Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 26 of 50. Andrew was gifted 10 shares of stock with a basis of $100 and a FMV of $150 on the date of

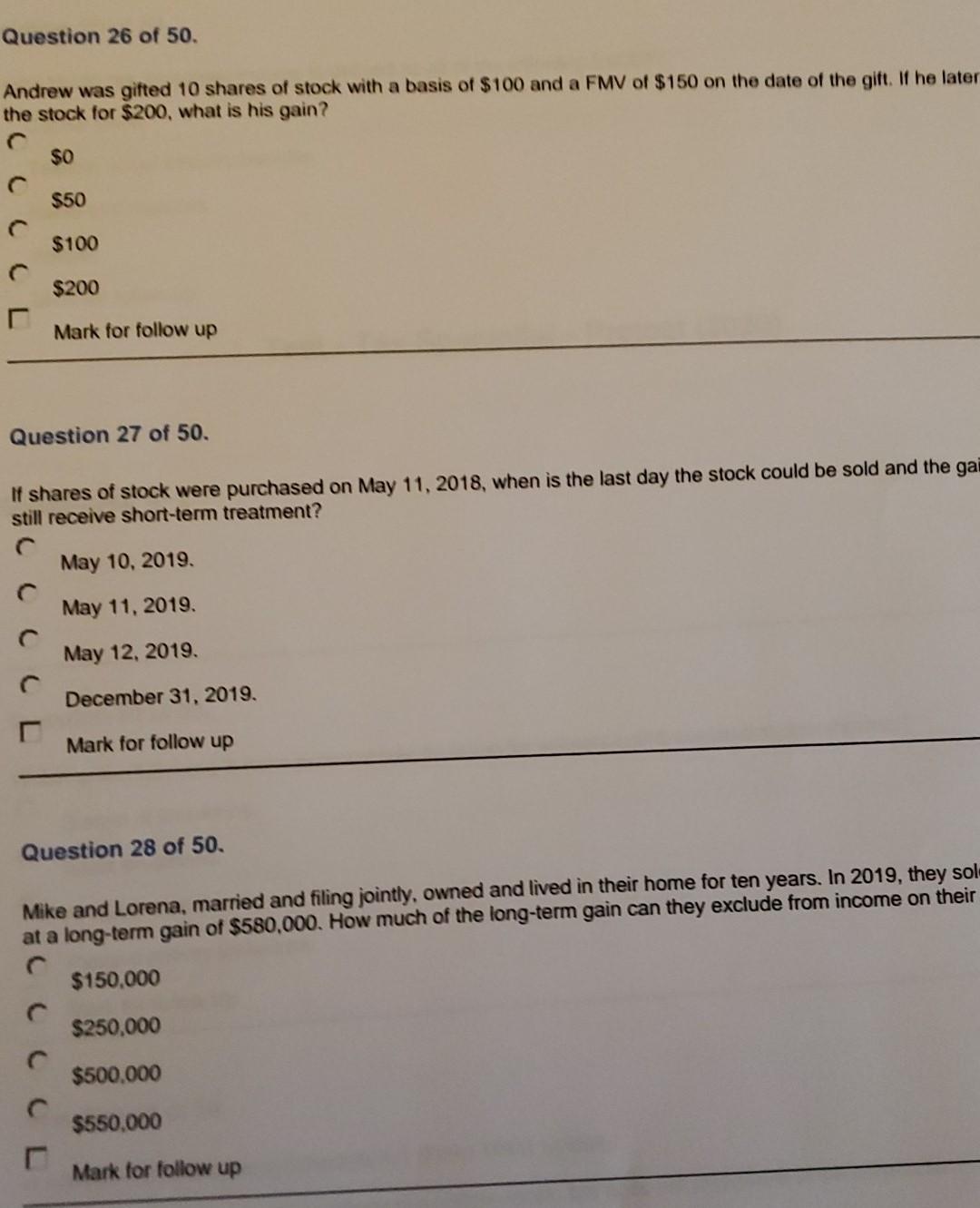

Question 26 of 50. Andrew was gifted 10 shares of stock with a basis of $100 and a FMV of $150 on the date of the gift. If he later the stock for $200, what is his gain? $0 $50 c $100 c $200 Mark for follow up Question 27 of 50. If shares of stock were purchased on May 11, 2018, when is the last day the stock could be sold and the gai still receive short-term treatment? May 10, 2019 May 11, 2019 May 12, 2019 December 31, 2019 Mark for follow up Question 28 of 50. Mike and Lorena, married and filing jointly, owned and lived in their home for ten years. In 2019, they sol at a long-term gain of $580,000. How much of the long-term gain can they exclude from income on their $150,000 $250,000 $500.000 $550.000 Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started