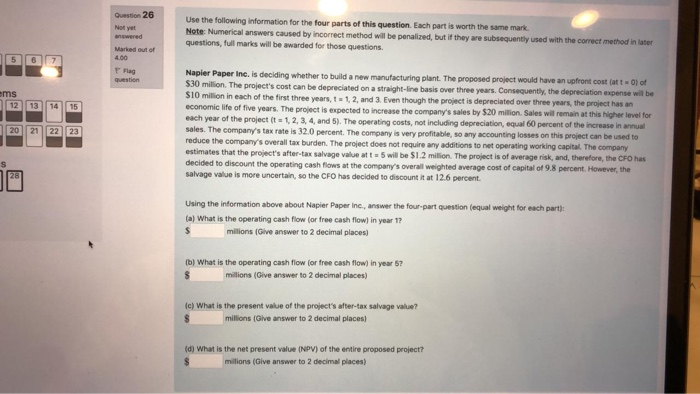

Question 26 Not yet answered Marked out of 4.00 P Flag question Use the following information for the four parts of this question. Each part is worth the same mark. Note: Numerical answers caused by incorrect method will be penalized, but if they are subsequently used with the correct method in later questions, full marks will be awarded for those questions. ems 12 13 14 15 Napler Paper Inc. is deciding whether to build a new manufacturing plant. The proposed project would have an upfront cost fatt-0) of $30 milion. The project's cost can be depreciated on a straight-line basis over three years. Consequently, the depreciation expense will be $10 million in each of the first three years, t = 1, 2, and 3. Even though the project is depreciated over three years, the project has an economic life of five years. The project is expected to increase the company's sales by $20 million Sales will remain at this higher level for each year of the project (t = 1, 2, 3, 4, and 5). The operating costs, not including depreciation, equal 60 percent of the increase in annual sales. The company's tax rate is 32.0 percent. The company is very profitable, so any accounting losses on this project can be used to reduce the company's overall tax burden. The project does not require any additions to net operating working capital. The company estimates that the project's after-tax salvage value at t = 5 will be $1.2 million. The project is of average risk, and therefore, the CFO has decided to discount the operating cash flows at the company's overall weighted average cost of capital of 9.8 percent. However, the salvage value is more uncertain, so the CFO has decided to discount it at 12.6 percent. 20 21 22 s Using the information above about Napier Paper Inc., answer the four part question (equal weight for each part): (a) What is the operating cash flow for free cash flow) in year 1? millions (Give answer to 2 decimal places) (b) What is the operating cash flow for free cash flow) in year 5? millions (Give answer to 2 decimal places) (c) What is the present value of the project's after-tax salvage value? millions (Give answer to 2 decimal places) (d) What is the net present value INPV) of the entire proposed project? millions (Give answer to 2 decimal places)