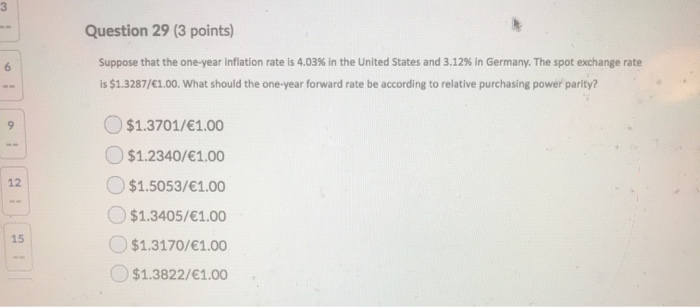

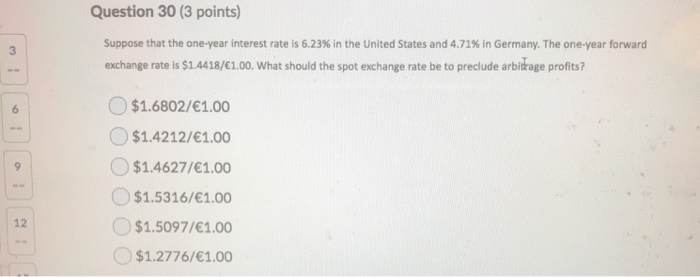

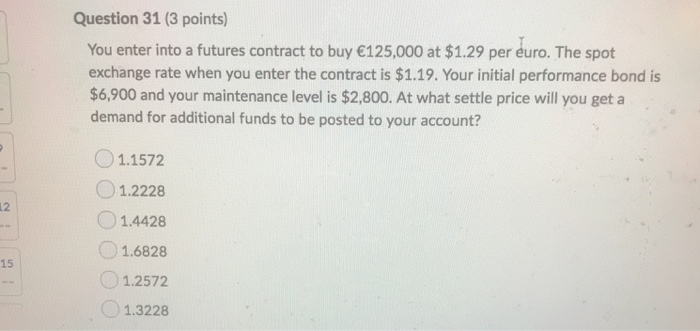

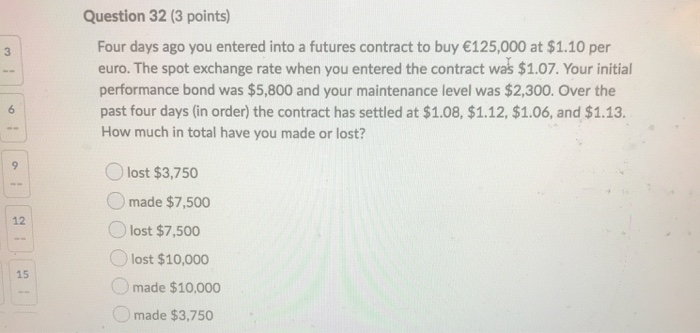

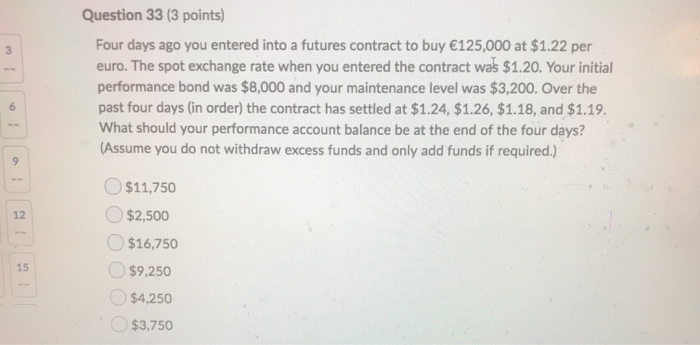

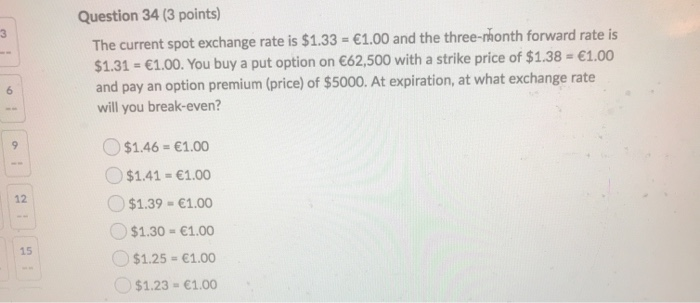

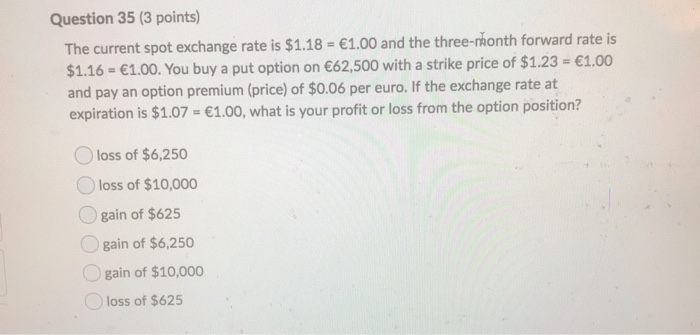

Question 29 (3 points) Suppose that the one-year inflation rate is 4.03% in the United States and 3.12% in Germany. The spot exchange rate is $1.3287/1.00. What should the one-year forward rate be according to relative purchasing power parity? O$1.3701/1.00 $1.2340/1.00 $1.5053/1.00 $1.3405/1.00 O$1.3170/1.00 $1.3822/1.00 Question 30 (3 points) Suppose that the one-year interest rate is 6.23% in the United States and 4.71% in Germany. The one-year forward exchange rate is $1.4418/1.00. What should the spot exchange rate be to preclude arbitrage profits? $1.6802/1.00 $1.4212/1.00 $1.4627/1.00 $1.5316/1.00 $1.5097/1.00 $1.2776/1.00 Question 31 (3 points) You enter into a futures contract to buy 125,000 at $1.29 per euro. The spot exchange rate when you enter the contract is $1.19. Your initial performance bond is $6,900 and your maintenance level is $2,800. At what settle price will you get a demand for additional funds to be posted to your account? e S2 1.1572 1.2228 1.4428 1.6828 1.2572 1.3228 Question 32 (3 points) Four days ago you entered into a futures contract to buy 125,000 at $1.10 per euro. The spot exchange rate when you entered the contract was $1.07. Your initial performance bond was $5,800 and your maintenance level was $2,300. Over the past four days (in order) the contract has settled at $1.08. $1.12, $1.06, and $1.13. How much in total have you made or lost? lost $3,750 made $7,500 lost $7,500 Olost $10,000 made $10,000 made $3,750 Question 33 (3 points) Four days ago you entered into a futures contract to buy 125,000 at $1.22 per euro. The spot exchange rate when you entered the contract was $1.20. Your initial performance bond was $8,000 and your maintenance level was $3,200. Over the past four days (in order) the contract has settled at $1.24, $1.26, $1.18, and $1.19. What should your performance account balance be at the end of the four days? (Assume you do not withdraw excess funds and only add funds if required.) $11,750 $2,500 $16,750 $9,250 $4,250 $3,750 Question 34 (3 points) The current spot exchange rate is $1.33 = 1.00 and the three-nhonth forward rate is $1.31 = 1.00. You buy a put option on 62,500 with a strike price of $1.38 = 1.00 and pay an option premium (price) of $5000. At expiration, at what exchange rate will you break-even? $1.46 = 1.00 $1.41 = 1.00 $1.39 - 1.00 $1.30 - 1.00 $1.25 = 1.00 $1.23 + 1.00