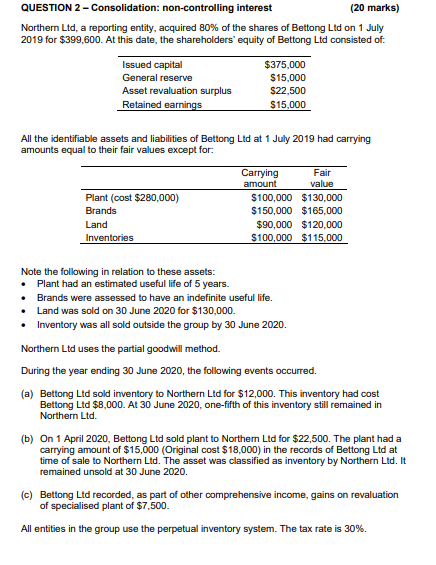

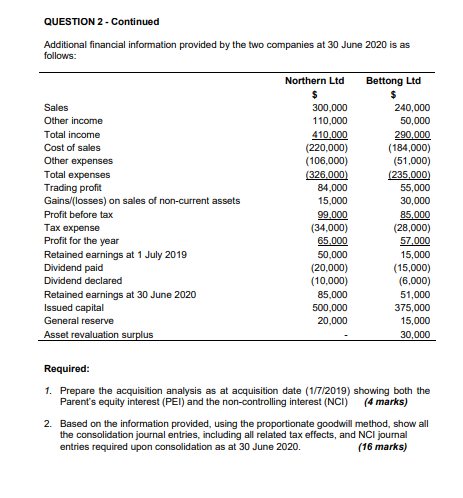

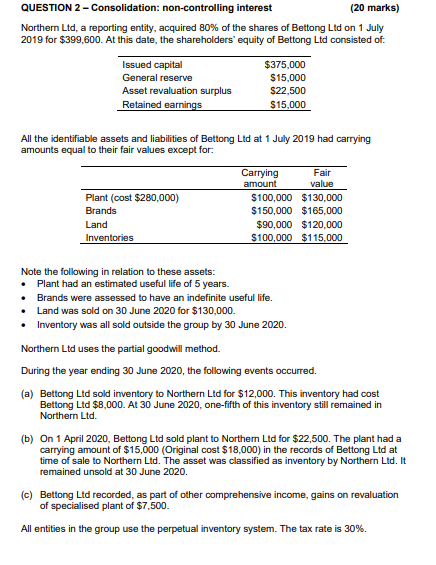

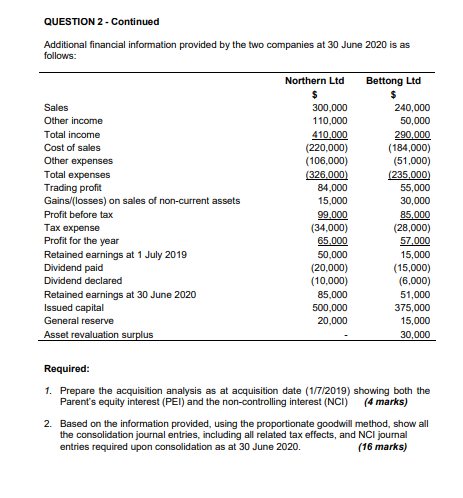

QUESTION 2-Consolidation: non-controlling interest (20 marks) Northern Ltd, a reporting entity, acquired 80 % of the shares of Bettong Ltd on 1 July 2019 for $399,600. At this date, the shareholders equity of Bettong Ltd consisted of Issued capital $375,000 General reserve $15,000 Asset revaluation surplus $22,500 Retained earnings $15,000 All the identifiable assets and liabilities of Bettong Ltd at 1 July 2019 had carrying amounts equal to their fair values except for Carrying amount Fair value Plant (cost $280,000) $100,000 $130,000 $150,000 $165,000 $90,000 $120,000 Brands Land Inventories $100,000 $115,000 Note the following in relation to these assets: Plant had an estimated useful life of 5 years Brands were assessed to have an indefinite useful life. Land was sold on 30 June 2020 for $130,000. Inventory was all sold outside the group by 30 June 2020. Northern Ltd uses the partial goodwill method. During the year ending 30 June 2020, the following events occurred (a) Bettong Ltd sold inventory to Northern Ltd for $12,000. This inventory had cost Bettong Ltd $8,000. At 30 June 2020, one-fifth of this inventory still remained in Northern Ltd. (b) On 1 April 2020, Bettong Ltd sold plant to Northern Ltd for $22,500. The plant had a carrying amount of $15,000 (Original cost $18,000) in the records of Bettong Ltd at time of sale to Northern Ltd. The asset was classified as inventory by Northern Ltd. It remained unsold at 30 June 2020. (c) Bettong Ltd recorded, as part of other comprehensive income, gains on revaluation of specialised plant of $7,500. All entities in the group use the perpetual inventory system. The tax rate is 30 %. QUESTION 2- Continued Additional financial information provided by the two companies at 30 June 2020 is as follows: Bettong Ltd Northern Ltd 300,000 240,000 Sales Other income 110,000 50,000 410.000 (220,000) Total income 290,000 (184,000) (51,000) Cost of sales Other expenses (106,000) Total expenses (326,000) (235,000) Trading profit 84,000 55,000 Gains/(losses) on sales of non-current assets 15,000 30,000 Profit before tax 99,000 85,000 (28,000) 57,000 15,000 Tax expense Profit for the year (34,000) 65,000 Retained earnings at 1 July 2019 Dividend paid Dividend declared 50,000 (20,000) (10,000) 85,000 (15,000) (6,000) 51,000 Retained earnings at 30 June 2020 Issued capital 500,000 375,000 General reserve 20,000 15,000 Asset revaluation surplus 30,000 Required: 1. Prepare the acquisition analysis as at acquisition date (1/7/2019) showing both the Parent's equity interest (PEI) and the non-controlling interest (NCI) (4 marks) 2. Based on the information provided, using the proportionate goodwill method, show all the consolidation journal entries, including all related tax effects, and NCI joumal entries required upon consolidation as at 30 June 2020. (16 marks) QUESTION 2-Consolidation: non-controlling interest (20 marks) Northern Ltd, a reporting entity, acquired 80 % of the shares of Bettong Ltd on 1 July 2019 for $399,600. At this date, the shareholders equity of Bettong Ltd consisted of Issued capital $375,000 General reserve $15,000 Asset revaluation surplus $22,500 Retained earnings $15,000 All the identifiable assets and liabilities of Bettong Ltd at 1 July 2019 had carrying amounts equal to their fair values except for Carrying amount Fair value Plant (cost $280,000) $100,000 $130,000 $150,000 $165,000 $90,000 $120,000 Brands Land Inventories $100,000 $115,000 Note the following in relation to these assets: Plant had an estimated useful life of 5 years Brands were assessed to have an indefinite useful life. Land was sold on 30 June 2020 for $130,000. Inventory was all sold outside the group by 30 June 2020. Northern Ltd uses the partial goodwill method. During the year ending 30 June 2020, the following events occurred (a) Bettong Ltd sold inventory to Northern Ltd for $12,000. This inventory had cost Bettong Ltd $8,000. At 30 June 2020, one-fifth of this inventory still remained in Northern Ltd. (b) On 1 April 2020, Bettong Ltd sold plant to Northern Ltd for $22,500. The plant had a carrying amount of $15,000 (Original cost $18,000) in the records of Bettong Ltd at time of sale to Northern Ltd. The asset was classified as inventory by Northern Ltd. It remained unsold at 30 June 2020. (c) Bettong Ltd recorded, as part of other comprehensive income, gains on revaluation of specialised plant of $7,500. All entities in the group use the perpetual inventory system. The tax rate is 30 %. QUESTION 2- Continued Additional financial information provided by the two companies at 30 June 2020 is as follows: Bettong Ltd Northern Ltd 300,000 240,000 Sales Other income 110,000 50,000 410.000 (220,000) Total income 290,000 (184,000) (51,000) Cost of sales Other expenses (106,000) Total expenses (326,000) (235,000) Trading profit 84,000 55,000 Gains/(losses) on sales of non-current assets 15,000 30,000 Profit before tax 99,000 85,000 (28,000) 57,000 15,000 Tax expense Profit for the year (34,000) 65,000 Retained earnings at 1 July 2019 Dividend paid Dividend declared 50,000 (20,000) (10,000) 85,000 (15,000) (6,000) 51,000 Retained earnings at 30 June 2020 Issued capital 500,000 375,000 General reserve 20,000 15,000 Asset revaluation surplus 30,000 Required: 1. Prepare the acquisition analysis as at acquisition date (1/7/2019) showing both the Parent's equity interest (PEI) and the non-controlling interest (NCI) (4 marks) 2. Based on the information provided, using the proportionate goodwill method, show all the consolidation journal entries, including all related tax effects, and NCI joumal entries required upon consolidation as at 30 June 2020. (16 marks)