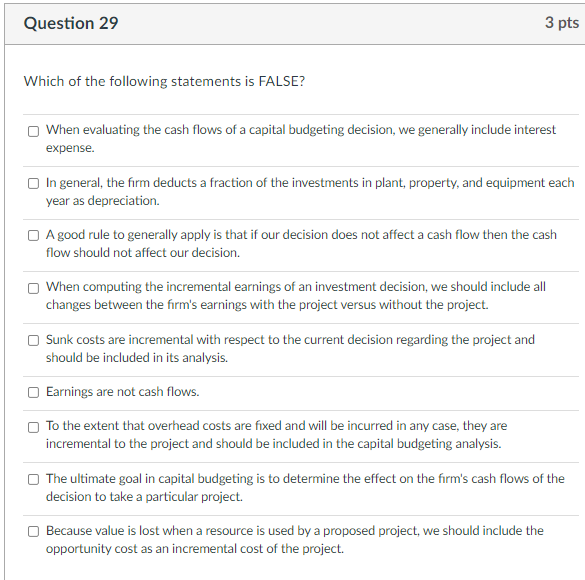

Question 29 3 pts Which of the following statements is FALSE? When evaluating the cash flows of a capital budgeting decision, we generally include interest expense. In general, the firm deducts a fraction of the investments in plant, property, and equipment each year as depreciation. A good rule to generally apply is that if our decision does not affect a cash flow then the cash flow should not affect our decision. When computing the incremental earnings of an investment decision, we should include all changes between the firm's earnings with the project versus without the project. Sunk costs are incremental with respect to the current decision regarding the project and should be included in its analysis. Earnings are not cash flows. To the extent that overhead costs are fixed and will be incurred in any case, they are incremental to the project and should be included in the capital budgeting analysis. The ultimate goal in capital budgeting is to determine the effect on the firm's cash flows of the decision to take a particular project. Because value is lost when a resource is used by a proposed project, we should include the opportunity cost as an incremental cost of the project. Question 29 3 pts Which of the following statements is FALSE? When evaluating the cash flows of a capital budgeting decision, we generally include interest expense. In general, the firm deducts a fraction of the investments in plant, property, and equipment each year as depreciation. A good rule to generally apply is that if our decision does not affect a cash flow then the cash flow should not affect our decision. When computing the incremental earnings of an investment decision, we should include all changes between the firm's earnings with the project versus without the project. Sunk costs are incremental with respect to the current decision regarding the project and should be included in its analysis. Earnings are not cash flows. To the extent that overhead costs are fixed and will be incurred in any case, they are incremental to the project and should be included in the capital budgeting analysis. The ultimate goal in capital budgeting is to determine the effect on the firm's cash flows of the decision to take a particular project. Because value is lost when a resource is used by a proposed project, we should include the opportunity cost as an incremental cost of the project