Answered step by step

Verified Expert Solution

Question

1 Approved Answer

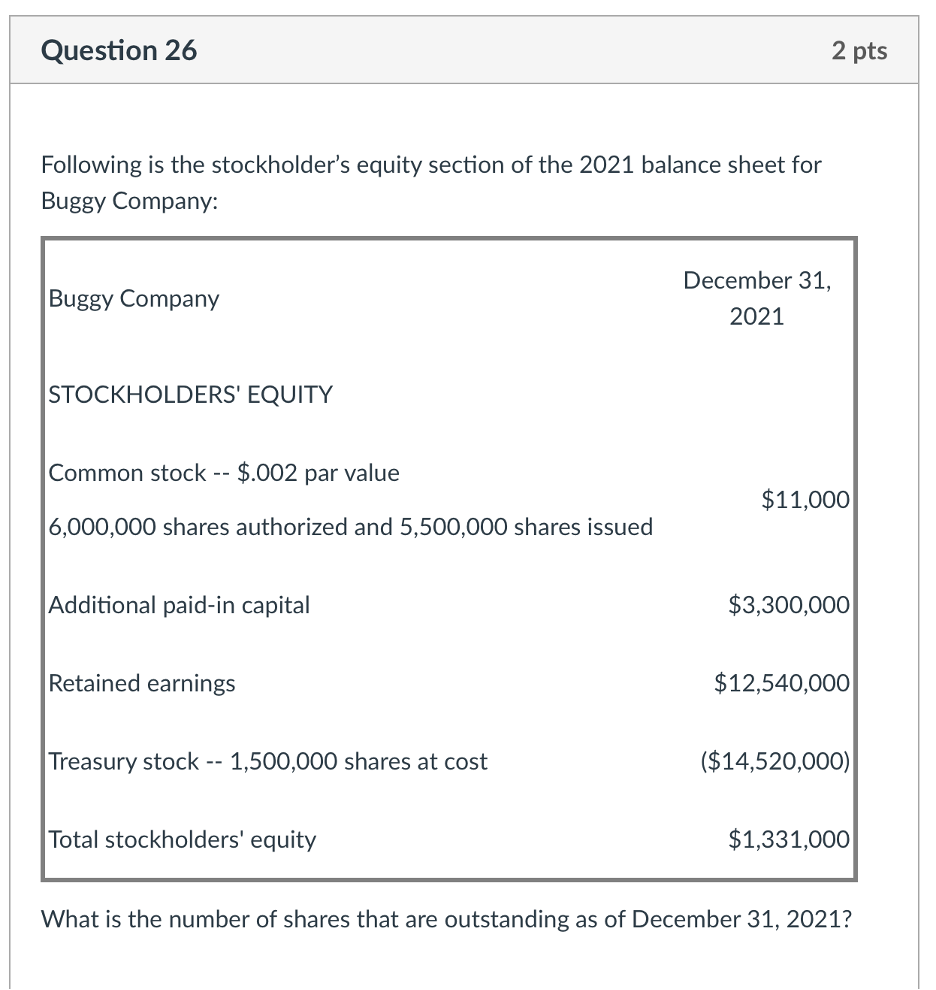

Question 26 Following is the stockholder's equity section of the 2021 balance sheet for Buggy Company: Buggy Company STOCKHOLDERS' EQUITY December 31, 2021 2

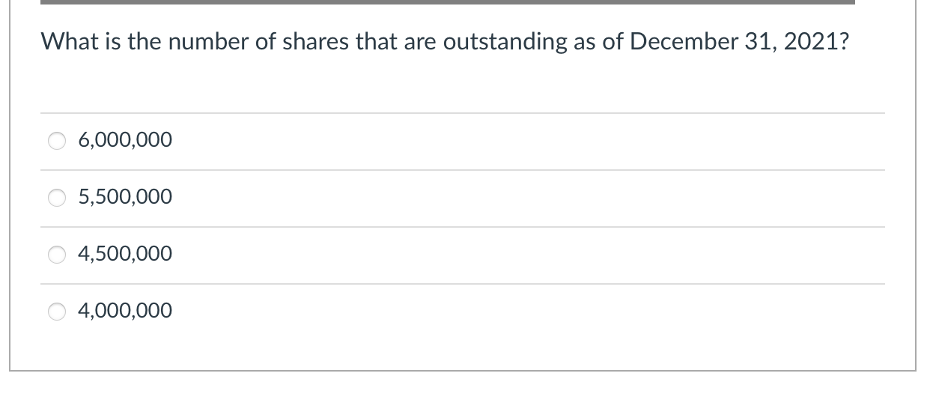

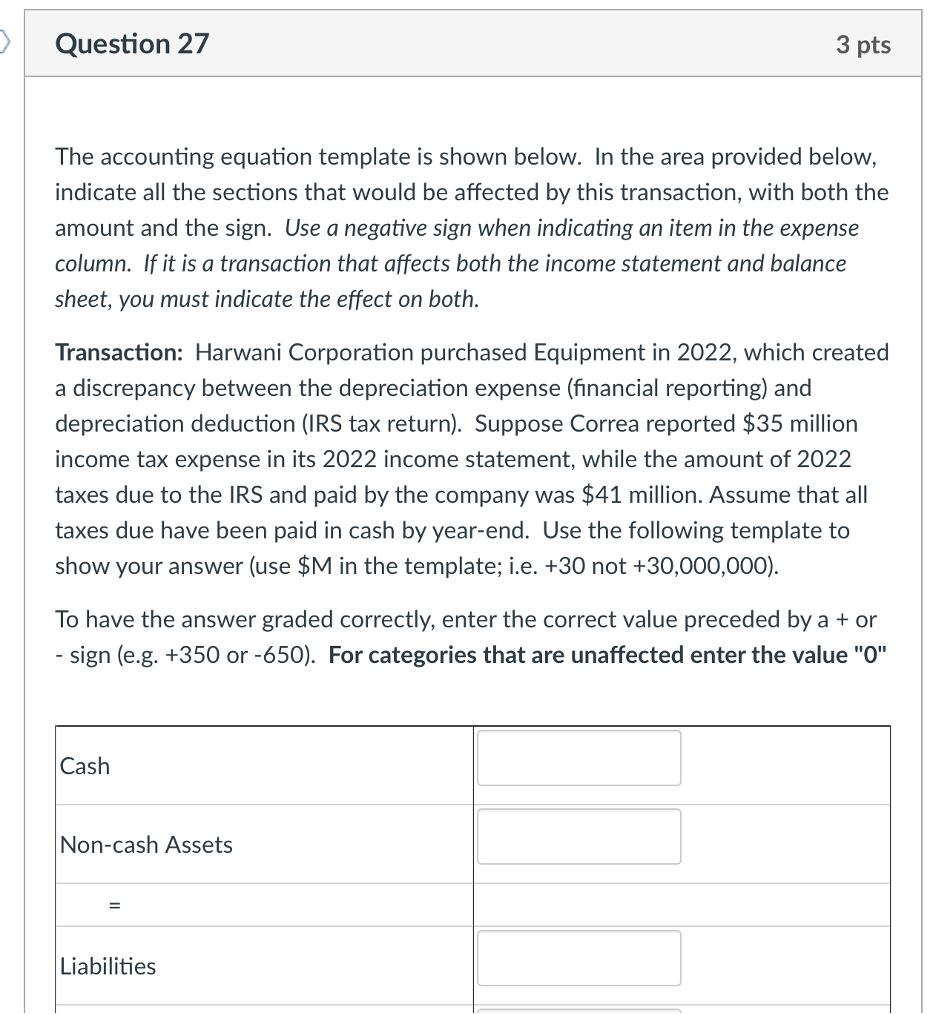

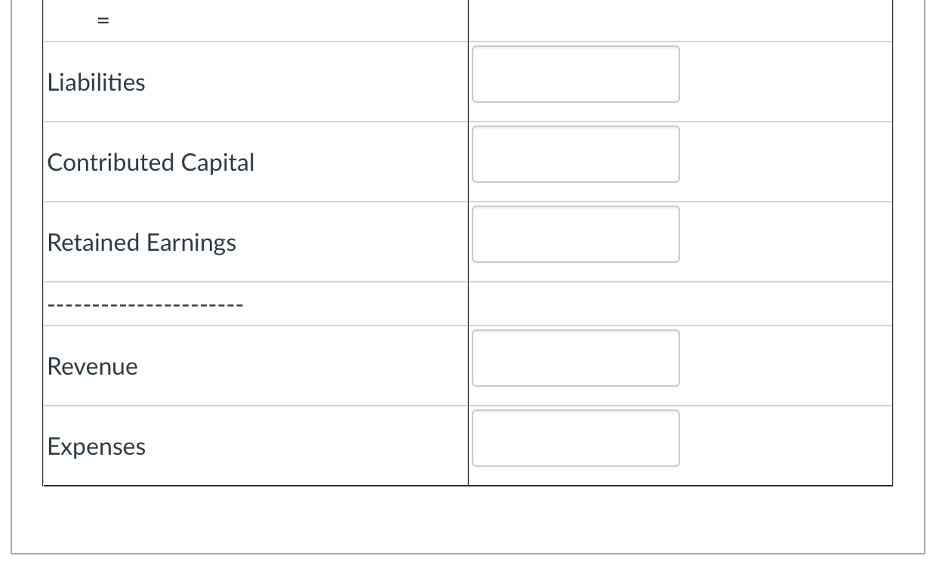

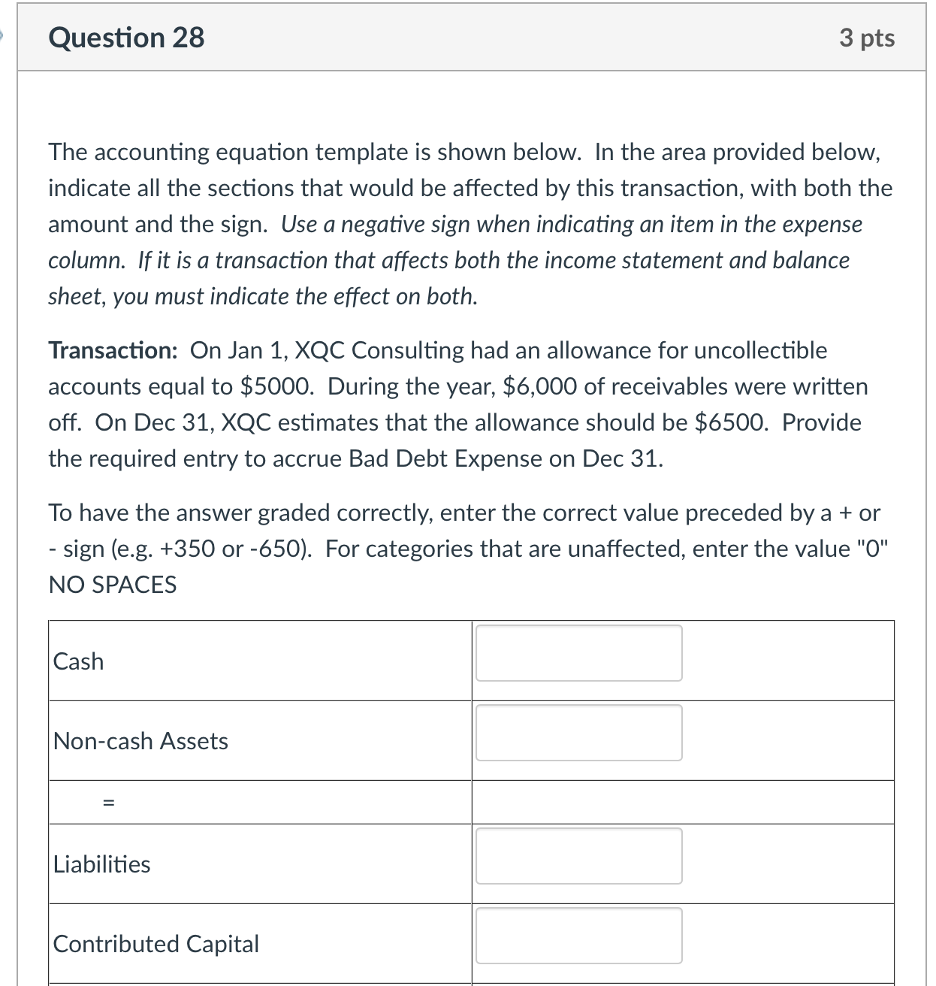

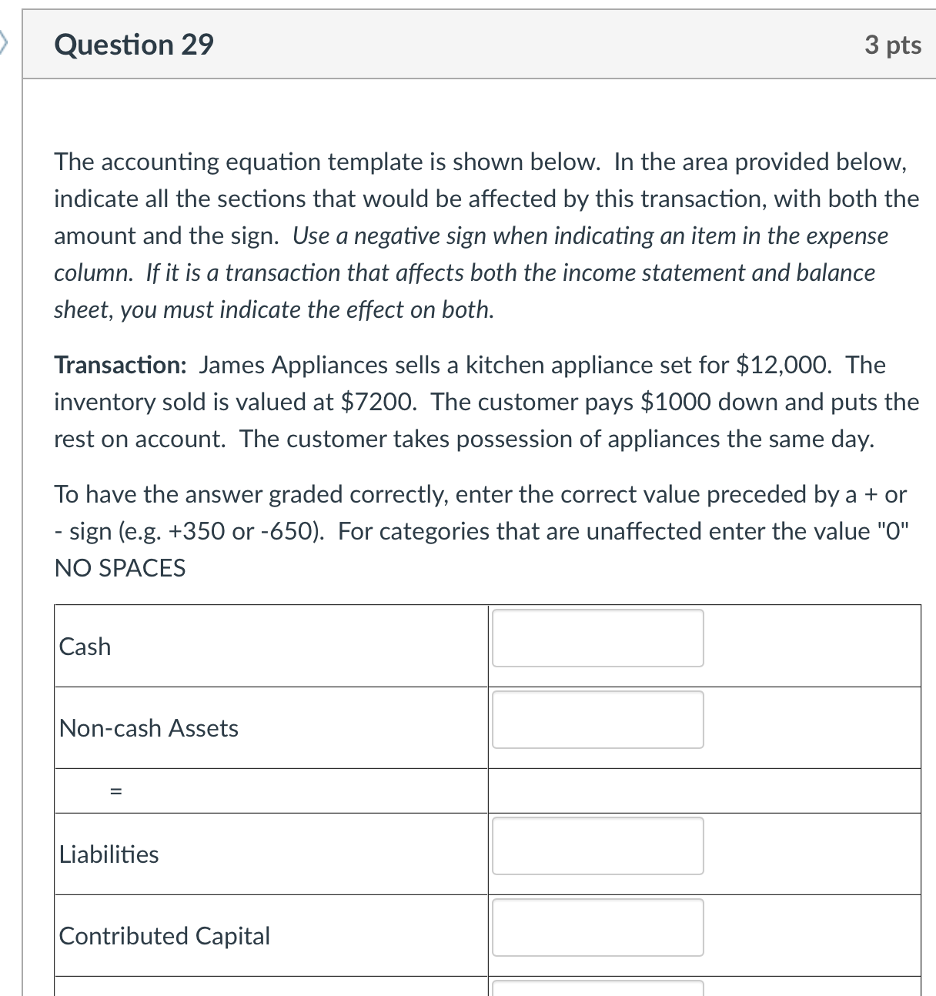

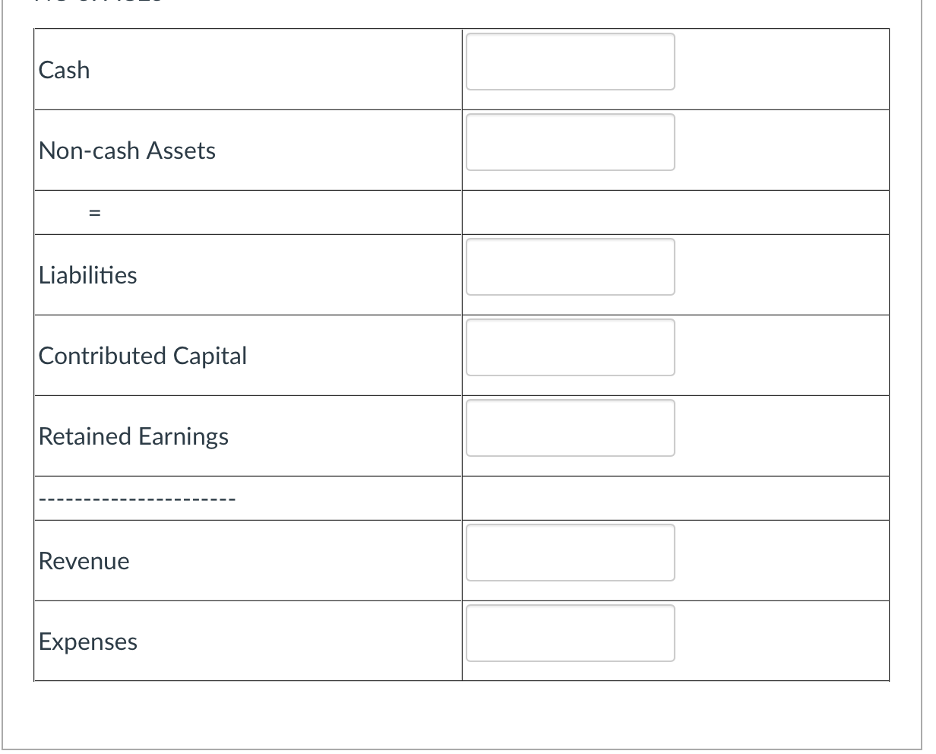

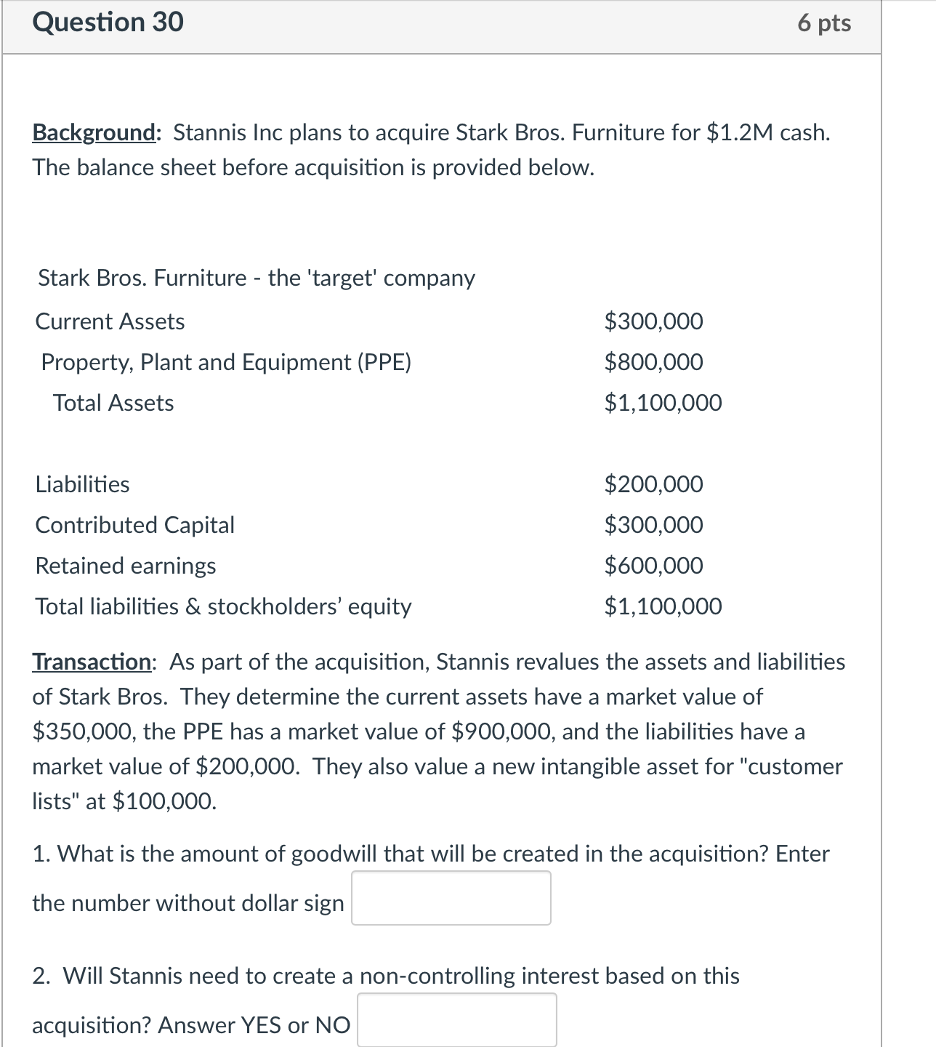

Question 26 Following is the stockholder's equity section of the 2021 balance sheet for Buggy Company: Buggy Company STOCKHOLDERS' EQUITY December 31, 2021 2 pts Common stock -- $.002 par value $11,000 6,000,000 shares authorized and 5,500,000 shares issued Additional paid-in capital $3,300,000 Retained earnings $12,540,000 Treasury stock -- 1,500,000 shares at cost ($14,520,000) $1,331,000 Total stockholders' equity What is the number of shares that are outstanding as of December 31, 2021? What is the number of shares that are outstanding as of December 31, 2021? 6,000,000 5,500,000 4,500,000 4,000,000 Question 27 3 pts The accounting equation template is shown below. In the area provided below, indicate all the sections that would be affected by this transaction, with both the amount and the sign. Use a negative sign when indicating an item in the expense column. If it is a transaction that affects both the income statement and balance sheet, you must indicate the effect on both. Transaction: Harwani Corporation purchased Equipment in 2022, which created a discrepancy between the depreciation expense (financial reporting) and depreciation deduction (IRS tax return). Suppose Correa reported $35 million income tax expense in its 2022 income statement, while the amount of 2022 taxes due to the IRS and paid by the company was $41 million. Assume that all taxes due have been paid in cash by year-end. Use the following template to show your answer (use $M in the template; i.e. +30 not +30,000,000). To have the answer graded correctly, enter the correct value preceded by a + or - sign (e.g. +350 or -650). For categories that are unaffected enter the value "0" Cash Non-cash Assets = Liabilities Liabilities Contributed Capital Retained Earnings Revenue Expenses Question 28 3 pts The accounting equation template is shown below. In the area provided below, indicate all the sections that would be affected by this transaction, with both the amount and the sign. Use a negative sign when indicating an item in the expense column. If it is a transaction that affects both the income statement and balance sheet, you must indicate the effect on both. Transaction: On Jan 1, XQC Consulting had an allowance for uncollectible accounts equal to $5000. During the year, $6,000 of receivables were written off. On Dec 31, XQC estimates that the allowance should be $6500. Provide the required entry to accrue Bad Debt Expense on Dec 31. To have the answer graded correctly, enter the correct value preceded by a + or - sign (e.g. +350 or -650). For categories that are unaffected, enter the value "0" NO SPACES Cash Non-cash Assets Liabilities Contributed Capital Cash Non-cash Assets Liabilities Contributed Capital Retained Earnings Revenue Expenses Question 29 3 pts The accounting equation template is shown below. In the area provided below, indicate all the sections that would be affected by this transaction, with both the amount and the sign. Use a negative sign when indicating an item in the expense column. If it is a transaction that affects both the income statement and balance sheet, you must indicate the effect on both. Transaction: James Appliances sells a kitchen appliance set for $12,000. The inventory sold is valued at $7200. The customer pays $1000 down and puts the rest on account. The customer takes possession of appliances the same day. To have the answer graded correctly, enter the correct value preceded by a + or -sign (e.g. +350 or -650). For categories that are unaffected enter the value "0" NO SPACES Cash Non-cash Assets = Liabilities Contributed Capital Cash Non-cash Assets Liabilities Contributed Capital Retained Earnings Revenue Expenses Question 30 6 pts Background: Stannis Inc plans to acquire Stark Bros. Furniture for $1.2M cash. The balance sheet before acquisition is provided below. Stark Bros. Furniture - the 'target' company Current Assets Property, Plant and Equipment (PPE) Total Assets Liabilities Contributed Capital Retained earnings Total liabilities & stockholders' equity $300,000 $800,000 $1,100,000 $200,000 $300,000 $600,000 $1,100,000 Transaction: As part of the acquisition, Stannis revalues the assets and liabilities of Stark Bros. They determine the current assets have a market value of $350,000, the PPE has a market value of $900,000, and the liabilities have a market value of $200,000. They also value a new intangible asset for "customer lists" at $100,000. 1. What is the amount of goodwill that will be created in the acquisition? Enter the number without dollar sign 2. Will Stannis need to create a non-controlling interest based on this acquisition? Answer YES or NO

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started