Answered step by step

Verified Expert Solution

Question

1 Approved Answer

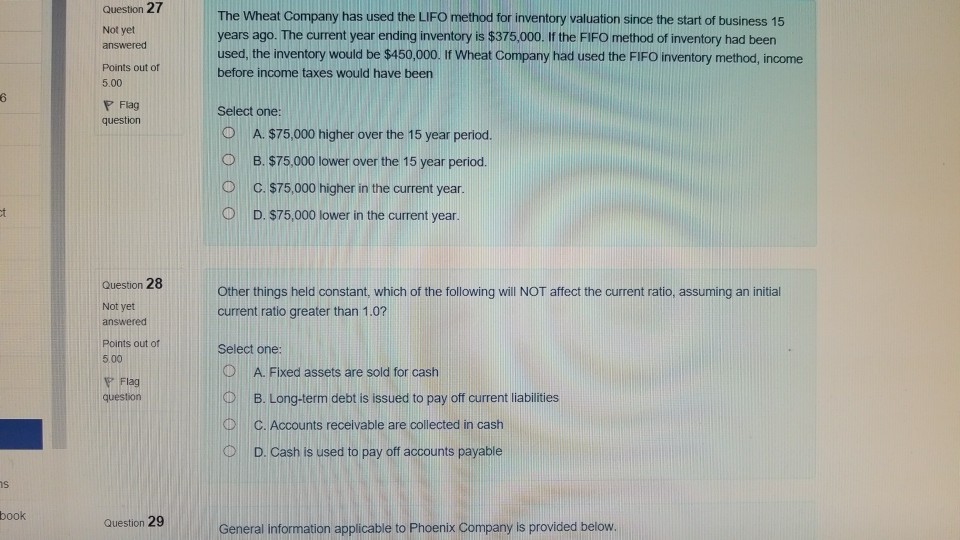

Question 27 Not yet answered Points out of 5.00 The Wheat Company has used the LIFO method for inventory valuation since the start of business

Question 27 Not yet answered Points out of 5.00 The Wheat Company has used the LIFO method for inventory valuation since the start of business 15 years ago. The current year ending inventory is $375,000. If the FIFO method of inventory had been used, the inventory would be $450,000. If Wheat Company had used the FIFO inventory method, income before income taxes would have been 6 P Flag question Select one 0 A, $75,000 higher over the 15 year period B. $75.000 lower over the 15 year period. c. $75,000 higher in the current year. 0 . D. S75000 lower in the current year. Question 28 Other things held constant, which of the following will NOT affect the current ratio, assuming an initial Not yet current ratio greater than 1.0? Select one: O A. Fixed assets are sold for cash Points out of 5.00 Flag question B. Long-term debt is issued to pay off current liabilities C. Accounts recelvable are collected in cash D. Cash is used to pay off accounts payable is book Question 29 General information applicable to Phoenix Company is provided below

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started