Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 28 (25 Marks) a) D & M Tech establishment used some of its profits to advance research on its technology offerings. The results were

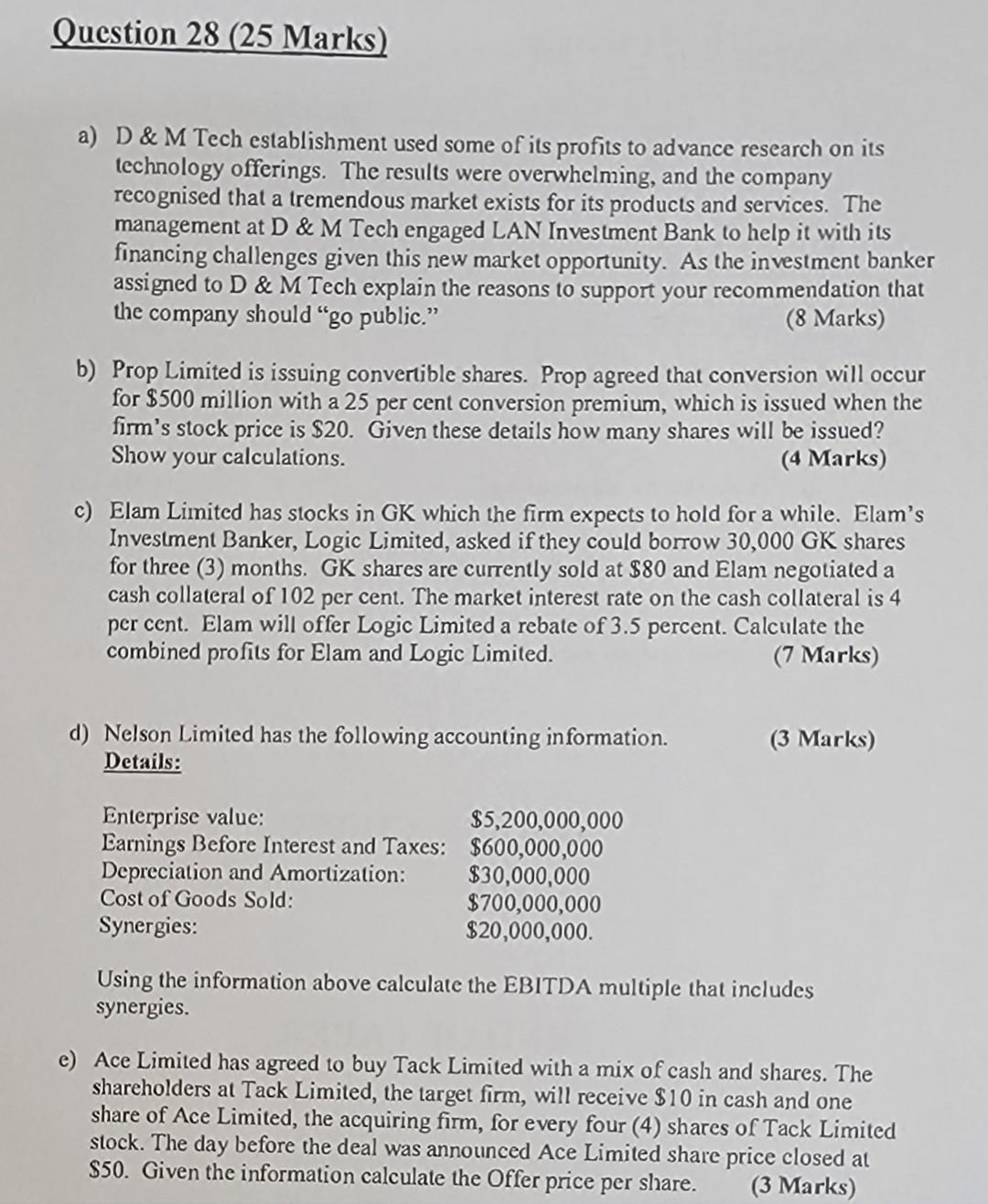

Question 28 (25 Marks) a) D & M Tech establishment used some of its profits to advance research on its technology offerings. The results were overwhelming, and the company recognised that a tremendous market exists for its products and services. The management at D & M Tech engaged LAN Investment Bank to help it with its financing challenges given this new market opportunity. As the investment banker assigned to D & M Tech explain the reasons to support your recommendation that the company should "go public." (8 Marks) b) Prop Limited is issuing convertible shares. Prop agreed that conversion will occur for $500 million with a 25 per cent conversion premium, which is issued when the firm's stock price is $20. Given these details how many shares will be issued? Show your calculations. (4 Marks) c) Elam Limited has stocks in GK which the firm expects to hold for a while. Elam's Investment Banker, Logic Limited, asked if they could borrow 30,000 GK shares for three (3) months. GK shares are currently sold at $80 and Elam negotiated a cash collateral of 102 per cent. The market interest rate on the cash collateral is 4 per cent. Elam will offer Logic Limited a rebate of 3.5 percent. Calculate the combined profits for Elam and Logic Limited. (7 Marks) d) Nelson Limited has the following accounting information. Details: (3 Marks) Enterprise value: $5,200,000,000 Earnings Before Interest and Taxes: $600,000,000 Depreciation and Amortization: $30,000,000 Cost of Goods Sold: $700,000,000 Synergies: $20,000,000 Using the information above calculate the EBITDA multiple that includes synergies. e) Ace Limited has agreed to buy Tack Limited with a mix of cash and shares. The shareholders at Tack Limited, the target firm, will receive $10 in cash and one share of Ace Limited, the acquiring firm, for every four (4) shares of Tack Limited stock. The day before the deal was announced Ace Limited share price closed at $50. Given the information calculate the Offer price per share. (3 Marks) Question 28 (25 Marks) a) D & M Tech establishment used some of its profits to advance research on its technology offerings. The results were overwhelming, and the company recognised that a tremendous market exists for its products and services. The management at D & M Tech engaged LAN Investment Bank to help it with its financing challenges given this new market opportunity. As the investment banker assigned to D & M Tech explain the reasons to support your recommendation that the company should "go public." (8 Marks) b) Prop Limited is issuing convertible shares. Prop agreed that conversion will occur for $500 million with a 25 per cent conversion premium, which is issued when the firm's stock price is $20. Given these details how many shares will be issued? Show your calculations. (4 Marks) c) Elam Limited has stocks in GK which the firm expects to hold for a while. Elam's Investment Banker, Logic Limited, asked if they could borrow 30,000 GK shares for three (3) months. GK shares are currently sold at $80 and Elam negotiated a cash collateral of 102 per cent. The market interest rate on the cash collateral is 4 per cent. Elam will offer Logic Limited a rebate of 3.5 percent. Calculate the combined profits for Elam and Logic Limited. (7 Marks) d) Nelson Limited has the following accounting information. Details: (3 Marks) Enterprise value: $5,200,000,000 Earnings Before Interest and Taxes: $600,000,000 Depreciation and Amortization: $30,000,000 Cost of Goods Sold: $700,000,000 Synergies: $20,000,000 Using the information above calculate the EBITDA multiple that includes synergies. e) Ace Limited has agreed to buy Tack Limited with a mix of cash and shares. The shareholders at Tack Limited, the target firm, will receive $10 in cash and one share of Ace Limited, the acquiring firm, for every four (4) shares of Tack Limited stock. The day before the deal was announced Ace Limited share price closed at $50. Given the information calculate the Offer price per share

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started