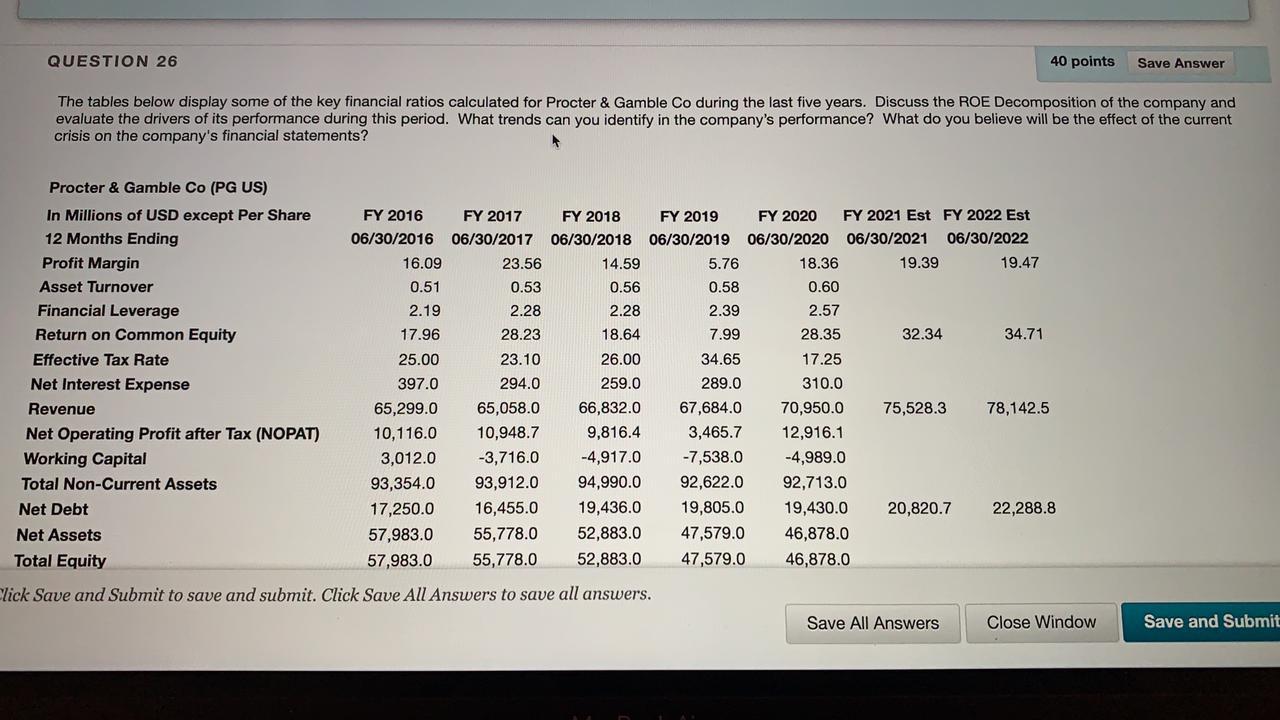

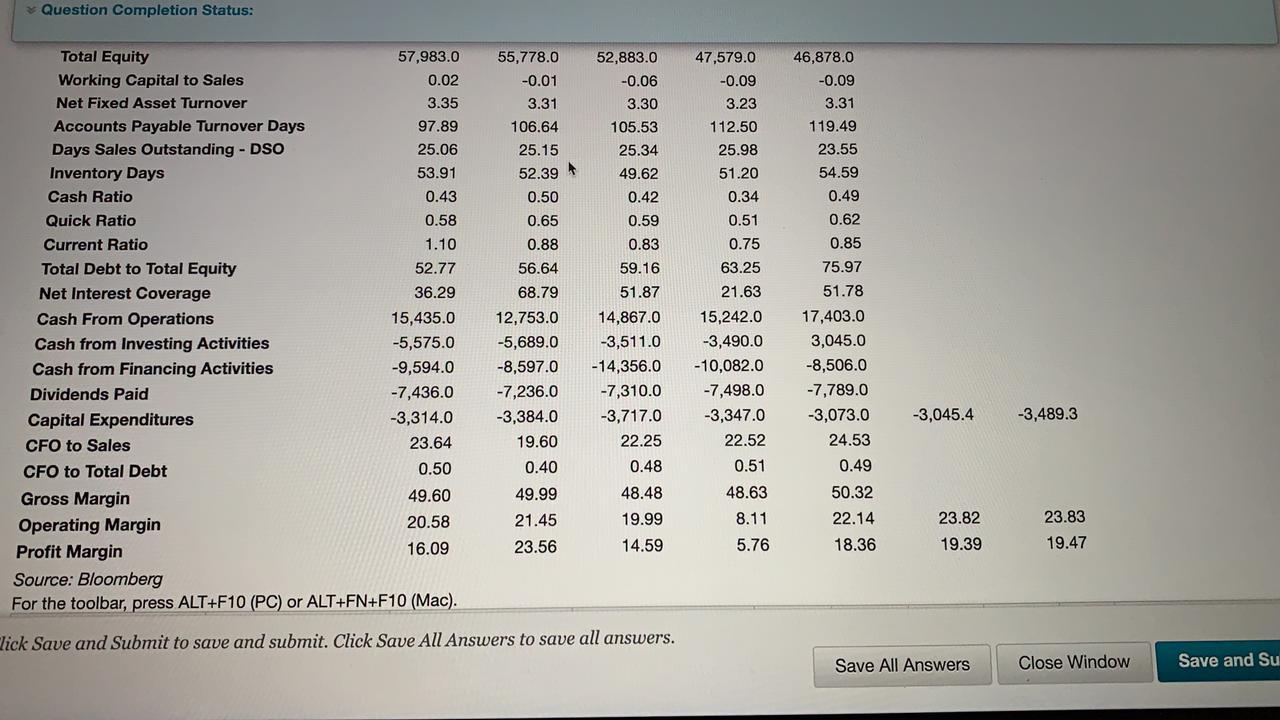

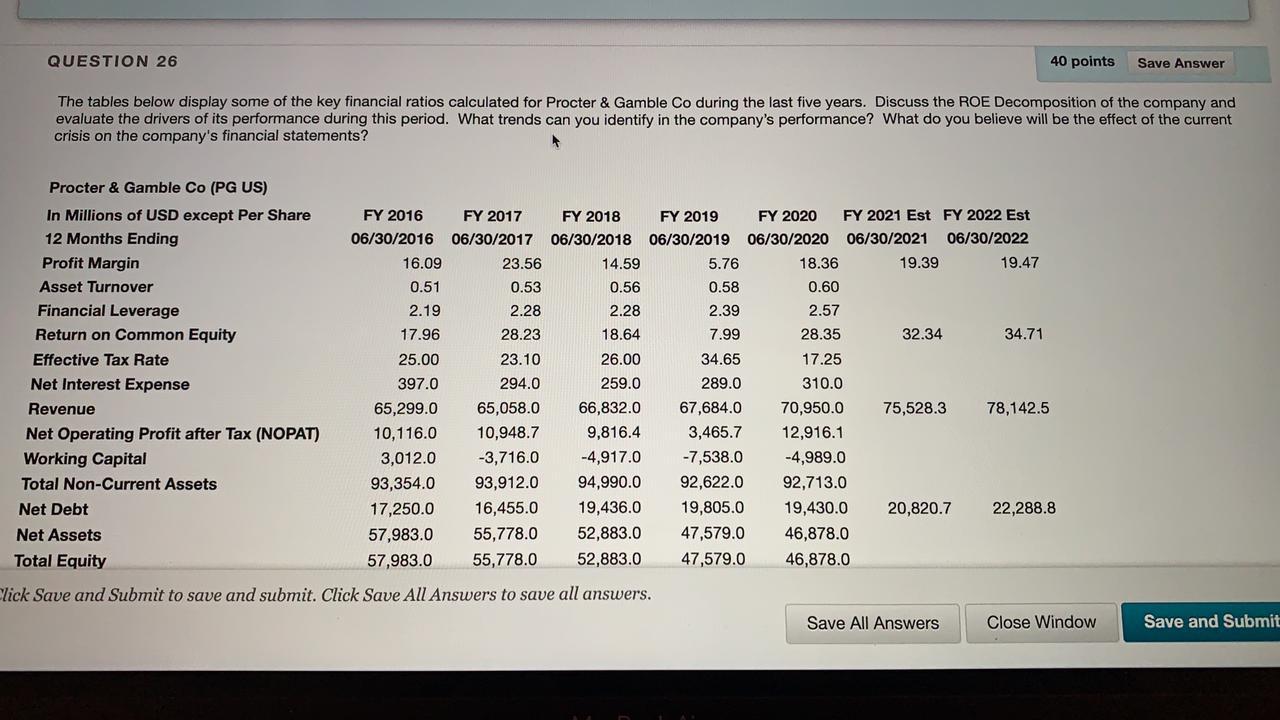

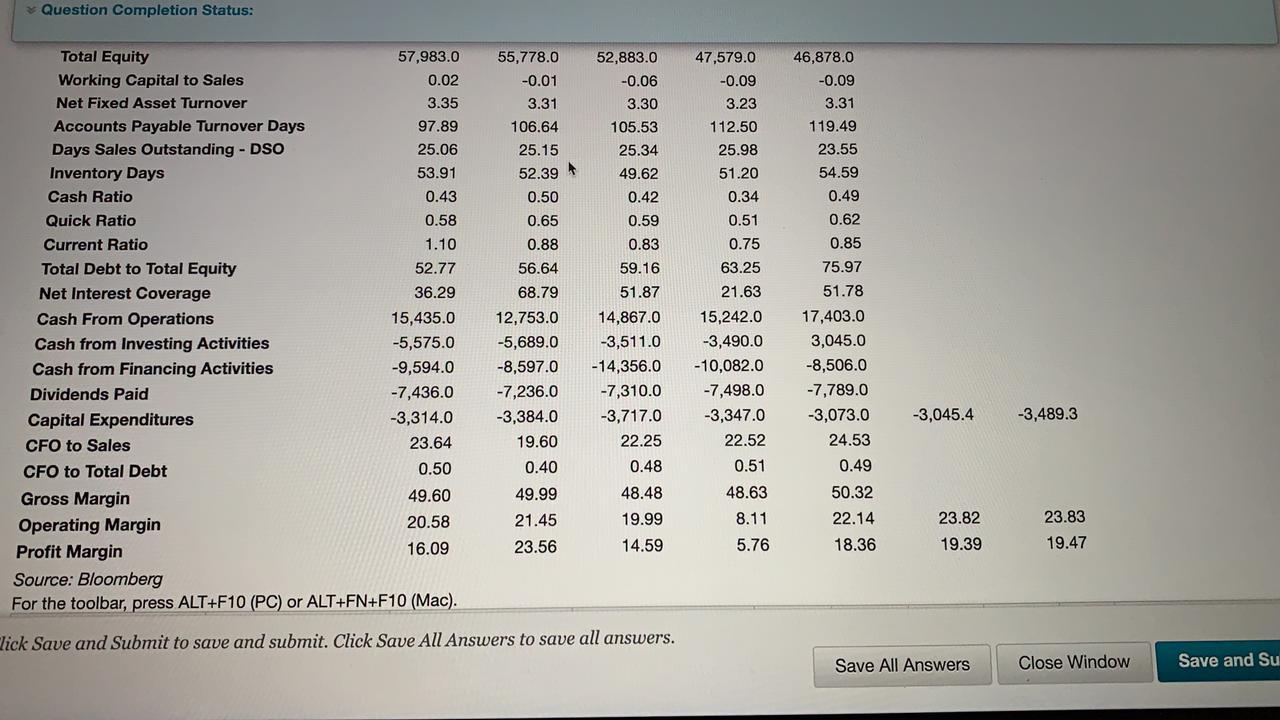

QUESTION 26 40 points Save Answer The tables below display some of the key financial ratios calculated for Procter & Gamble Co during the last five years. Discuss the ROE Decomposition of the company and evaluate the drivers of its performance during this period. What trends can you identify in the company's performance? What do you believe will be the effect of the current crisis on the company's financial statements? FY 2016 06/30/2016 16.09 0.51 2.19 Procter & Gamble Co (PG US) In Millions of USD except Per Share 12 Months Ending Profit Margin Asset Turnover Financial Leverage Return on Common Equity Effective Tax Rate Net Interest Expense Revenue Net Operating Profit after Tax (NOPAT) Working Capital Total Non-Current Assets Net Debt Net Assets Total Equity 17.96 25.00 397.0 65,299.0 10,116.0 3,012.0 93,354.0 17,250.0 57,983.0 57,983.0 FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 Est FY 2022 Est 06/30/2017 06/30/2018 06/30/2019 06/30/2020 06/30/2021 06/30/2022 23.56 14.59 5.76 18.36 19.39 19.47 0.53 0.56 0.58 0.60 2.28 2.28 2.39 2.57 28.23 18.64 7.99 28.35 32.34 34.71 23.10 26.00 34.65 17.25 294.0 259.0 289.0 310.0 65,058.0 66,832.0 67,684.0 70,950.0 75,528.3 78,142.5 10,948.7 9,816.4 3,465.7 12,916.1 -3,716.0 -4,917.0 -7,538.0 -4,989.0 93,912.0 94,990.0 92,622.0 92,713.0 16,455.0 19,436.0 19,805.0 19,430.0 20,820.7 22,288.8 55,778.0 52,883.0 47,579.0 46,878.0 55,778.0 52,883.0 47,579.0 46,878.0 lick Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers Close Window Save and Submit Question Completion Status: 55,778.0 -0.01 3.31 106.64 25.15 52,883.0 -0.06 3.30 105.53 25.34 49.62 0.42 47,579.0 -0.09 3.23 112.50 25.98 51.20 0.34 46,878.0 -0.09 3.31 119.49 23.55 54.59 52.39 0.49 0.50 0.65 0.59 0.51 0.88 0.83 0.75 63.25 56.64 21.63 Total Equity 57,983.0 Working Capital to Sales 0.02 Net Fixed Asset Turnover 3.35 Accounts Payable Turnover Days 97.89 Days Sales Outstanding - DSO 25.06 Inventory Days 53.91 Cash Ratio 0.43 Quick Ratio 0.58 Current Ratio 1.10 Total Debt to Total Equity 52.77 Net Interest Coverage 36.29 Cash From Operations 15,435.0 Cash from Investing Activities -5,575.0 Cash from Financing Activities -9,594.0 Dividends Paid -7,436.0 Capital Expenditures -3,314.0 CFO to Sales 23.64 CFO to Total Debt 0.50 Gross Margin 49.60 Operating Margin 20.58 Profit Margin 16.09 Source: Bloomberg For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). 68.79 12,753.0 -5,689.0 -8,597.0 -7,236.0 -3,384.0 19.60 0.40 59.16 51.87 14,867.0 -3,511.0 -14,356.0 -7,310.0 -3,717.0 22.25 0.48 48.48 19.99 0.62 0.85 75.97 51.78 17,403.0 3,045.0 -8,506.0 -7,789.0 -3,073.0 24.53 0.49 -3,045.4 15,242.0 -3,490.0 -10,082.0 -7,498.0 -3,347.0 22.52 0.51 48.63 8.11 5.76 -3,489.3 49.99 21.45 23.56 50.32 22.14 23.82 19.39 23.83 19.47 14.59 18.36 Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers Close Window Save and Su