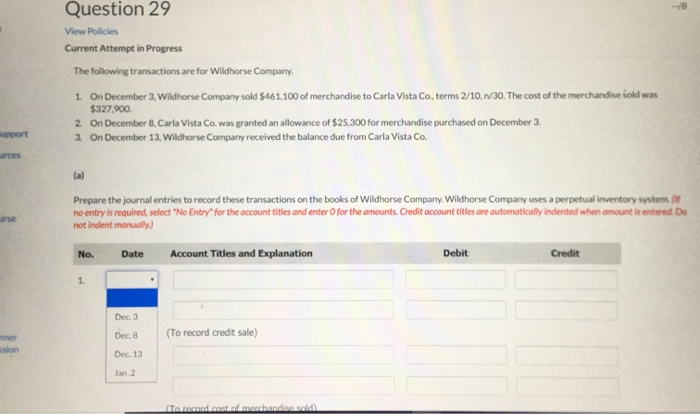

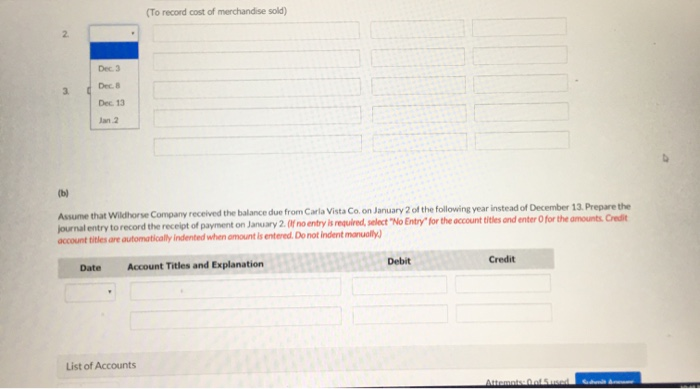

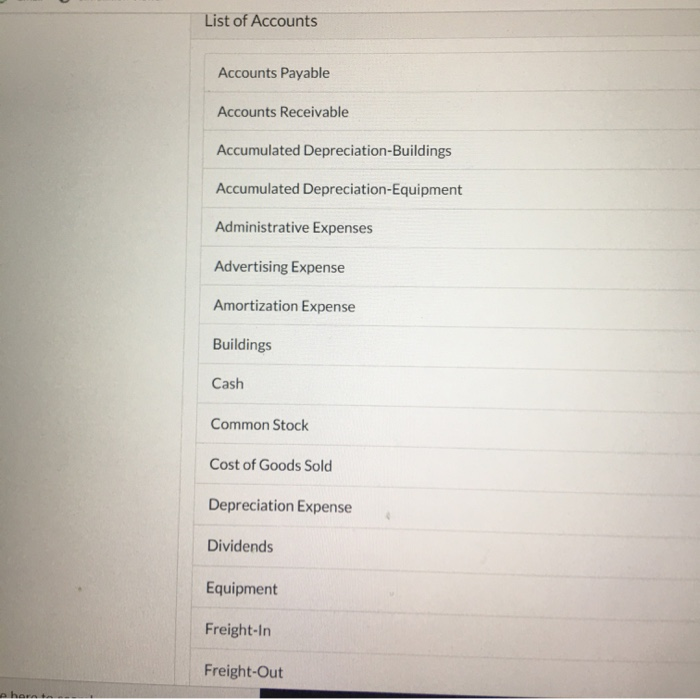

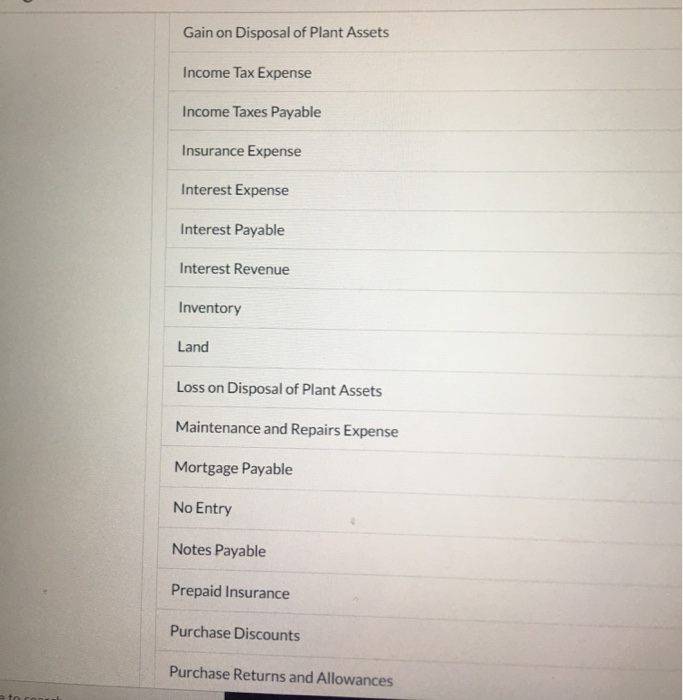

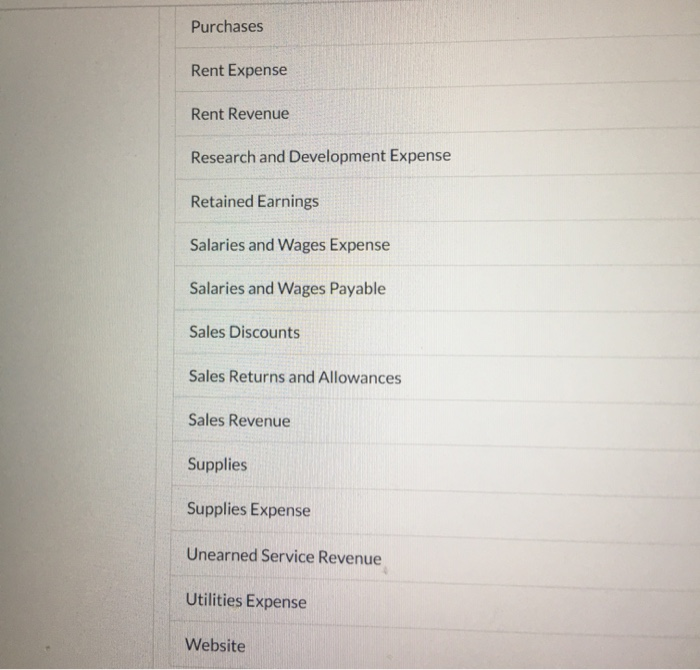

Question 29 View Policies Current Attempt in Progress The following transactions are for Wildhorse Company, 1. On December 3, Wildhorse Company sold $461,100 of merchandise to Carla Vista Co, terms 2/10, 1/30. The cost of the merchandise sold was $327.900 2 On December 8, Carla Vista Co. was granted an allowance of $25,300 for merchandise purchased on December 3. 3. On December 13, Wildhorse Company received the balance due from Carla Vista Co. support urces Prepare the journal entries to record these transactions on the books of Wildhorse Company, Wildhorse Company uses a perpetual inventory system. no entry is required, select "No Entry for the account titles and enter for the amounts. Credit account titles are automatically indented when amount is entered De not indent manually) No. Date Account Titles and Explanation Debit Credit Dec 3 Dec 8 (To record credit sale) Dec 13 candid a adidesa di (To record cost of merchandise sold) Dec 3 Dec. 8 Dec 13 2 Assume that Wildhorse Company received the balance due from Carla Vista Co. on January 2 of the following year instead of December 13. Prepare the journal entry to record the receipt of payment on January 2017 no entry is required, select "No Entry for the account titles and enter for the amounts Credit account titles are automatically indented when amount is entered. Do not indent manually Debit Credit Date Account Titles and Explanation List of Accounts Automated List of Accounts Accounts Payable Accounts Receivable Accumulated Depreciation-Buildings Accumulated Depreciation Equipment Administrative Expenses Advertising Expense Amortization Expense Buildings Cash Common Stock Cost of Goods Sold Depreciation Expense Dividends Equipment Freight-In Freight-Out Gain on Disposal of Plant Assets Income Tax Expense Income Taxes Payable Insurance Expense Interest Expense Interest Payable Interest Revenue Inventory Land Loss on Disposal of Plant Assets Maintenance and Repairs Expense Mortgage Payable No Entry Notes Payable Prepaid Insurance Purchase Discounts Purchase Returns and Allowances Purchases Rent Expense Rent Revenue Research and Development Expense Retained Earnings Salaries and Wages Expense Salaries and Wages Payable Sales Discounts Sales Returns and Allowances Sales Revenue Supplies Supplies Expense Unearned Service Revenue Utilities Expense Website