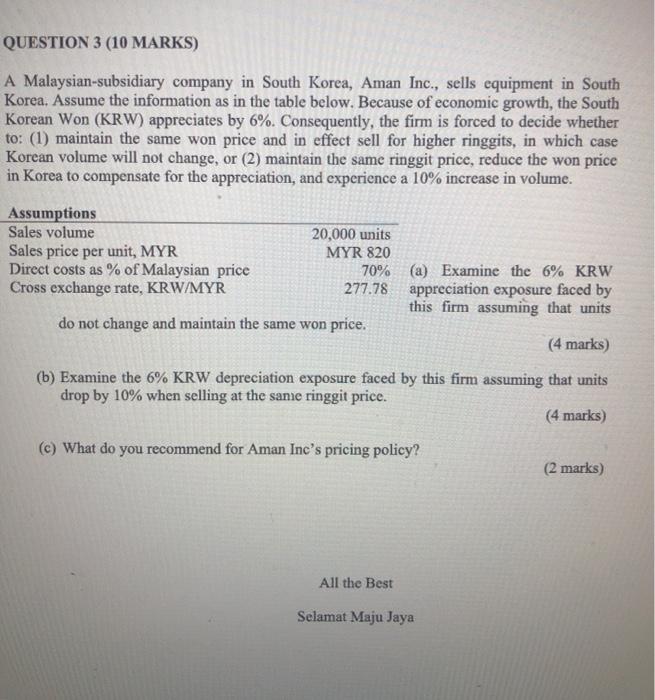

QUESTION 3 (10 MARKS) A Malaysian-subsidiary company in South Korea, Aman Inc., sells equipment in South Korea. Assume the information as in the table below. Because of economic growth, the South Korean Won (KRW) appreciates by 6%. Consequently, the firm is forced to decide whether to: (1) maintain the same won price and in effect sell for higher ringgits, in which case Korean volume will not change, or (2) maintain the same ringgit price, reduce the won price in Korea to compensate for the appreciation, and experience a 10% increase in volume. Assumptions Sales volume 20,000 units Sales price per unit, MYR MYR 820 Direct costs as % of Malaysian price 70% (a) Examine the 6% KRW Cross exchange rate, KRW/MYR 277.78 appreciation exposure faced by this firm assuming that units do not change and maintain the same won price. (4 marks) (b) Examine the 6% KRW depreciation exposure faced by this firm assuming that units drop by 10% when selling at the same ringgit price. (4 marks) (c) What do you recommend for Aman Inc's pricing policy? (2 marks) All the Best Selamat Maju Jaya QUESTION 3 (10 MARKS) A Malaysian-subsidiary company in South Korea, Aman Inc., sells equipment in South Korea. Assume the information as in the table below. Because of economic growth, the South Korean Won (KRW) appreciates by 6%. Consequently, the firm is forced to decide whether to: (1) maintain the same won price and in effect sell for higher ringgits, in which case Korean volume will not change, or (2) maintain the same ringgit price, reduce the won price in Korea to compensate for the appreciation, and experience a 10% increase in volume. Assumptions Sales volume 20,000 units Sales price per unit, MYR MYR 820 Direct costs as % of Malaysian price 70% (a) Examine the 6% KRW Cross exchange rate, KRW/MYR 277.78 appreciation exposure faced by this firm assuming that units do not change and maintain the same won price. (4 marks) (b) Examine the 6% KRW depreciation exposure faced by this firm assuming that units drop by 10% when selling at the same ringgit price. (4 marks) (c) What do you recommend for Aman Inc's pricing policy? (2 marks) All the Best Selamat Maju Jaya