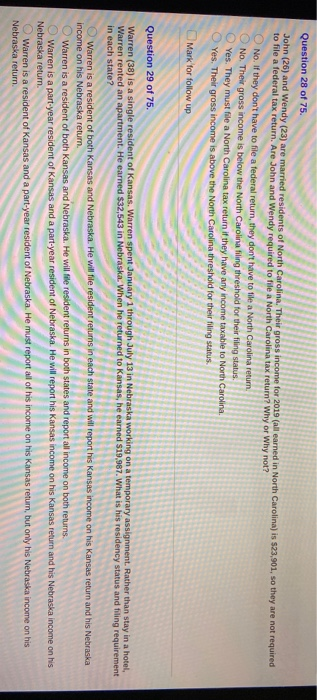

Question 28 of 75. John (26) and Wendy (23) are married residents of North Carolina. Their gross income for 2019 (all earned in North Carolina) is $23,901, so they are not required to file a federal tax return. Are John and Wendy required to file a North Carolina tax return? Why or Why not? No. if they don't have to file a federal return, they don't have to file a North Carolina return No. Their gross income is below the North Carolina filing threshold for their filing status. Yes. They must file a North Carolina tax return if they have any income taxable to North Carolina Yes. Their gross income is above the North Carolina threshold for their filing status Mark for follow up Question 29 of 75. Warren (38) is a single resident of Kansas, Warren spent January 1 through July 13 in Nebraska working on a temporary assignment. Rather than stay in a hotel, Warren rented an apartment. He earned $32,543 in Nebraska. When he returned to Kansas, he earned $19,987. What is his residency status and filing requirement in each state? Warren is a resident of both Kansas and Nebraska. He will file resident returns in each state and will report his Kansas income on his Kansas return and his Nebraska income on his Nebraska return Warren is a resident of both Kansas and Nebraska. He will file resident returns in both states and report all income on both returns. Warren is a part-year resident of Kansas and a part-year resident of Nebraska. He will report his Kansas income on his Kansas return and his Nebraska income on his Nebraska return. Warren is a resident of Kansas and a part-year resident of Nebraska. He must report all of his income on his Kansas return, but only his Nebraska income on his Nebraska return. Question 28 of 75. John (26) and Wendy (23) are married residents of North Carolina. Their gross income for 2019 (all earned in North Carolina) is $23,901, so they are not required to file a federal tax return. Are John and Wendy required to file a North Carolina tax return? Why or Why not? No. if they don't have to file a federal return, they don't have to file a North Carolina return No. Their gross income is below the North Carolina filing threshold for their filing status. Yes. They must file a North Carolina tax return if they have any income taxable to North Carolina Yes. Their gross income is above the North Carolina threshold for their filing status Mark for follow up Question 29 of 75. Warren (38) is a single resident of Kansas, Warren spent January 1 through July 13 in Nebraska working on a temporary assignment. Rather than stay in a hotel, Warren rented an apartment. He earned $32,543 in Nebraska. When he returned to Kansas, he earned $19,987. What is his residency status and filing requirement in each state? Warren is a resident of both Kansas and Nebraska. He will file resident returns in each state and will report his Kansas income on his Kansas return and his Nebraska income on his Nebraska return Warren is a resident of both Kansas and Nebraska. He will file resident returns in both states and report all income on both returns. Warren is a part-year resident of Kansas and a part-year resident of Nebraska. He will report his Kansas income on his Kansas return and his Nebraska income on his Nebraska return. Warren is a resident of Kansas and a part-year resident of Nebraska. He must report all of his income on his Kansas return, but only his Nebraska income on his Nebraska return