Answered step by step

Verified Expert Solution

Question

1 Approved Answer

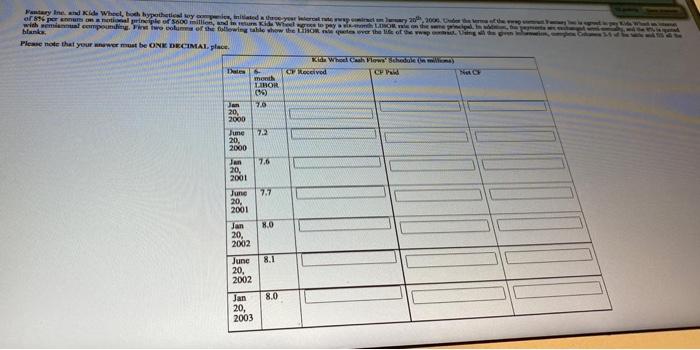

Question 28 Fantasy Inc. and Kids Wheel, both hypothetical toy companies, initiated a three-year interest rate swap contract on January 20th, 2000. Under the terms

Question 28

Fantasy Inc. and Kids Wheel, both hypothetical toy companies, initiated a three-year interest rate swap contract on January 20th, 2000. Under the terms of the swap contract Fantasy Inc is agreed to pay Kids Wheel an interest of 8% per annum on a notional principle of $600 million, and in return Kids Wheel agrees to pay a six-month LIBOR rate on the same principal. In addition, the payments are exchanged semi-annually, and the 8% is quoted with semiannual compounding. First two columns of the following table show the LIBOR rate quotes over the life of the swap contract. Using all the given information, complete Columns 3-5 of the table and fill all the blanks.

Please note that your answer must be ONE DECIMAL place.

Kids Wheel Cash Flows Schedule (in millions)

Dates

6-month LIBOR (%)

CF Received

CF Paid

Net CF

Jan 20, 2000

7.0

June 20, 2000

7.2

Jan 20, 2001

7.6

June 20, 2001

7.7

Jan 20, 2002

8.0

June 20, 2002

8.1

Jan 20, 2003

8.0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started