table to guide your work: SUMMARY LOAN INFORMATION: Cash fiow firom operations: Net Operating income (NO.) Less Debt Service (DS) AFTER-TAX CASH CLOW FROM SALE IN YEAR 5: Sales Price Sales costs Mortgage Balance Original Cost Basis Accumulated Depreciation Capital Gain Depreciation recapture Price appreciation Tax on price appreciation Tax on depreciation recapture Total capital gain tax $174,166 $560,000 $279,246 $202,389 $59,449 $114,717 Use the information from the previous question. Estimate the After Tax Cash Flow of Yoar 1. $279,246$59,449$560,000$202,389$114,717$174,166 QUESTION 27 Use the information from the previous question. Estimate the adjusted basis in year 2 Used to calculate the sale taxes. $1,947,031$6,153,000$4,087,773$5,519,017$2,065,227$5,533,454 Use the information from the previous quessor. Eslinath the adusted basis in year 2 used to calculale the sale tases. 51,047,031$6,153,000$4,097,773$5,519,017$2,065,227$5,533,454 QUESTION 28 Use the information from the previous question. Estimate the Ater Tax Cash Flow Frork Sale. $2,065,227$1,793,285$5,533,454$4,057,773$1,947,03156,153,000 QUESTION 25 An income producing propery has an expected NOI of $560,000 in year 1 and 5760.000 in yeu 2 . The potectial imvestor wam hald this invisument for a 2 yes (Ifell at hi 6.50% and a LTV of 75% with monthly payments. The purchase price of the property is 55,750,000 and its recale value is 56,153 , 000 (in Yoar 2 , Ondinary hoome Tax is of the property. Estimale the Before Tax Cash Flow of Year 1. Use the following table to guide your work: SUMMARY LOAN INFORMATION: Cash fiow firom operations: Net Operating income (NO.) Less Debt Service (DS) AFTER-TAX CASH CLOW FROM SALE IN YEAR 5: Sales Price Sales costs Mortgage Balance Original Cost Basis Accumulated Depreciation Capital Gain Depreciation recapture Price appreciation Tax on price appreciation Tax on depreciation recapture Total capital gain tax $174,166 $560,000 $279,246 $202,389 $59,449 $114,717 Use the information from the previous question. Estimate the After Tax Cash Flow of Yoar 1. $279,246$59,449$560,000$202,389$114,717$174,166 QUESTION 27 Use the information from the previous question. Estimate the adjusted basis in year 2 Used to calculate the sale taxes. $1,947,031$6,153,000$4,087,773$5,519,017$2,065,227$5,533,454 Use the information from the previous quessor. Eslinath the adusted basis in year 2 used to calculale the sale tases. 51,047,031$6,153,000$4,097,773$5,519,017$2,065,227$5,533,454 QUESTION 28 Use the information from the previous question. Estimate the Ater Tax Cash Flow Frork Sale. $2,065,227$1,793,285$5,533,454$4,057,773$1,947,03156,153,000