Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 28 This fact pattern provides information for Q#28-Q#36, inclusive. Merle Company operates a retail outlet in a prime location in Palm Springs. On September

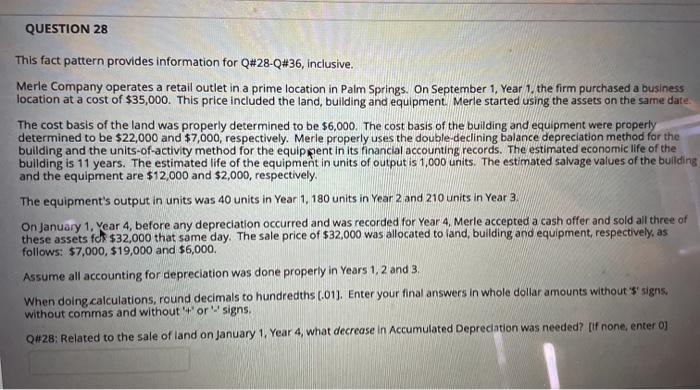

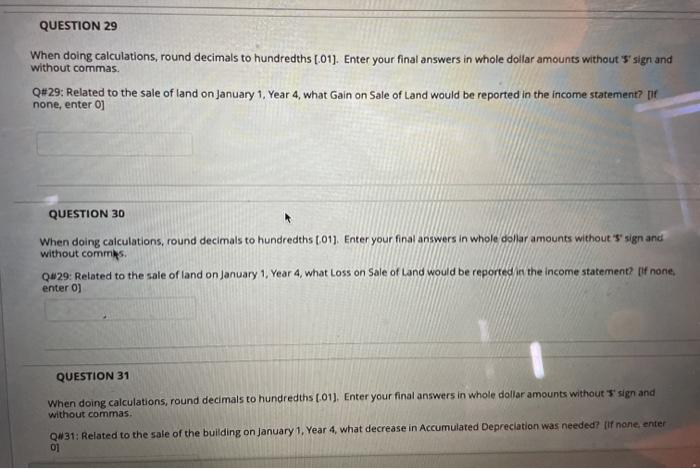

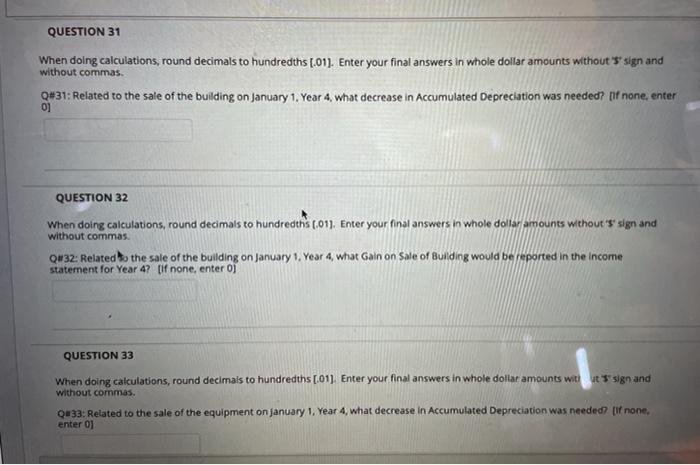

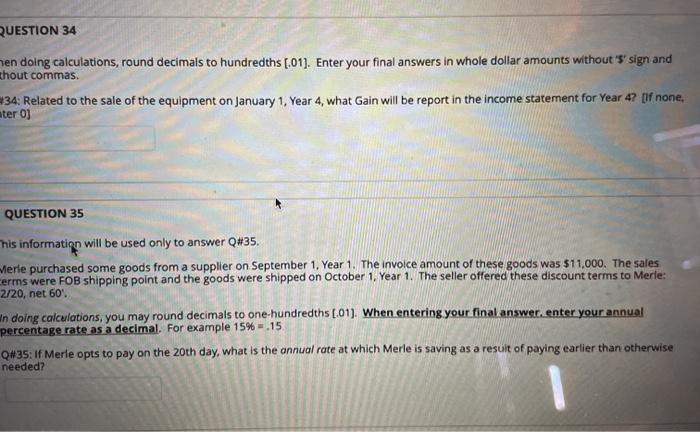

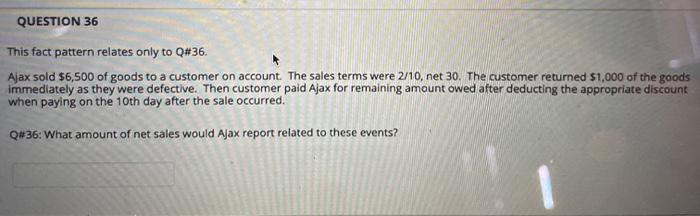

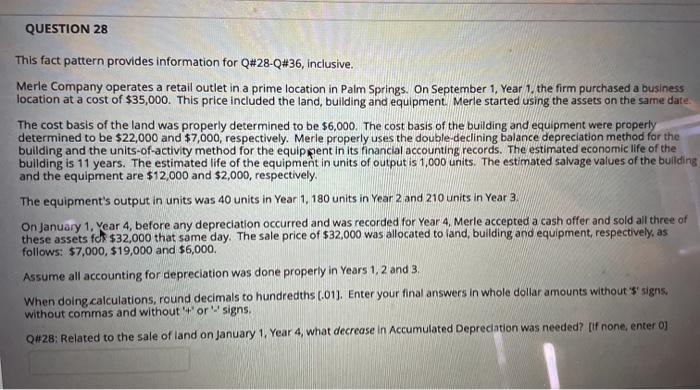

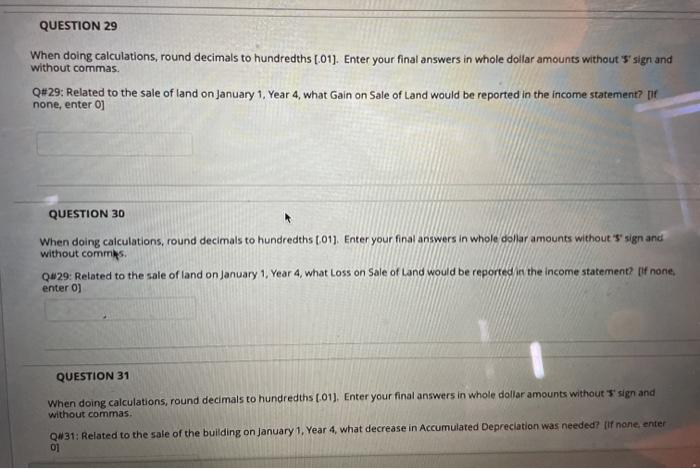

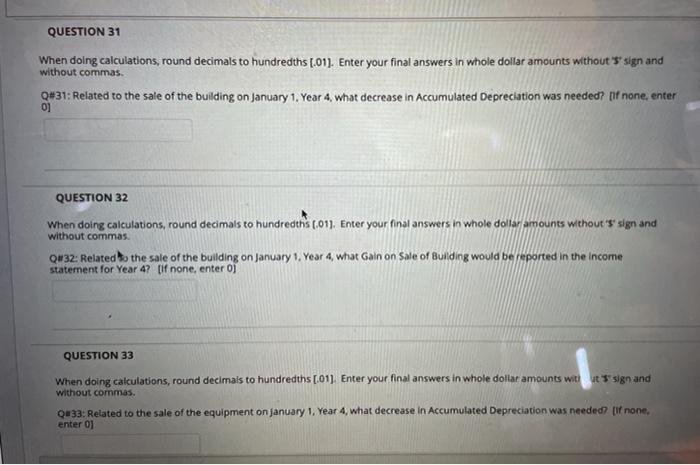

QUESTION 28 This fact pattern provides information for Q#28-Q#36, inclusive. Merle Company operates a retail outlet in a prime location in Palm Springs. On September 1, Year 1, the firm purchased a business location at a cost of $35,000. This price included the land, building and equipment Merle started using the assets on the same date. The cost basis of the land was properly determined to be $6,000. The cost basis of the building and equipment were properly determined to be $22,000 and $7,000, respectively. Merle properly uses the double-declining balance depreciation method for the building and the units-of-activity method for the equippent in its financial accounting records. The estimated economic life of the building is 11 years. The estimated life of the equipment in units of output is 1,000 units. The estimated salvage values of the building and the equipment are $12,000 and $2,000, respectively. The equipment's output in units was 40 units in Year 1, 180 units in Year 2 and 210 units in Year 3 On January 1. Year 4, before any depreciation occurred and was recorded for Year 4. Merle accepted a cash offer and sold all three of these assets fd $32,000 that same day. The sale price of $32,000 was allocated to land, building and equipment, respectively, as follows: $7,000, $19,000 and $6,000. Assume all accounting for depreciation was done properly in Years 1, 2 and 3. When doing calculations, round decimals to hundredths 0.01). Enter your final answers in whole dollar amounts without '' signs. without commas and without or signs, Q#28: Related to the sale of land on January 1, Year 4, what decrease in Accumulated Depreciation was needed? [If none, enter] QUESTION 29 When doing calculations, round decimals to hundredths [.01). Enter your final answers in whole dollar amounts without ''sign and without commas Q#29: Related to the sale of land on January 1. Year 4, what Gain on Sale of Land would be reported in the income statement? none, enter 0] QUESTION 30 When doing calculations, round decimals to hundredths 1.011. Enter your final answers in whole dollar amounts without'' sign and without comme Q#29: Related to the sale of land on January 1, Year 4, what Loss on Sale of Land would be reported in the income statement of none. entero) QUESTION 31 When doing calculations, round decimals to hundredths (01). Enter your final answers in whole dollar amounts without sign and without commas. QW31: Related to the sale of the building on January 1, Year 4, what decrease in Accumulated Depreciation was needed? pif none, enter 01 QUESTION 31 When doing calculations, round decimals to hundredths [.01). Enter your final answers in whole dollar amounts without 'sign and without commas. Q#31: Related to the sale of the building on January 1, Year 4, what decrease in Accumulated Depreciation was needed? Dif none, enter 0] QUESTION 32 When doing calculations, round decimals to hundredths 1.011. Enter your final answers in whole dollar amounts without "s' sign and without commas. Qw32: Related to the sale of the building on January 1. Year 4, what Gain on sale of Bulding would be reported in the Income statement for Year 4? [If none, enter 0) QUESTION 33 When doing calculations, round decimals to hundredths [.01). Enter your final answers in whole dollar amounts with sign and without commas. Q#33: Related to the sale of the equipment on January 1, Year 4, what decrease in Accumulated Depreciation was needed? lift none, enter 0] QUESTION 34 men doing calculations, round decimals to hundredths (01). Enter your final answers in whole dollar amounts without 's' sign and thout commas. *34: Related to the sale of the equipment on January 1, Year 4, what Gain will be report in the income statement for Year 47 of none, ater 0] QUESTION 35 This informatizn will be used only to answer Q#35. Merle purchased some goods from a supplier on September 1, Year 1. The invoice amount of these goods was $11,000. The sales cerms were FOB shipping point and the goods were shipped on October 1, Year 1. The seller offered these discount terms to Merle: 2/20, net 60 Wn doing calculations, you may round decimals to one-hundredths (.01). When entering your final answer, enter your annual percentage rate as a decimal. For example 15% = .15 Q#35: If Merle opts to pay on the 20th day, what is the annual rate at which Merle is saving as a result of paying earlier than otherwise needed? QUESTION 36 This fact pattern relates only to Q#36. Ajax sold $6,500 of goods to a customer on account. The sales terms were 2/10, net 30. The customer returned $1,000 of the goods immediately as they were defective. Then customer paid Ajax for remaining amount owed after deducting the appropriate discount when paying on the 10th day after the sale occurred. Q#36: What amount of net sales would Ajax report related to these events

QUESTION 28 This fact pattern provides information for Q#28-Q#36, inclusive. Merle Company operates a retail outlet in a prime location in Palm Springs. On September 1, Year 1, the firm purchased a business location at a cost of $35,000. This price included the land, building and equipment Merle started using the assets on the same date. The cost basis of the land was properly determined to be $6,000. The cost basis of the building and equipment were properly determined to be $22,000 and $7,000, respectively. Merle properly uses the double-declining balance depreciation method for the building and the units-of-activity method for the equippent in its financial accounting records. The estimated economic life of the building is 11 years. The estimated life of the equipment in units of output is 1,000 units. The estimated salvage values of the building and the equipment are $12,000 and $2,000, respectively. The equipment's output in units was 40 units in Year 1, 180 units in Year 2 and 210 units in Year 3 On January 1. Year 4, before any depreciation occurred and was recorded for Year 4. Merle accepted a cash offer and sold all three of these assets fd $32,000 that same day. The sale price of $32,000 was allocated to land, building and equipment, respectively, as follows: $7,000, $19,000 and $6,000. Assume all accounting for depreciation was done properly in Years 1, 2 and 3. When doing calculations, round decimals to hundredths 0.01). Enter your final answers in whole dollar amounts without '' signs. without commas and without or signs, Q#28: Related to the sale of land on January 1, Year 4, what decrease in Accumulated Depreciation was needed? [If none, enter] QUESTION 29 When doing calculations, round decimals to hundredths [.01). Enter your final answers in whole dollar amounts without ''sign and without commas Q#29: Related to the sale of land on January 1. Year 4, what Gain on Sale of Land would be reported in the income statement? none, enter 0] QUESTION 30 When doing calculations, round decimals to hundredths 1.011. Enter your final answers in whole dollar amounts without'' sign and without comme Q#29: Related to the sale of land on January 1, Year 4, what Loss on Sale of Land would be reported in the income statement of none. entero) QUESTION 31 When doing calculations, round decimals to hundredths (01). Enter your final answers in whole dollar amounts without sign and without commas. QW31: Related to the sale of the building on January 1, Year 4, what decrease in Accumulated Depreciation was needed? pif none, enter 01 QUESTION 31 When doing calculations, round decimals to hundredths [.01). Enter your final answers in whole dollar amounts without 'sign and without commas. Q#31: Related to the sale of the building on January 1, Year 4, what decrease in Accumulated Depreciation was needed? Dif none, enter 0] QUESTION 32 When doing calculations, round decimals to hundredths 1.011. Enter your final answers in whole dollar amounts without "s' sign and without commas. Qw32: Related to the sale of the building on January 1. Year 4, what Gain on sale of Bulding would be reported in the Income statement for Year 4? [If none, enter 0) QUESTION 33 When doing calculations, round decimals to hundredths [.01). Enter your final answers in whole dollar amounts with sign and without commas. Q#33: Related to the sale of the equipment on January 1, Year 4, what decrease in Accumulated Depreciation was needed? lift none, enter 0] QUESTION 34 men doing calculations, round decimals to hundredths (01). Enter your final answers in whole dollar amounts without 's' sign and thout commas. *34: Related to the sale of the equipment on January 1, Year 4, what Gain will be report in the income statement for Year 47 of none, ater 0] QUESTION 35 This informatizn will be used only to answer Q#35. Merle purchased some goods from a supplier on September 1, Year 1. The invoice amount of these goods was $11,000. The sales cerms were FOB shipping point and the goods were shipped on October 1, Year 1. The seller offered these discount terms to Merle: 2/20, net 60 Wn doing calculations, you may round decimals to one-hundredths (.01). When entering your final answer, enter your annual percentage rate as a decimal. For example 15% = .15 Q#35: If Merle opts to pay on the 20th day, what is the annual rate at which Merle is saving as a result of paying earlier than otherwise needed? QUESTION 36 This fact pattern relates only to Q#36. Ajax sold $6,500 of goods to a customer on account. The sales terms were 2/10, net 30. The customer returned $1,000 of the goods immediately as they were defective. Then customer paid Ajax for remaining amount owed after deducting the appropriate discount when paying on the 10th day after the sale occurred. Q#36: What amount of net sales would Ajax report related to these events

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started