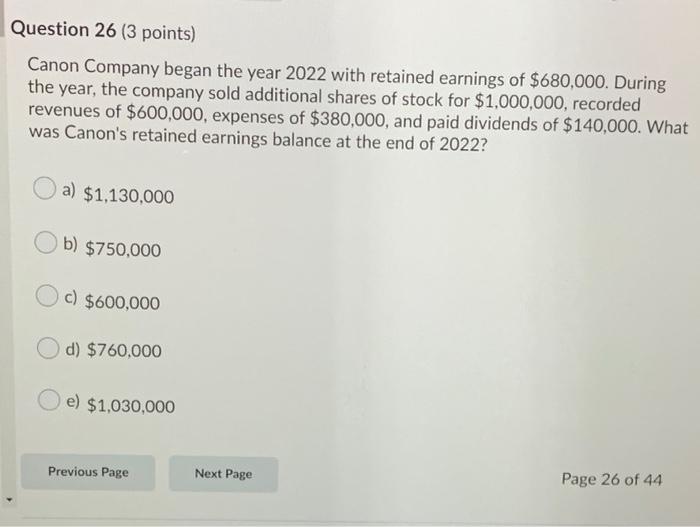

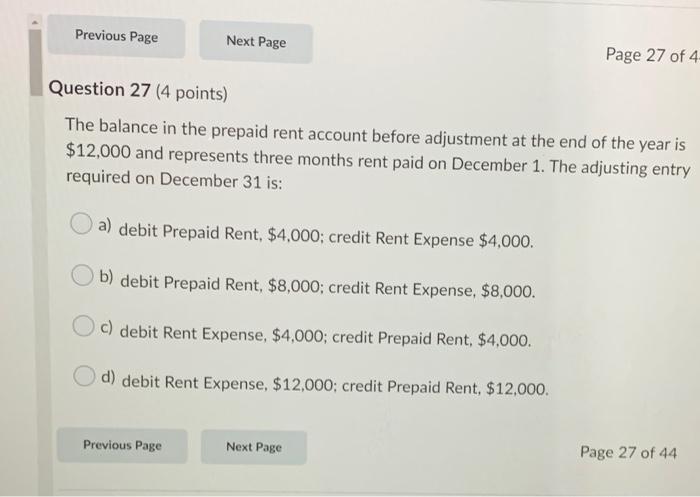

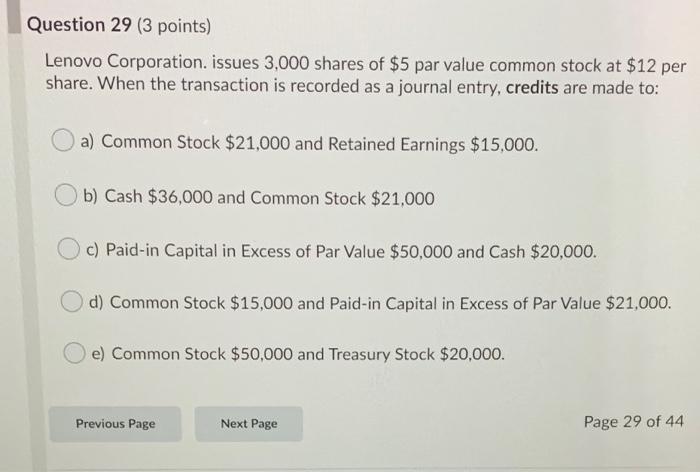

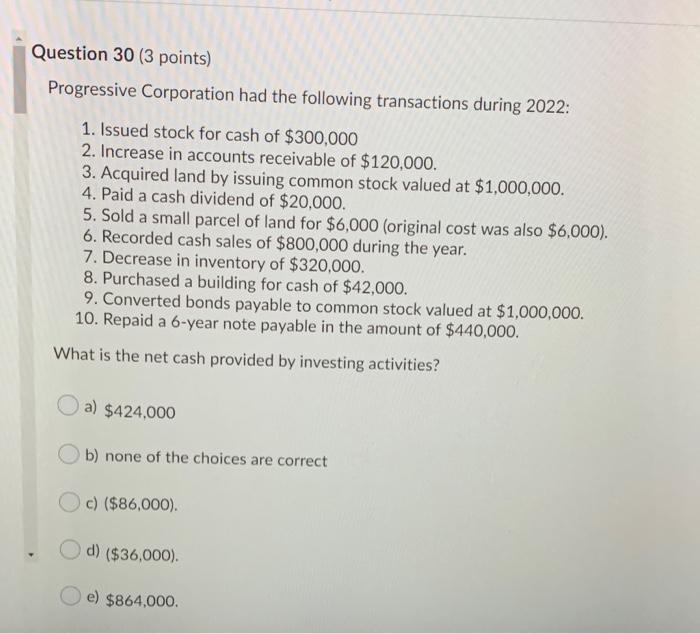

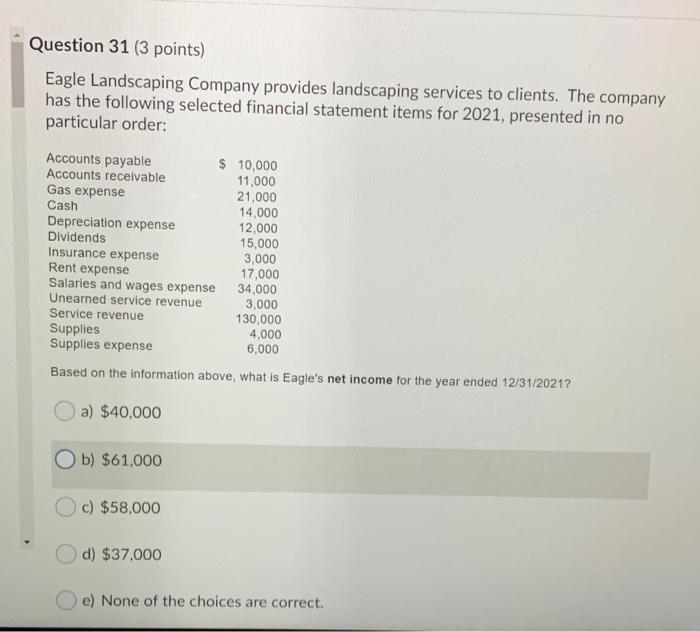

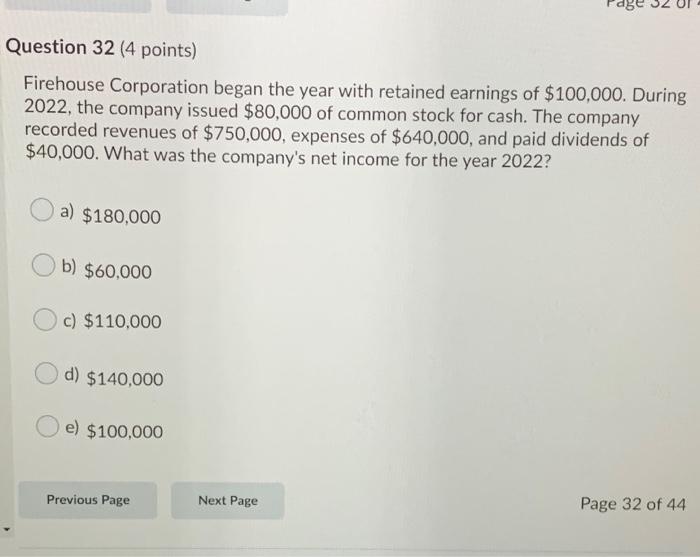

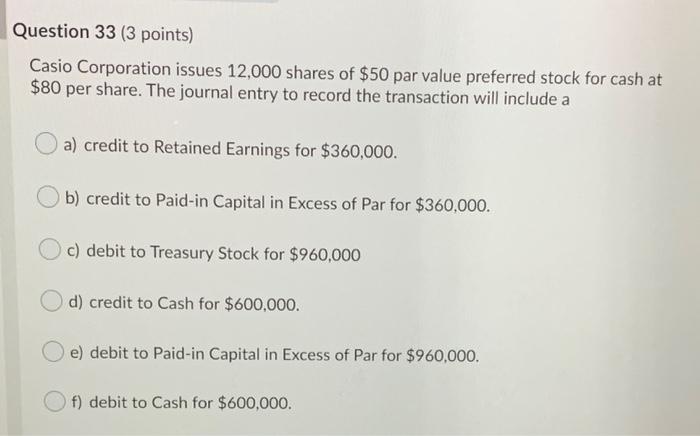

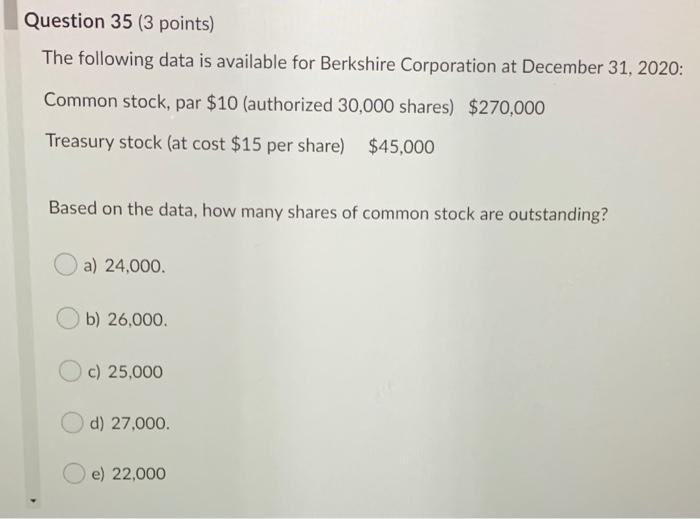

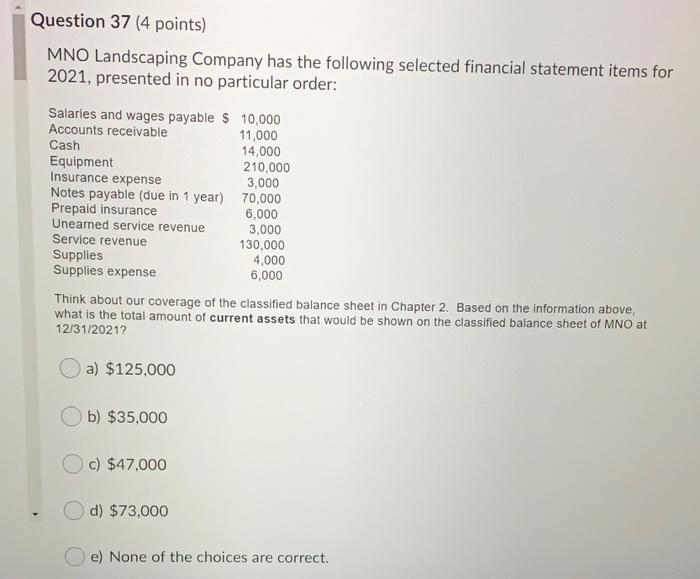

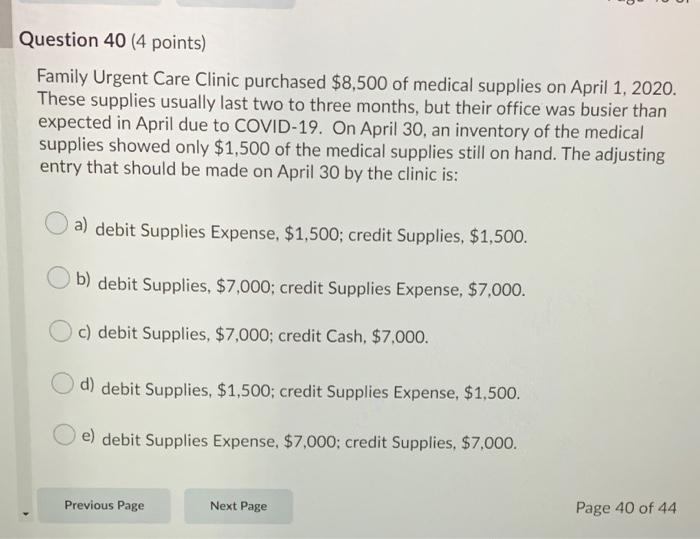

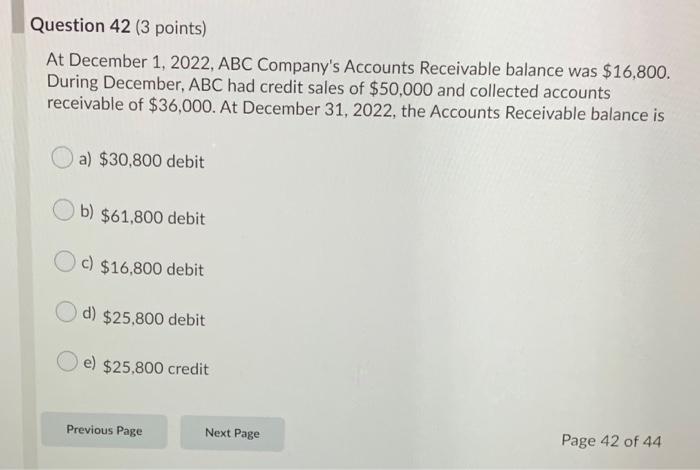

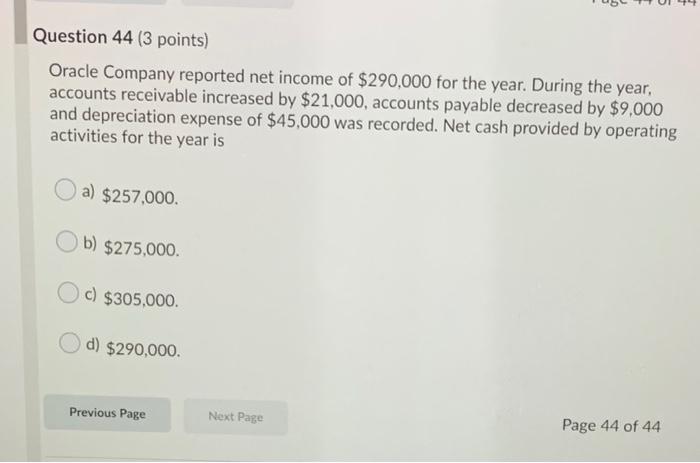

Question 26 (3 points) Canon Company began the year 2022 with retained earnings of $680,000. During the year, the company sold additional shares of stock for $1,000,000, recorded revenues of $600,000, expenses of $380,000, and paid dividends of $140,000. What was Canon's retained earnings balance at the end of 2022? a) $1,130,000 b) $750,000 c) $600,000 d) $760,000 e) $1,030,000 Previous Page Next Page Page 26 of 44 Previous Page Next Page Page 27 of 4 Question 27 (4 points) The balance in the prepaid rent account before adjustment at the end of the year is $12,000 and represents three months rent paid on December 1. The adjusting entry required on December 31 is: a) debit Prepaid Rent, $4,000; credit Rent Expense $4,000. b) debit Prepaid Rent, $8,000; credit Rent Expense, $8,000. Oc) debit Rent Expense, $4,000; credit Prepaid Rent, $4,000. d) debit Rent Expense, $12,000; credit Prepaid Rent, $12,000. Previous Page Next Page Page 27 of 44 Question 29 (3 points) Lenovo Corporation. issues 3,000 shares of $5 par value common stock at $12 per share. When the transaction is recorded as a journal entry, credits are made to: a) Common Stock $21,000 and Retained Earnings $15,000. b) Cash $36,000 and Common Stock $21,000 c) Paid-in Capital in Excess of Par Value $50,000 and Cash $20,000. d) Common Stock $15,000 and Paid-in Capital in Excess of Par Value $21,000. e) Common Stock $50,000 and Treasury Stock $20,000. Previous Page Next Page Page 29 of 44 Question 30 (3 points) Progressive Corporation had the following transactions during 2022: 1. Issued stock for cash of $300,000 2. Increase in accounts receivable of $120,000. 3. Acquired land by issuing common stock valued at $1,000,000. 4. Paid a cash dividend of $20,000. 5. Sold a small parcel of land for $6,000 (original cost was also $6,000). 6. Recorded cash sales of $800,000 during the year. 7. Decrease in inventory of $320,000. 8. Purchased a building for cash of $42,000. 9. Converted bonds payable to common stock valued at $1,000,000. 10. Repaid a 6-year note payable in the amount of $440,000. What is the net cash provided by investing activities? a) $424.000 b) none of the choices are correct c) ($86,000). d) ($36,000). e) $864,000. Question 31 (3 points) Eagle Landscaping Company provides landscaping services to clients. The company has the following selected financial statement items for 2021, presented in no particular order: Accounts payable $ 10,000 Accounts receivable 11,000 Gas expense 21,000 Cash 14,000 Depreciation expense 12,000 Dividends 15,000 Insurance expense 3,000 Rent expense 17,000 Salaries and wages expense 34.000 Unearned service revenue 3,000 Service revenue 130,000 Supplies 4,000 Supplies expense 6,000 Based on the information above, what is Eagle's net income for the year ended 12/31/2021? a) $40,000 b) $61,000 c) $58,000 d) $37.000 e) None of the choices are correct. Question 32 (4 points) Firehouse Corporation began the year with retained earnings of $100,000. During 2022, the company issued $80,000 of common stock for cash. The company recorded revenues of $750,000, expenses of $640,000, and paid dividends of $40,000. What was the company's net income for the year 2022? a) $180,000 b) $60,000 c) $110,000 d) $140,000 e) $100,000 Previous Page Next Page Page 32 of 44 Question 33 (3 points) Casio Corporation issues 12,000 shares of $50 par value preferred stock for cash at $80 per share. The journal entry to record the transaction will include a a) credit to Retained Earnings for $360,000. b) credit to Paid-in Capital in Excess of Par for $360,000. c) debit to Treasury Stock for $960,000 d) credit to Cash for $600,000. e) debit to Paid-in Capital in Excess of Par for $960,000. f) debit to Cash for $600,000. Question 35 (3 points) The following data is available for Berkshire Corporation at December 31, 2020: Common stock, par $10 (authorized 30,000 shares) $270,000 Treasury stock (at cost $15 per share) $45,000 Based on the data, how many shares of common stock are outstanding? a) 24,000. b) 26,000. c) 25,000 d) 27,000. e) 22,000 Question 37 (4 points) MNO Landscaping Company has the following selected financial statement items for 2021, presented in no particular order: Salaries and wages payable $ 10,000 Accounts receivable 11,000 Cash 14,000 Equipment 210,000 Insurance expense 3,000 Notes payable (due in 1 year) 70,000 Prepaid insurance 6,000 Unearned service revenue 3,000 Service revenue 130,000 Supplies 4,000 Supplies expense 6,000 Think about our coverage of the classified balance sheet in Chapter 2. Based on the information above, what is the total amount of current assets that would be shown on the classified balance sheet of MNO at 12/31/20212 a) $125,000 b) $35,000 c) $47,000 d) $73,000 e) None of the choices are correct. Question 40 (4 points) Family Urgent Care Clinic purchased $8,500 of medical supplies on April 1, 2020. These supplies usually last two to three months, but their office was busier than expected in April due to COVID-19. On April 30, an inventory of the medical supplies showed only $1,500 of the medical supplies still on hand. The adjusting entry that should be made on April 30 by the clinic is: a) debit Supplies Expense, $1,500; credit Supplies, $1,500. b) debit Supplies, $7,000; credit Supplies Expense, $7,000. c) debit Supplies, $7,000; credit Cash, $7,000. d) debit Supplies, $1,500; credit Supplies Expense, $1,500. e) debit Supplies Expense, $7,000; credit Supplies, $7,000. Previous Page Next Page Page 40 of 44 Question 42 (3 points) At December 1, 2022, ABC Company's Accounts Receivable balance was $16,800. During December, ABC had credit sales of $50,000 and collected accounts receivable of $36,000. At December 31, 2022, the Accounts Receivable balance is a) $30,800 debit b) $61,800 debit c) $16,800 debit d) $25,800 debit e) $25,800 credit Previous Page Next Page Page 42 of 44 Question 44 (3 points) Oracle Company reported net income of $290,000 for the year. During the year, accounts receivable increased by $21,000, accounts payable decreased by $9,000 and depreciation expense of $45,000 was recorded. Net cash provided by operating activities for the year is a) $257,000 b) $275,000 c) $305,000 d) $290,000. Previous Page Next Page Page 44 of 44