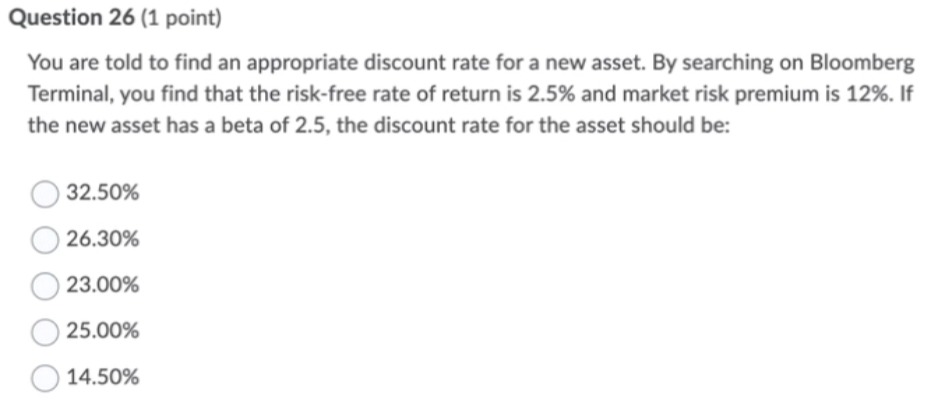

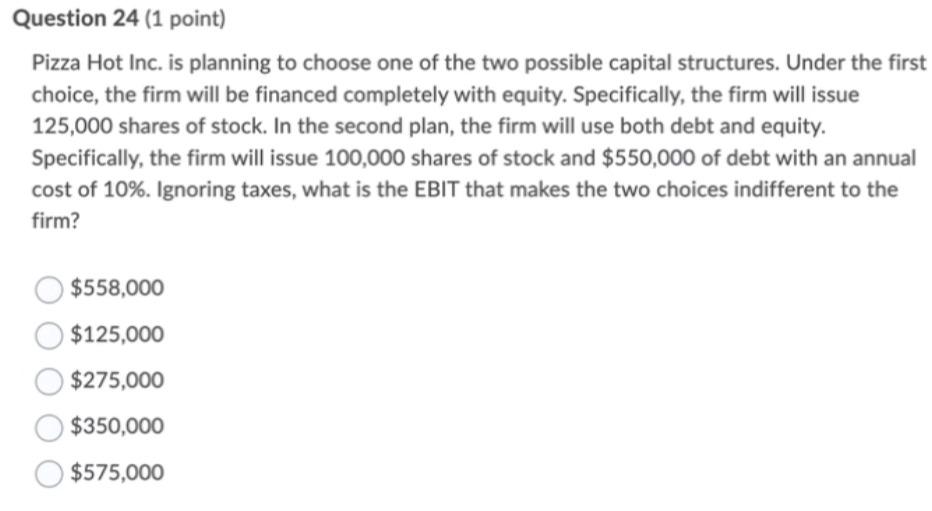

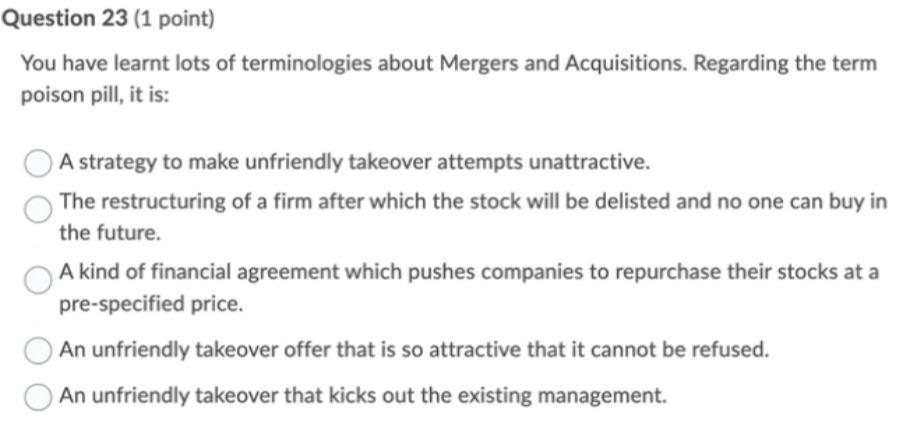

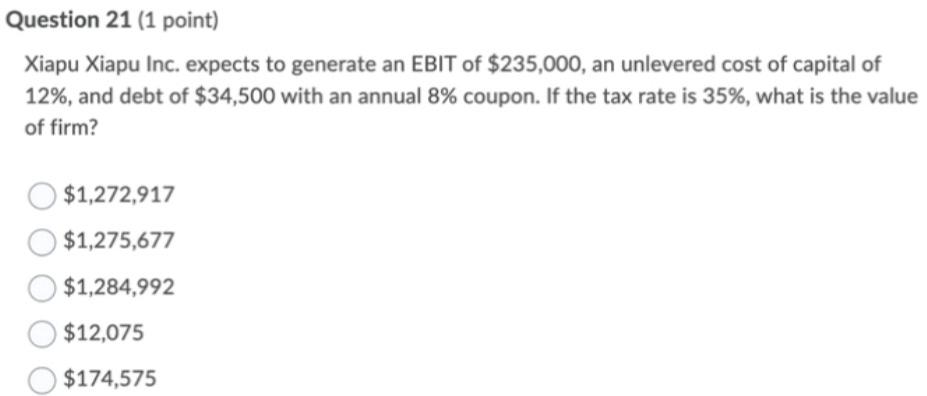

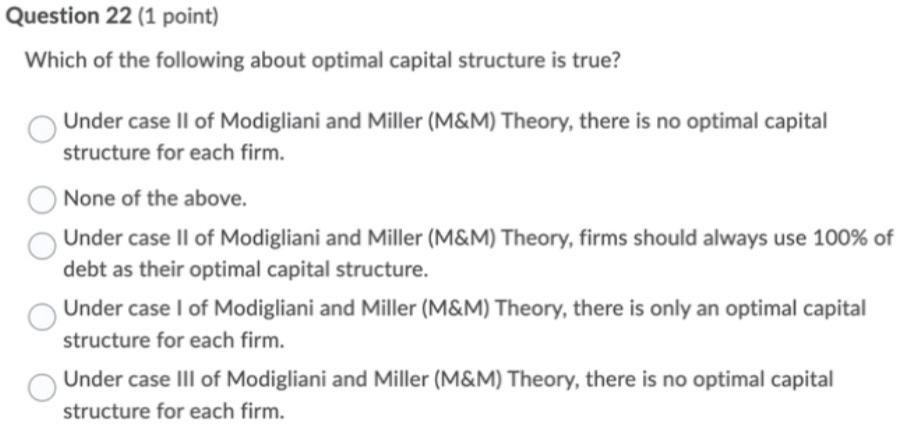

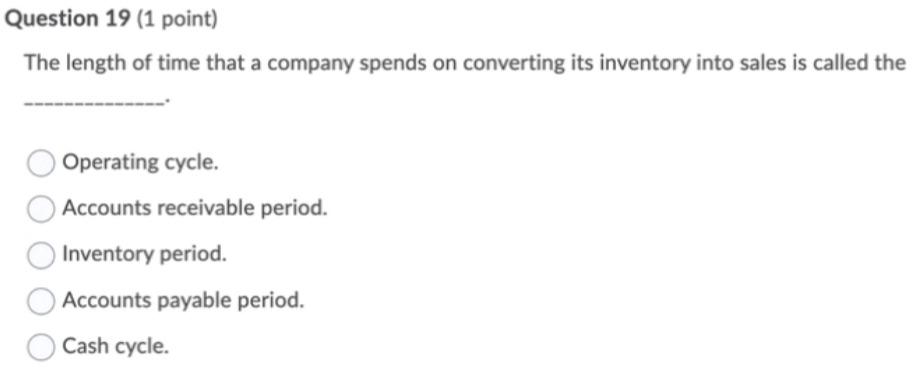

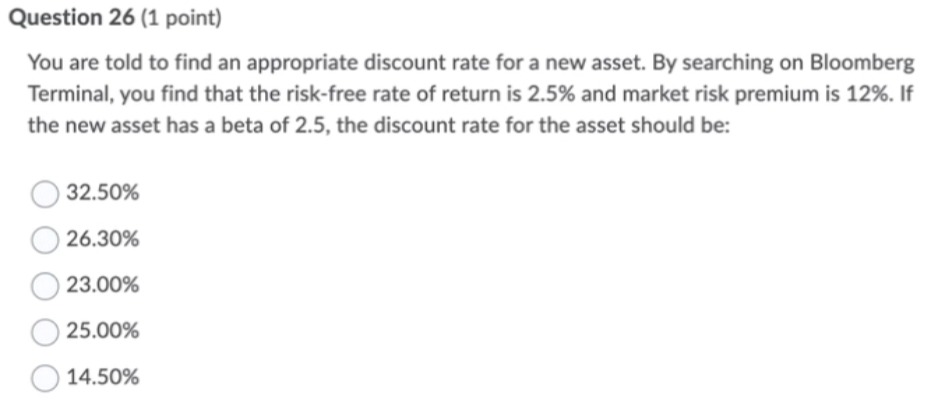

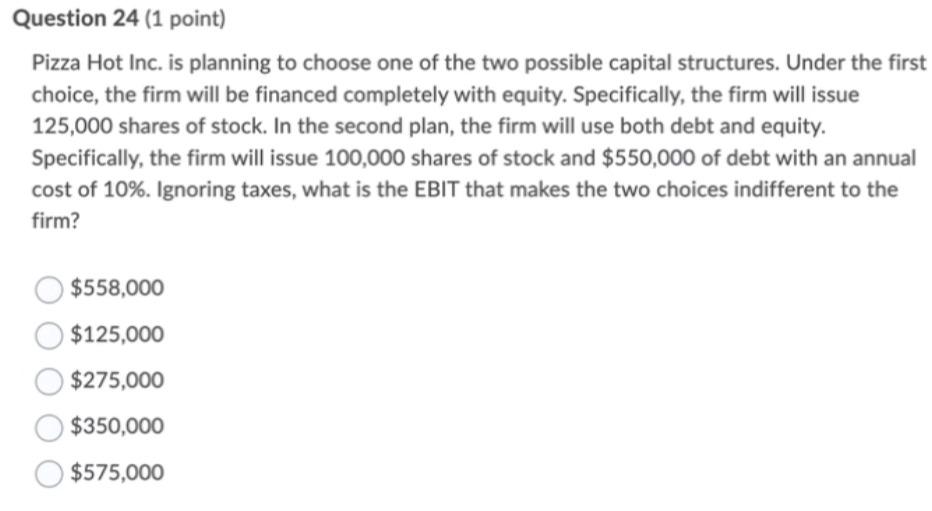

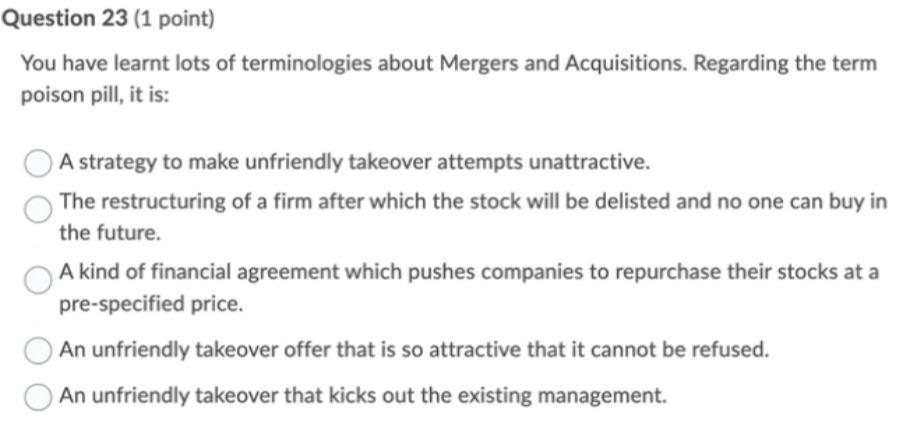

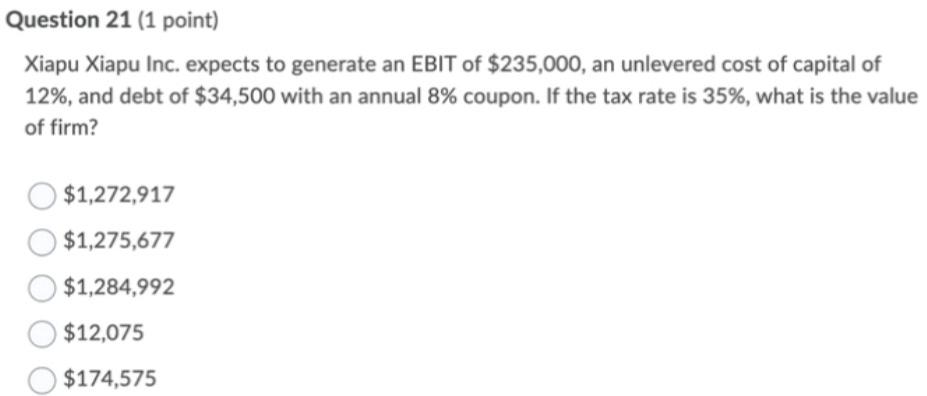

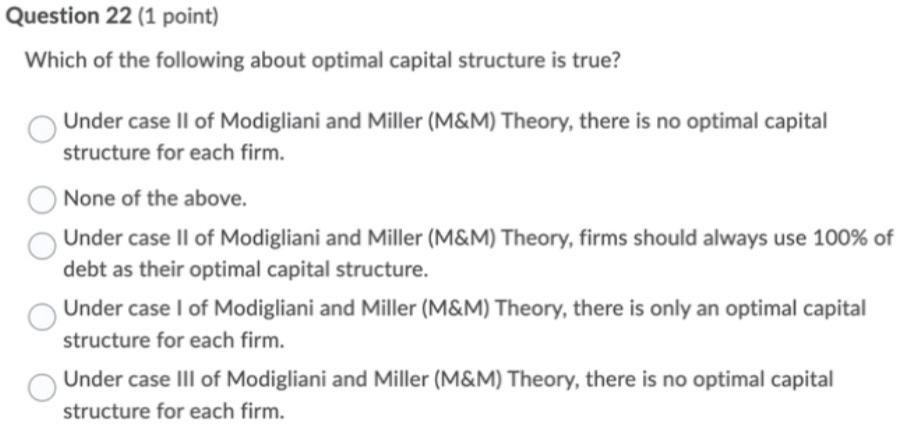

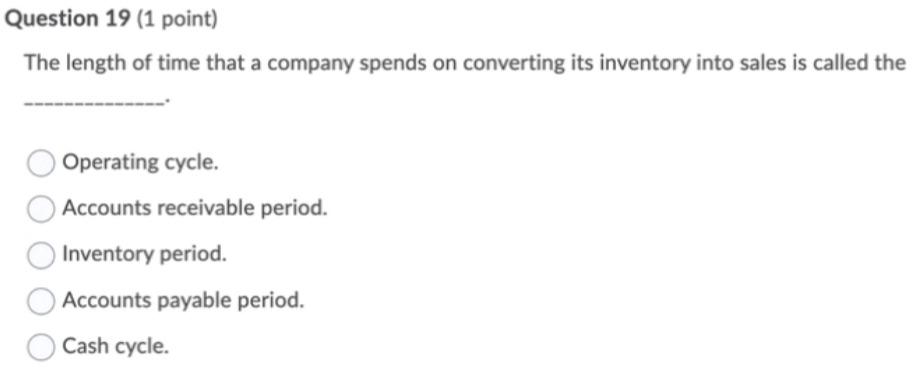

Question 26 (1 point) You are told to find an appropriate discount rate for a new asset. By searching on Bloomberg Terminal, you find that the risk-free rate of return is 2.5% and market risk premium is 12%. If the new asset has a beta of 2.5, the discount rate for the asset should be: 32.50% 26.30% 23.00% 25.00% 14.50% Question 24 (1 point) Pizza Hot Inc. is planning to choose one of the two possible capital structures. Under the first choice, the firm will be financed completely with equity. Specifically, the firm will issue 125,000 shares of stock. In the second plan, the firm will use both debt and equity. Specifically, the firm will issue 100,000 shares of stock and $550,000 of debt with an annual cost of 10%. Ignoring taxes, what is the EBIT that makes the two choices indifferent to the firm? $558,000 $125,000 $275,000 $350,000 $575,000 Question 23 (1 point) You have learnt lots of terminologies about Mergers and Acquisitions. Regarding the term poison pill, it is: A strategy to make unfriendly takeover attempts unattractive. The restructuring of a firm after which the stock will be delisted and no one can buy in the future. A kind of financial agreement which pushes companies to repurchase their stocks at a pre-specified price. An unfriendly takeover offer that is so attractive that it cannot be refused. An unfriendly takeover that kicks out the existing management. Question 21 (1 point) Xiapu Xiapu Inc. expects to generate an EBIT of $235,000, an unlevered cost of capital of 12%, and debt of $34,500 with an annual 8% coupon. If the tax rate is 35%, what is the value of firm? $1,272,917 $1,275,677 $1,284,992 $12,075 $174,575 Question 22 (1 point) Which of the following about optimal capital structure is true? Under case II of Modigliani and Miller (M&M) Theory, there is no optimal capital structure for each firm. None of the above. Under case II of Modigliani and Miller (M&M) Theory, firms should always use 100% of debt as their optimal capital structure. Under case I of Modigliani and Miller (M&M) Theory, there is only an optimal capital structure for each firm. Under case III of Modigliani and Miller (M&M) Theory, there is no optimal capital structure for each firm. Question 19 (1 point) The length of time that a company spends on converting its inventory into sales is called the Operating cycle. Accounts receivable period. Inventory period. Accounts payable period. Cash cycle