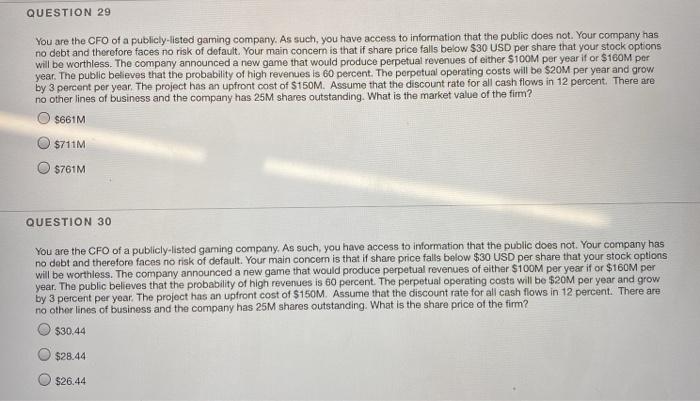

QUESTION 29 You are the CFO of a publicly listed gaming company. As such, you have access to information that the public does not. Your company has no debt and therefore faces no risk of default. Your main concern is that if share price falls below $30 USD per share that your stock options will be worthless. The company announced a new game that would produce perpetual revenues of either $100M per year if or $160M por year. The public believes that the probability of high revenues is 60 percent. The perpetual operating costs will be $20M per year and grow by 3 percent per year. The project has an upfront cost of $150M. Assume that the discount rate for all cash flows in 12 percent. There are no other lines of business and the company has 25M shares outstanding. What is the market value of the firm? O $661M $711M $761M QUESTION 30 You are the CFO of a publicly-listed gaming company. As such, you have access to information that the public does not. Your company has no debt and therefore faces no risk of default. Your main concern is that if share price falls below $30 USD per share that your stock options will be worthless. The company announced a new game that would produce perpetual revenues of either $100M per year if or $160M per year. The public believes that the probability of high revenues is 60 percent. The perpetual operating costs will be $20M per year and grow by 3 percent per year. The project has an upfront cost of $150M. Assume that the discount rate for all cash flows in 12 percent. There are no other lines of business and the company has 25M shares outstanding. What is the share price of the firm? $30.44 $28.44 $26.44 QUESTION 29 You are the CFO of a publicly listed gaming company. As such, you have access to information that the public does not. Your company has no debt and therefore faces no risk of default. Your main concern is that if share price falls below $30 USD per share that your stock options will be worthless. The company announced a new game that would produce perpetual revenues of either $100M per year if or $160M por year. The public believes that the probability of high revenues is 60 percent. The perpetual operating costs will be $20M per year and grow by 3 percent per year. The project has an upfront cost of $150M. Assume that the discount rate for all cash flows in 12 percent. There are no other lines of business and the company has 25M shares outstanding. What is the market value of the firm? O $661M $711M $761M QUESTION 30 You are the CFO of a publicly-listed gaming company. As such, you have access to information that the public does not. Your company has no debt and therefore faces no risk of default. Your main concern is that if share price falls below $30 USD per share that your stock options will be worthless. The company announced a new game that would produce perpetual revenues of either $100M per year if or $160M per year. The public believes that the probability of high revenues is 60 percent. The perpetual operating costs will be $20M per year and grow by 3 percent per year. The project has an upfront cost of $150M. Assume that the discount rate for all cash flows in 12 percent. There are no other lines of business and the company has 25M shares outstanding. What is the share price of the firm? $30.44 $28.44 $26.44