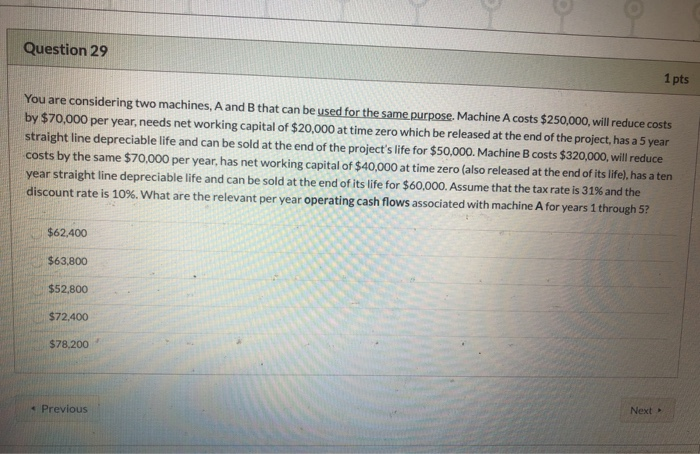

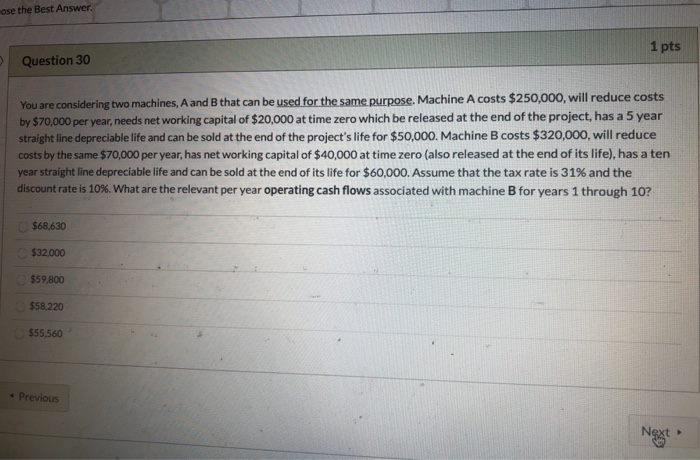

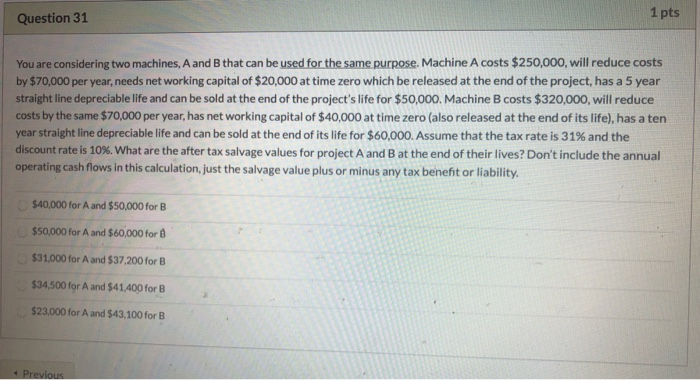

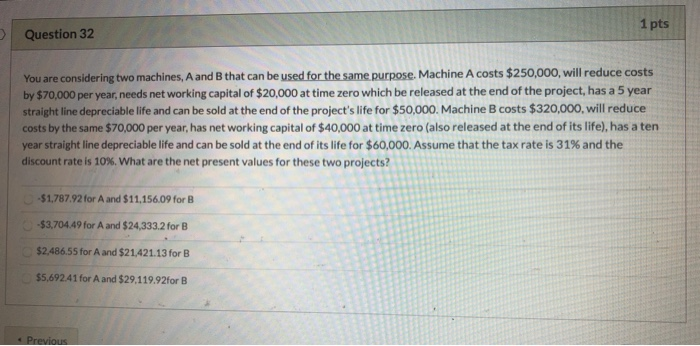

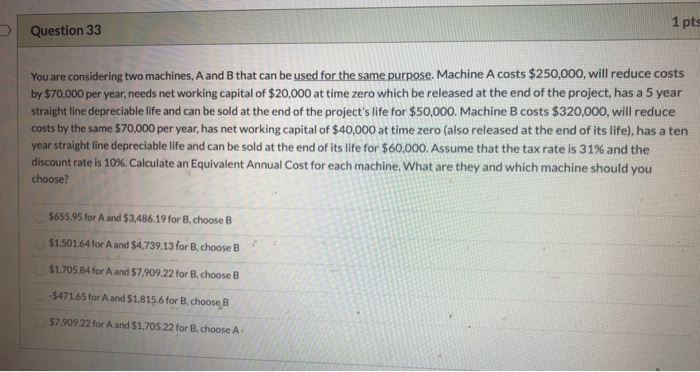

Question 29 1 pts You are considering two machines, A and B that can be used for the same purpose. Machine A costs $250,000, will reduce costs by $70,000 per year, needs net working capital of $20,000 at time zero which be released at the end of the project has a 5 year straight line depreciable life and can be sold at the end of the project's life for $50,000. Machine B costs $320,000, will reduce costs by the same $70,000 per year, has net working capital of $40,000 at time zero (also released at the end of its life), has a ten year straight line depreciable life and can be sold at the end of its life for $60,000. Assume that the tax rate is 31% and the discount rate is 10%. What are the relevant per year operating cash flows associated with machine A for years 1 through 5? $62,400 $63,800 $52,800 $72,400 $78.200 Next Previous ose the Best Answer. 1 1 pts Question 30 You are considering two machines, A and B that can be used for the same purpose. Machine A costs $250,000, will reduce costs by $70,000 per year, needs net working capital of $20,000 at time zero which be released at the end of the project, has a 5 year straight line depreciable life and can be sold at the end of the project's life for $50,000. Machine B costs $320,000, will reduce costs by the same $70,000 per year, has net working capital of $40,000 at time zero (also released at the end of its life), has a ten year straight line depreciable life and can be sold at the end of its life for $60,000. Assume that the tax rate is 31% and the discount rate is 10%. What are the relevant per year operating cash flows associated with machine B for years 1 through 10? $68,630 $32,000 $59,800 $58.220 $55,560 Previous Next Question 31 1 pts You are considering two machines, A and B that can be used for the same purpose. Machine A costs $250,000, will reduce costs by $70,000 per year, needs net working capital of $20,000 at time zero which be released at the end of the project, has a 5 year straight line depreciable life and can be sold at the end of the project's life for $50,000. Machine B costs $320,000, will reduce costs by the same $70,000 per year, has net working capital of $40,000 at time zero (also released at the end of its life), has a ten year straight line depreciable life and can be sold at the end of its life for $60,000. Assume that the tax rate is 31% and the discount rate is 10%. What are the after tax salvage values for project A and B at the end of their lives? Don't include the annual operating cash flows in this calculation, just the salvage value plus or minus any tax benent or liability $40,000 for A and $50,000 for B $50,000 for A and $60,000 for 8 $31,000 for A and $37.200 for B $34.500 for A and $41.400 for B $23.000 for A and $43.100 for B Previous Question 32 1 pts You are considering two machines, A and B that can be used for the same purpose. Machine A costs $250,000, will reduce costs by $70,000 per year, needs net working capital of $20,000 at time zero which be released at the end of the project, has a 5 year straight line depreciable life and can be sold at the end of the project's life for $50,000. Machine B costs $320,000, will reduce costs by the same $70,000 per year, has net working capital of $40,000 at time zero (also released at the end of its life), has a ten year straight line depreciable life and can be sold at the end of its life for $60,000. Assume that the tax rate is 31% and the discount rate is 10%. What are the net present values for these two projects? $1.787.92 for A and $11.156.09 for B $3.704.49 for A and $24,333.2 for B $2,486.55 for A and $21.421.13 for B $5,69241 for Aand $29.119.92for B Preous Question 33 1 pts You are considering two machines, A and B that can be used for the same purpose. Machine A costs $250,000, will reduce costs by $70,000 per year, needs net working capital of $20,000 at time zero which be released at the end of the project, has a 5 year straight line depreciable life and can be sold at the end of the project's life for $50,000. Machine B costs $320,000, will reduce costs by the same $70,000 per year, has net working capital of $40,000 at time zero (also released at the end of its life), has a ten year straight line depreciable life and can be sold at the end of its life for $60,000. Assume that the tax rate is 31% and the discount rate is 10%. Calculate an Equivalent Annual Cost for each machine. What are they and which machine should you choose? $655.95 for A and $3.486.19 for B, choose B $1.501.64 for A and $4.739.13 for B, choose B $1.705.84 for A and $7,909.22 for B, choose B -$47165 for A and $1.815.6 for B, choose B $7.909 22 for A and $1.705.22 for B, choose A