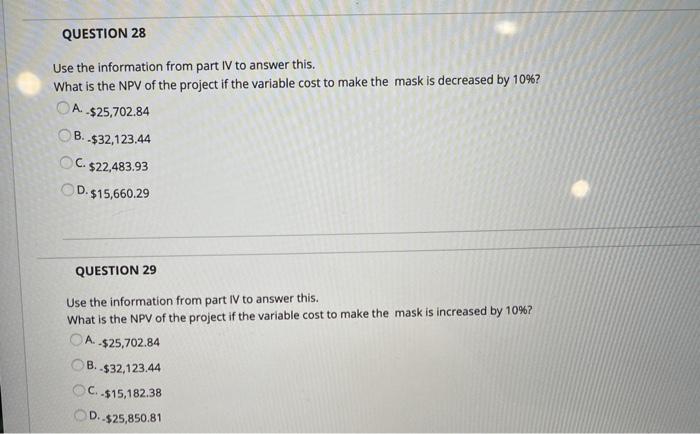

QUESTION 28 Use the information from part IV to answer this. What is the NPV of the project if the variable cost to make the mask is decreased by 10%? A $25,702.84 B. $32,123.44 C. - $22,483.93 D.$15,660.29 QUESTION 29 Use the information from part IV to answer this. What is the NPV of the project if the variable cost to make the mask is increased by 10%? . -$25,702.84 B..$32,123.44 C..$15,182.38 D. $25,850.81 Part IV Sensitivity Analysis Use this information to answer questions 26 -30. BearKat Enterprises has a WACC of 7.1% BearKat Enterprises wants you to do a sensitivity analysis where you increase the mask price by 10% and decrease it by 10%. Also see what happens when you increase the variable costs by 10% and decrease them by 10%. Part VA Scenario Analysis Use this information to answer questions 31- 34. Suppose BearKat Enterprises management team decides to do a scenario analysis. They want you to calculate the expected NPV, standard deviation, and coefficient of variation for a new project. These are not the NPV's that you calculated earlier). They give you the following data: Best case has a 25% probability and has an NPV of $29 M. Base case has a 55% probability and has an NPV of S12M. Worst case has a 20% probability and has an NPV of -$35M. Part IV: Sensitivity Analysis Use this information to answer questions 26-30. BearKat Enterprises has a WACC of 7.1% BearKat Enterprises wants you to do a sensitivity analysis where you increase the mask price by 10% and decrease it by 10%. Also see what happens when you increase the variable costs by 10% and decrease them by 10%. Part VA Scenario Analysis Use this information to answer questions 31- 34. Suppose Bear Kat Enterprises management team decides to do a scenario analysis. They want you to calculate the expected NPV, standard deviation, and coefficient of variation for a new project. These are not the NPV's that you calculated earlier). They give you the following data: Best case has a 25% probability and has an NPV of $29 M. Base case has a 55% probability and has an NPV of $12M. . Worst case has a 20% probability and has an NPV of -$35M