Answered step by step

Verified Expert Solution

Question

1 Approved Answer

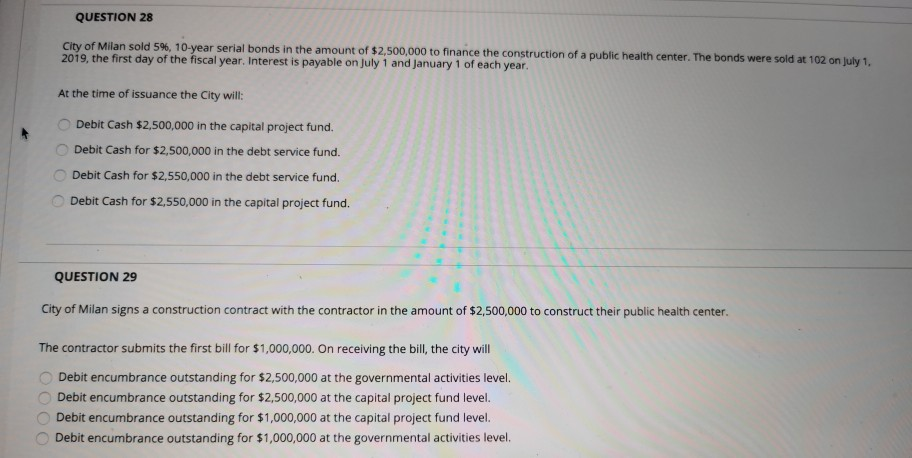

QUESTION 28 City of Milan sold 5%, 10-year serial bonds in the amount of $2,500,000 to finance the construction of a public health center. The

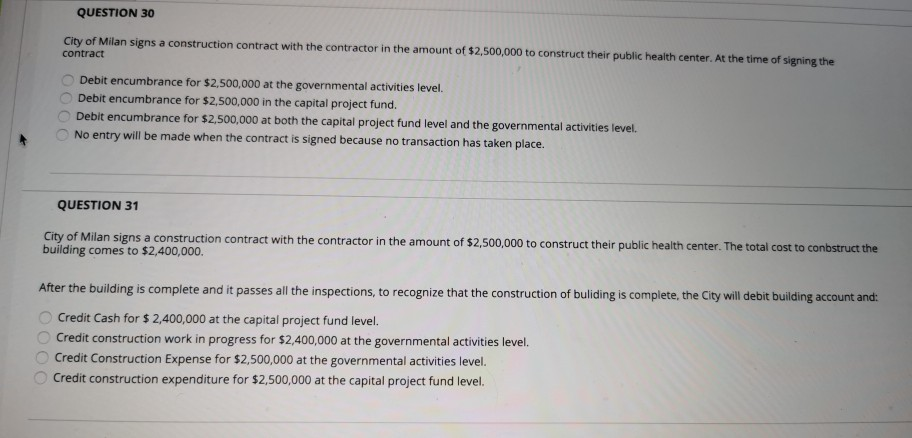

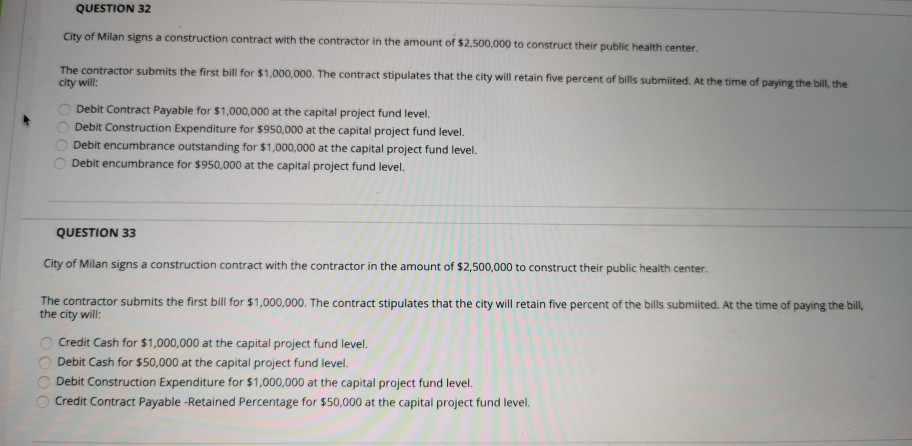

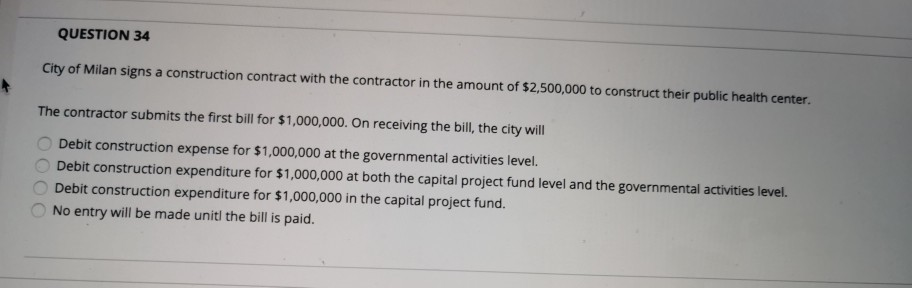

QUESTION 28 City of Milan sold 5%, 10-year serial bonds in the amount of $2,500,000 to finance the construction of a public health center. The bonds were sold at 102 on July 1, 2019, the first day of the fiscal year. Interest is payable on July 1 and January 1 of each year. At the time of issuance the City will: Debit Cash $2,500,000 in the capital project fund. Debit Cash for $2,500,000 in the debt service fund. Debit Cash for $2,550,000 in the debt service fund. Debit Cash for $2,550,000 in the capital project fund. QUESTION 29 City of Milan signs a construction contract with the contractor in the amount of $2,500,000 to construct their public health center. The contractor submits the first bill for $1,000,000. On receiving the bill, the city will Debit encumbrance outstanding for $2,500,000 at the governmental activities level. Debit encumbrance outstanding for $2,500,000 at the capital project fund level. Debit encumbrance outstanding for $1,000,000 at the capital project fund level. Debit encumbrance outstanding for $1,000,000 at the governmental activities level, QUESTION 30 City of Milan signs a construction contract with the contractor in the amount of $2,500,000 to construct their public health center. At the time of signing the contract Debit encumbrance for $2,500,000 at the governmental activities level. Debit encumbrance for $2,500,000 in the capital project fund. Debit encumbrance for $2,500,000 at both the capital project fund level and the governmental activities level. No entry will be made when the contract is signed because no transaction has taken place. QUESTION 31 City of Milan signs a construction contract with the contractor in the amount of $2,500,000 to construct their public health center. The total cost to conbstruct the building comes to $2,400,000. OOOO After the building is complete and it passes all the inspections, to recognize that the construction of buliding is complete, the City will debit building account and: Credit Cash for $ 2,400,000 at the capital project fund level. Credit construction work in progress for $2,400,000 at the governmental activities level. Credit Construction Expense for $2,500,000 at the governmental activities level. Credit construction expenditure for $2,500,000 at the capital project fund level. QUESTION 32 City of Milan signs a construction contract with the contractor in the amount of $2,500,000 to construct their public health center The contractor submits the first bill for $1,000,000. The contract stipulates that the city will retain five percent of bills submited. At the time of paying the bill, the city will: Debit Contract Payable for $1,000,000 at the capital project fund level. Debit Construction Expenditure for $950,000 at the capital project fund level. Debit encumbrance outstanding for $1,000,000 at the capital project fund level. Debit encumbrance for $950,000 at the capital project fund level. QUESTION 33 City of Milan signs a construction contract with the contractor in the amount of $2,500,000 to construct their public health center. The contractor submits the first bill for $1,000,000. The contract stipulates that the city will retain five percent of the bills submiited. At the time of paying the bill, the city will: Credit Cash for $1,000,000 at the capital project fund level. Debit Cash for $50,000 at the capital project fund level. Debit Construction Expenditure for $1,000,000 at the capital project fund level. Credit Contract Payable -Retained Percentage for $50,000 at the capital project fund level. QUESTION 34 City of Milan signs a construction contract with the contractor in the amount of $2,500,000 to construct their public health center. The contractor submits the first bill for $1,000,000. On receiving the bill, the city will Debit construction expense for $1,000,000 at the governmental activities level. Debit construction expenditure for $1,000,000 at both the capital project fund level and the governmental activities level. Debit construction expenditure for $1,000,000 in the capital project fund. No entry will be made unit the bill is paid

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started