Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2(B) On July 1, 2025, PBN Corp. purchased a factory, including land, building, and machines for $3,200,000 from Millan Inc. In addition, PBN

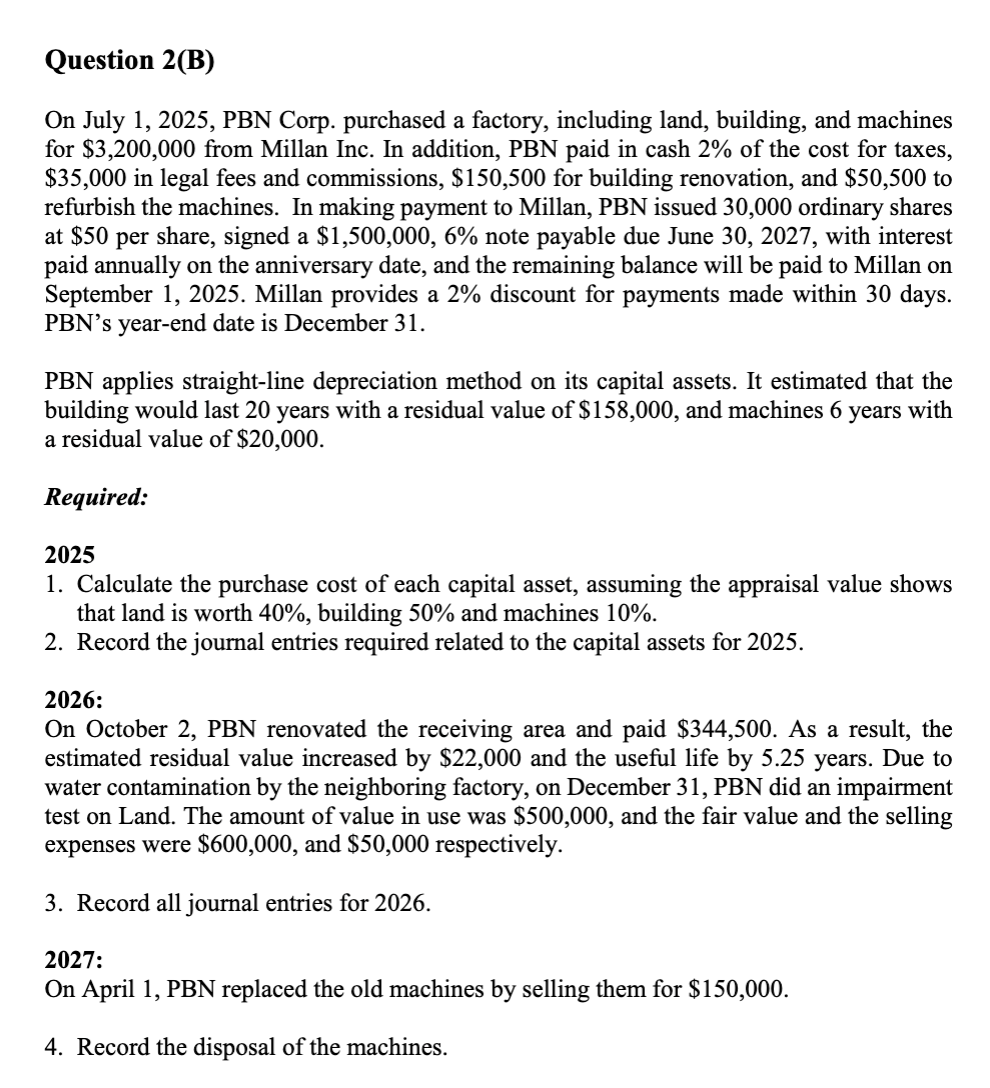

Question 2(B) On July 1, 2025, PBN Corp. purchased a factory, including land, building, and machines for $3,200,000 from Millan Inc. In addition, PBN paid in cash 2% of the cost for taxes, $35,000 in legal fees and commissions, $150,500 for building renovation, and $50,500 to refurbish the machines. In making payment to Millan, PBN issued 30,000 ordinary shares at $50 per share, signed a $1,500,000, 6% note payable due June 30, 2027, with interest paid annually on the anniversary date, and the remaining balance will be paid to Millan on September 1, 2025. Millan provides a 2% discount for payments made within 30 days. PBN's year-end date is December 31. PBN applies straight-line depreciation method on its capital assets. It estimated that the building would last 20 years with a residual value of $158,000, and machines 6 years with a residual value of $20,000. Required: 2025 1. Calculate the purchase cost of each capital asset, assuming the appraisal value shows that land is worth 40%, building 50% and machines 10%. 2. Record the journal entries required related to the capital assets for 2025. 2026: On October 2, PBN renovated the receiving area and paid $344,500. As a result, the estimated residual value increased by $22,000 and the useful life by 5.25 years. Due to water contamination by the neighboring factory, on December 31, PBN did an impairment test on Land. The amount of value in use was $500,000, and the fair value and the selling expenses were $600,000, and $50,000 respectively. 3. Record all journal entries for 2026. 2027: On April 1, PBN replaced the old machines by selling them for $150,000. 4. Record the disposal of the machines.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started