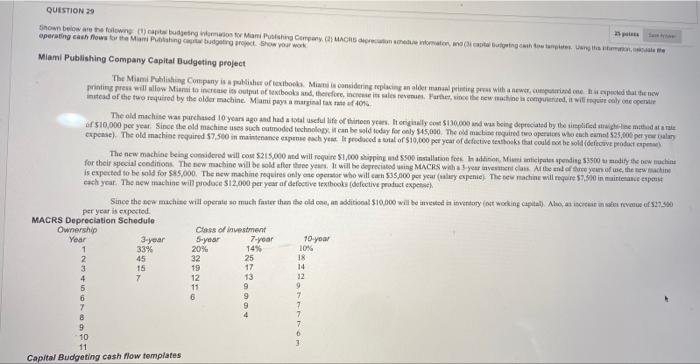

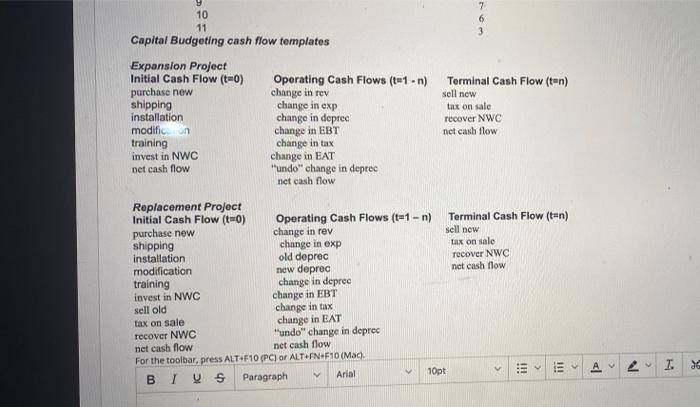

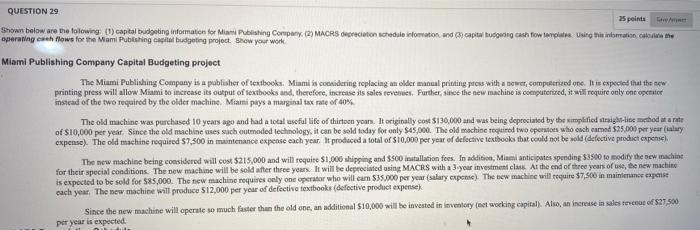

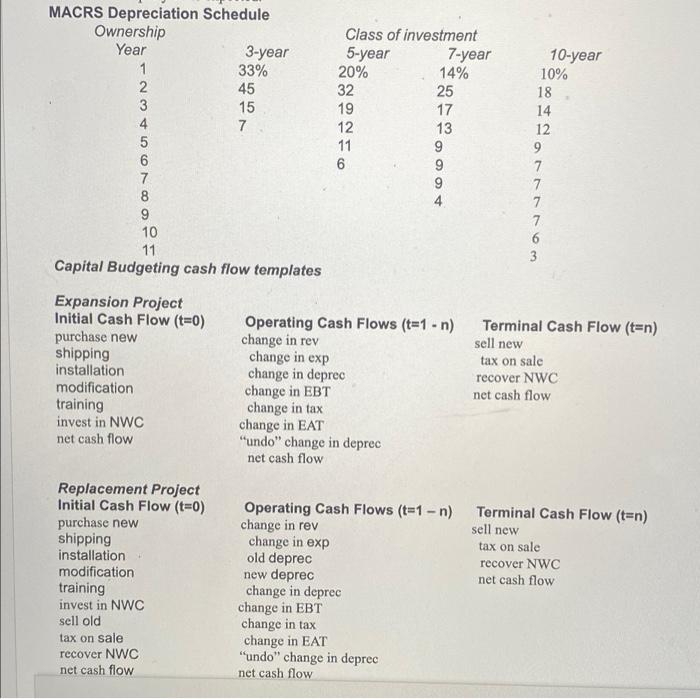

QUESTION 29 Shown below are the flow budgeting onto tong Com MARS women, Buting canh tower operating cash flows to the Mani Pathing but how you Miami Publishing Company Capital Budgeting project The Miami Plishing Company is publisher of textbooks Miami considering replacing an older manual ping pon with a new comme pod the new printing press will allow Miami to increase its output of textbooks and therefore, il Puner, inceleme is computed it will quittolyoner Open Instead of the two required by the older machine. Miami pays a marginal tax rate of 10% The old machine was purchased 10 years ago and had a total site of the years. Itongly cost $130.000 and was being depreciated by the simplified with stanie of $10,000 per year. Since the old machine uses such outmoded technology, it can be sold today for only $45,000. The old is required to operators who chemat $25.00 per year expense). The old machine required 57.500 in maintenance espre ach yeu le produced total of 510.000 per year of defective textbooks that could not be sold (efecwe podat pe The new machine being considered will cost $215.000 and will require $1,000 shipping and S500 installation for that. Mitate pending 3500 u modity the new machine for their special conditions. The new machine will be sold after he year. It will be deprecated in MACRS with 1 year investments Altbeto free you of use, the new machine is expected to be sold for $85,000. The machine requires only one or who will ca 535,000 per your(lary expenses. The new machine will require 57.310 in maintenance expense cach year. The new machine will produce $12.000 per year of defective thooks (defective product expense) Since the new machine will openie so much finster than the old one, an additional $10,000 will be invested in inventory (not working capital). Als, as increien aber even of 529.900 per year is expected MACRS Depreciation Schedule Ownership Class of investment Year 3-year 5-year 7-year 10-your 1 33% 20% 14% 10% 2. 45 32 25 18 3 15 19 17 14 4 7 12 32 5 11 9 9 6 9 7 7 7 B 9 10 11 Capital Budgeting cash flow templates 9 10 11 Capital Budgeting cash flow templates 7 6 3 Expansion Project Initial Cash Flow (t=0) Operating Cash Flows (t#1 - n) Terminal Cash Flow (tan) purchase new change in rev sell new shipping change in exp installation tax on sale change in deprec recover NWC modific on change in EBT net cash flow training change in tax invest in NWC change in EAT net cash flow "undo" change in deprec net cash flow Replacement Project Initial Cash Flow (0) Operating Cash Flows (t-1-n) Terminal Cash Flow (tan) purchase new change in rev sell new shipping change in exp tax on sale installation old deprec Tecover NWC modification new deprec net cash flow training change in deprec invest in NWC change in EBT sell old change in tax tax on sale change in EAT recover NWC "undo" change in deprec net cash flow net cash flow For the toolbar, press ALT F10 (PC) or ALT FN.F10 (Mac) BI V S Paragraph Arial 10pt !!! > I. V 11! A QUESTION 29 25 points Shown below are the folowing (1) captalbudgeting information for Miami Publishing Company (2) MACRS Oreciation schedule infomation and capital budgering cash flow me. Using this into the operating each flows for the Mami Publishing to budgeting project show your work Miami Publishing Company Capital Budgeting project The Miami Publishing Company is publisher of textbooks. Minmi is considering replacing an older manual printing press with a newer, computerized one. It is expected that the new printing press will allow Miami to increase its output of textbooks and therefore, increase its sales revenues. Further, since the new machine is computerized, it will require only cat openstor instead of the two required by the older machine. Miami pays a marginal tax rate of 40% The old machine was purchased 10 years ago and had a total useful life of thirteen years. It originally cost $130,000 and was being depreciated by the simplified straight-line method warte of $10,000 per year. Since the old machine uses such outmoded technology, it can be sold today for only $45,000. The old machine required to operates who cacheamed 525,000 per year (alary expense). The old machine required 57.500 in maintenance expense each year. It produced a total of 10,000 per year of defective textbooks that could not be sold (defective product expense) The new machine being considered will cost $215,000 and will require $1,000 shipping and $500 installation fees. In addition, Miami anticipates spending 83500 to modify the new machine for their special conditions. The new machine will be sold after three years. It will be depreciated using MACRS with a 3 year investment class Arthe end of three years of use, the new machine is expected to be sold for 585,000. The new machine requires only one operator who will cam $35.000 per year (salary expense). The new machine will require $7,500 in maintenance expense cach year. The new machine will produce $12,000 per year of defective textbooks (defective product expense Since the new machine will operate so much faster than the old one, an additional $10,000 will be invested inventory networking capital). Also, an increase in sales terras of 27.500 per year is expected MACRS Depreciation Schedule Ownership Year 3-year 1 33% 2 45 3 15 4 7 5 Woo AWN Class of investment 5-year 7-year 20% 14% 32 25 19 17 12 13 11 9 6 9 9 4. 10-year 10% 18 14 12 9 7 7 7 7 6 3 7 8 9 10 11 Capital Budgeting cash flow templates Expansion Project Initial Cash Flow (t=0) purchase new shipping installation modification training invest in NWC net cash flow Operating Cash Flows (t=1 - n) change in rev change in exp change in deprec change in EBT change in tax change in EAT "undo" change in deprec net cash flow Terminal Cash Flow (t=n) sell new tax on sale recover NWC net cash flow Replacement Project Initial Cash Flow (t=0) purchase new shipping installation modification training invest in NWC sell old tax on sale recover NWC net cash flow Operating Cash Flows (t=1 - n) change in rev change in exp old deprec new deprec change in deprec change in EBT change in tax change in EAT "undo" change in deprec net cash flow Terminal Cash Flow (t=n) sell new tax on sale recover NWC net cash flow QUESTION 29 Shown below are the flow budgeting onto tong Com MARS women, Buting canh tower operating cash flows to the Mani Pathing but how you Miami Publishing Company Capital Budgeting project The Miami Plishing Company is publisher of textbooks Miami considering replacing an older manual ping pon with a new comme pod the new printing press will allow Miami to increase its output of textbooks and therefore, il Puner, inceleme is computed it will quittolyoner Open Instead of the two required by the older machine. Miami pays a marginal tax rate of 10% The old machine was purchased 10 years ago and had a total site of the years. Itongly cost $130.000 and was being depreciated by the simplified with stanie of $10,000 per year. Since the old machine uses such outmoded technology, it can be sold today for only $45,000. The old is required to operators who chemat $25.00 per year expense). The old machine required 57.500 in maintenance espre ach yeu le produced total of 510.000 per year of defective textbooks that could not be sold (efecwe podat pe The new machine being considered will cost $215.000 and will require $1,000 shipping and S500 installation for that. Mitate pending 3500 u modity the new machine for their special conditions. The new machine will be sold after he year. It will be deprecated in MACRS with 1 year investments Altbeto free you of use, the new machine is expected to be sold for $85,000. The machine requires only one or who will ca 535,000 per your(lary expenses. The new machine will require 57.310 in maintenance expense cach year. The new machine will produce $12.000 per year of defective thooks (defective product expense) Since the new machine will openie so much finster than the old one, an additional $10,000 will be invested in inventory (not working capital). Als, as increien aber even of 529.900 per year is expected MACRS Depreciation Schedule Ownership Class of investment Year 3-year 5-year 7-year 10-your 1 33% 20% 14% 10% 2. 45 32 25 18 3 15 19 17 14 4 7 12 32 5 11 9 9 6 9 7 7 7 B 9 10 11 Capital Budgeting cash flow templates 9 10 11 Capital Budgeting cash flow templates 7 6 3 Expansion Project Initial Cash Flow (t=0) Operating Cash Flows (t#1 - n) Terminal Cash Flow (tan) purchase new change in rev sell new shipping change in exp installation tax on sale change in deprec recover NWC modific on change in EBT net cash flow training change in tax invest in NWC change in EAT net cash flow "undo" change in deprec net cash flow Replacement Project Initial Cash Flow (0) Operating Cash Flows (t-1-n) Terminal Cash Flow (tan) purchase new change in rev sell new shipping change in exp tax on sale installation old deprec Tecover NWC modification new deprec net cash flow training change in deprec invest in NWC change in EBT sell old change in tax tax on sale change in EAT recover NWC "undo" change in deprec net cash flow net cash flow For the toolbar, press ALT F10 (PC) or ALT FN.F10 (Mac) BI V S Paragraph Arial 10pt !!! > I. V 11! A QUESTION 29 25 points Shown below are the folowing (1) captalbudgeting information for Miami Publishing Company (2) MACRS Oreciation schedule infomation and capital budgering cash flow me. Using this into the operating each flows for the Mami Publishing to budgeting project show your work Miami Publishing Company Capital Budgeting project The Miami Publishing Company is publisher of textbooks. Minmi is considering replacing an older manual printing press with a newer, computerized one. It is expected that the new printing press will allow Miami to increase its output of textbooks and therefore, increase its sales revenues. Further, since the new machine is computerized, it will require only cat openstor instead of the two required by the older machine. Miami pays a marginal tax rate of 40% The old machine was purchased 10 years ago and had a total useful life of thirteen years. It originally cost $130,000 and was being depreciated by the simplified straight-line method warte of $10,000 per year. Since the old machine uses such outmoded technology, it can be sold today for only $45,000. The old machine required to operates who cacheamed 525,000 per year (alary expense). The old machine required 57.500 in maintenance expense each year. It produced a total of 10,000 per year of defective textbooks that could not be sold (defective product expense) The new machine being considered will cost $215,000 and will require $1,000 shipping and $500 installation fees. In addition, Miami anticipates spending 83500 to modify the new machine for their special conditions. The new machine will be sold after three years. It will be depreciated using MACRS with a 3 year investment class Arthe end of three years of use, the new machine is expected to be sold for 585,000. The new machine requires only one operator who will cam $35.000 per year (salary expense). The new machine will require $7,500 in maintenance expense cach year. The new machine will produce $12,000 per year of defective textbooks (defective product expense Since the new machine will operate so much faster than the old one, an additional $10,000 will be invested inventory networking capital). Also, an increase in sales terras of 27.500 per year is expected MACRS Depreciation Schedule Ownership Year 3-year 1 33% 2 45 3 15 4 7 5 Woo AWN Class of investment 5-year 7-year 20% 14% 32 25 19 17 12 13 11 9 6 9 9 4. 10-year 10% 18 14 12 9 7 7 7 7 6 3 7 8 9 10 11 Capital Budgeting cash flow templates Expansion Project Initial Cash Flow (t=0) purchase new shipping installation modification training invest in NWC net cash flow Operating Cash Flows (t=1 - n) change in rev change in exp change in deprec change in EBT change in tax change in EAT "undo" change in deprec net cash flow Terminal Cash Flow (t=n) sell new tax on sale recover NWC net cash flow Replacement Project Initial Cash Flow (t=0) purchase new shipping installation modification training invest in NWC sell old tax on sale recover NWC net cash flow Operating Cash Flows (t=1 - n) change in rev change in exp old deprec new deprec change in deprec change in EBT change in tax change in EAT "undo" change in deprec net cash flow Terminal Cash Flow (t=n) sell new tax on sale recover NWC net cash flow