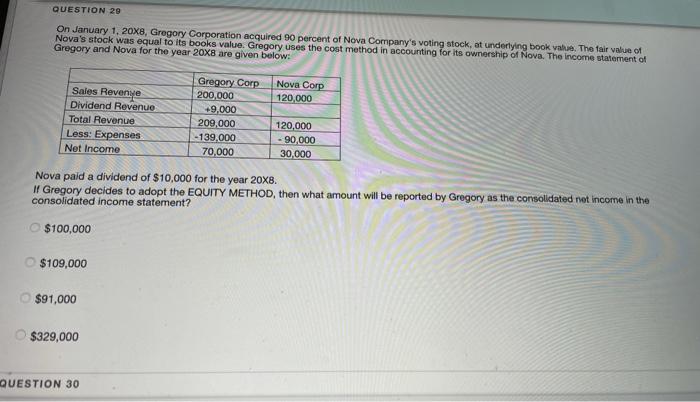

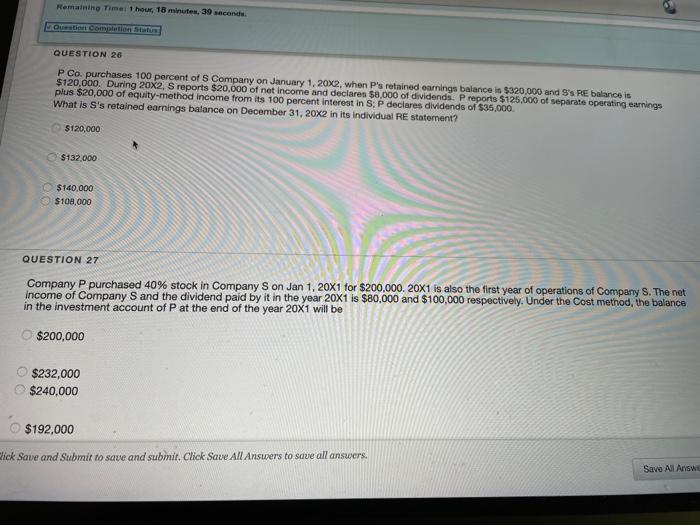

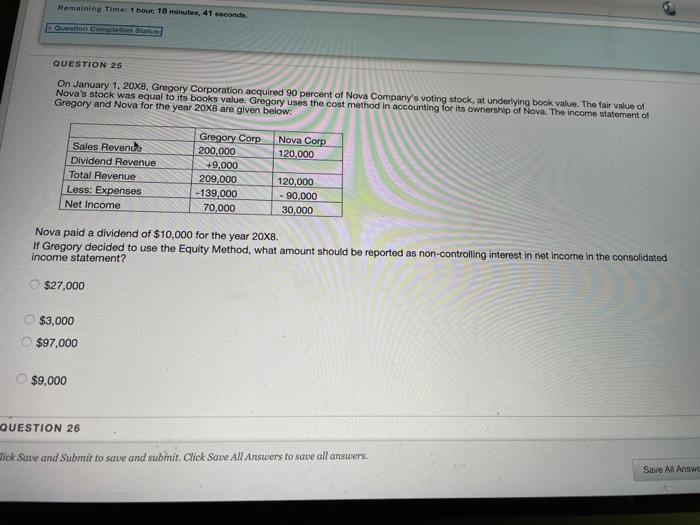

QUESTION 29 On January 1, 20X8, Gregory Corporation acquired 90 percent of Nova Company's voting stock, at underlying book value. The fair value of Nova's stock was equal to its books value. Gregory uses the cost method in accounting for its ownership of Nova. The income statement of Gregory and Nova for the year 20X8 are given below. Nova Corp 120,000 Sales Revenge Dividend Revenue Total Revenue Less: Expenses Net Income Gregory Corp 200,000 +9,000 209,000 - 139,000 70,000 120,000 - 90,000 30,000 Nova paid a dividend of $10,000 for the year 20x8. If Gregory decides to adopt the EQUITY METHOD, then what amount will be reported by Gregory as the consolidated net income in the consolidated income statement? $100,000 $109,000 $91,000 $329,000 QUESTION 30 Remaining Time: 1 hour, 18 minutes, 39 seconda Oration completion QUESTION 26 P Co. purchases 100 percent of Company on January 1, 20X2, when P's retained earnings balance is $320,000 and SS RE balance is $120.000. During 20X2, S reports $20,000 of net income and declares $8,000 of dividends. P reports $125,000 of separate operating earrings plus $20,000 of equity-method income from its 100 percent interest in S. P declares dividends of $35,000 What is S's retained earnings balance on December 31, 20X2 in its individual RE statement? $120,000 $132.000 $140,000 $100,000 QUESTION 27 Company P purchased 40% stock in Company Son Jan 1, 20x1 for $200.000. 20x1 is also the first year of operations of Company S. The net income of Company S and the dividend paid by it in the year 20X1 is $80,000 and $100,000 respectively. Under the Cost method, the balance in the investment account of P at the end of the year 20X1 will be $200,000 $232,000 $240,000 $192,000 dick Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answe Remaining Time! Thour, 18 minutes, 41 seconds Question completion QUESTION 25 On January 1, 20X8. Gregory Corporation acquired 90 percent of Nova Company's voting stock, at underlying book value. The fair value of Nova's stock was equal to its books value. Gregory uses the cost method in accounting for its ownership of Nova. The income statement of Gregory and Nova for the year 20X8 are given below. Nova Corp 120,000 Sales Revenu Dividend Revenue Total Revenue Loss: Expenses Net Income Gregory Corp 200,000 +9,000 209,000 -139,000 70,000 120,000 - 90,000 30,000 Nova paid a dividend of $10,000 for the year 20X8. If Gregory decided to use the Equity Method, what amount should be reported as non-controlling interest in net income in the consolidated income statement? $27,000 $3,000 $97,000 $9,000 QUESTION 26 lick Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Antwe