Answered step by step

Verified Expert Solution

Question

1 Approved Answer

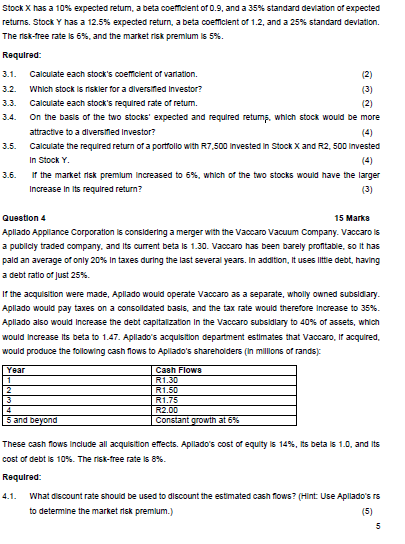

Question 3 1 8 Marks Stock X has a 1 0 % expected return, a beta coefficient of 0 . 9 , and a 3

Question Marks

Stock X has a expected return, a beta coefficient of and a standard deviation of expected

returns. Stock Y has a expected return, a beta coefficient of and a standard deviation.

The riskfree rate is and the market risk premium is

Required:

Calculate each stocks coefficient of variation.

Which stock is riskier for a diversified investor?

Calculate each stocks required rate of return.

On the basis of the two stocks expected and required returns, which stock would be more

attractive to a diversified investor?

Calculate the required return of a portfolio with R invested in Stock X and R invested

in Stock Y

If the market risk premium increased to which of the two stocks would have the larger

increase in its required return?

Question Marks

Apilado Appliance Corporation is considering a merger with the Vaccaro Vacuum Company. Vaccaro is

a publicly traded company, and its current beta is Vaccaro has been barely profitable, so it has

paid an average of only in taxes during the last several years. In addition, it uses little debt, having

a debt ratio of just

If the acquisition were made, Apilado would operate Vaccaro as a separate, wholly owned subsidiary.

Apilado would pay taxes on a consolidated basis, and the tax rate would therefore increase to

Apilado also would increase the debt capitalization in the Vaccaro subsidiary to of assets, which

would increase its beta to Apilados acquisition department estimates that Vaccaro, if acquired,

would produce the following cash flows to Apilados shareholders in millions of rands:

Year Cash Flows

R

R

R

R

and beyond Constant growth at

These cash flows include all acquisition effects. Apilados cost of equity is its beta is and its

cost of debt is The riskfree rate is

Required:

What discount rate should be used to discount the estimated cash flows? Hint: Use Apilados rs

to determine the market risk premium.

MBA

MAYJUNE SPECIAL EXAMINATION

What is the rand value of Vaccaro to Apilado?

Vaccaro has million common shares outstanding. What is the maximum price per share that

Apilado should offer for Vaccaro? If the tender offer is accepted at this price, what will happen to

Apilados stock price?Stock X has a expected retum, a beta coefficlent of and a standard devlation of expected

returns. Stock Y has a expected return, a beta coefficient of and a standard deviation.

The riskfree rate and the market risk premlum is

Requlred:

Calculate each stock's coefficient of variation.

Which stock is riskler for a dlversifled Investor?

Calculate each stock's requlred rate of retum.

On the basls of the two stocks' expected and required retumi, which stock would be more

attractive to a diversined Investor?

Calculate the requlred return of a portfollo with Invested in Stock and Invested

In Stock

If the market risk premlum Increased to which of the two stocks would have the larger

Increase in its requlred return?

Questlon

Marks

Apllado Appllance Corporation Is considering a merger with the Vaccaro Vacuum Company. Vaccaro is

a publlcly traded company, and its current beta is Vaccaro has been barely profitable, it has

pald an average of only In taxes during the last several years. In addltion, It uses Ilttle debt, having

a debt ratio of just

If the acquisition were made, Apllado would operate Vaccaro as a separate, wholly owned subsidlary.

Apllado would pay taxes on a consolldated basls, and the tax rate would therefore increase to

Apllado also would Increase the debt capitalzation In the Vaccaro subsidlary to of assets, which

would Increase its beta to Apllado's acquisition department estimates that Vaccaro, If acqured

would produce the following cash flows to Apllado's shareholders In milllons of rands:

These cash fows Include all acqusition effects. Apllado's cost of equity is its beta is and its

cost of debt is The riskfree rate

Requlred:

What discount rate should be used to dlscount the estimated cash fows? Hint: Use Apllado's rs

to determine the market risk premlum.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started