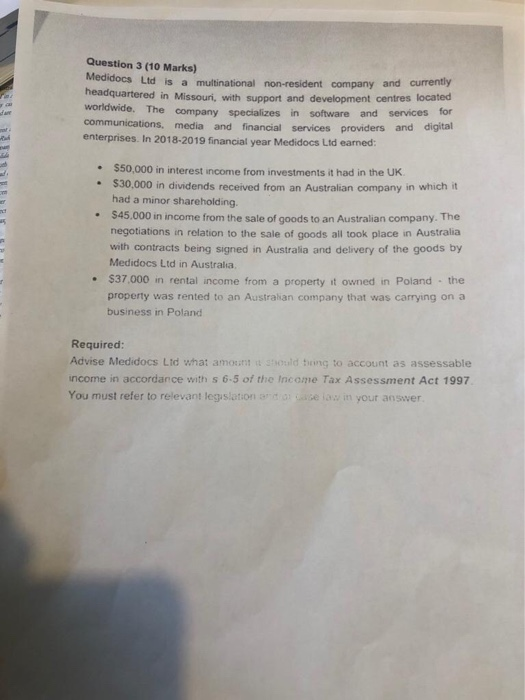

Question 3 (10 Marks) Medidocs Ltd is a multinational non-resident company and currently headquartered in Missouri, with support and development centres located Worldwide. The company specializes in software and services for communications, media dae and financial services providers and digital enterprises. In 2018-2019 financial year Medidocs Ltd earned: $50,000 in interest income from investments it had in the UK $30,000 in dividends received from an Australian company in which it had a minor shareholding. $45.000 in income from the sale of goods to an Australian company. The negotiations in relation to the sale of goods all took place in Australia with contracts being signed in Australia and delivery of the goods by Medidocs Ltd in Australia, $37,000 in rental income from a property it owned in Poland the property was rented to an Australian company that was carrying on a business in Poland Required: Advise Medidocs Ltd what amount should trng to account as assessable income in accordance with s 6-5 of the Income Tax Assessment Act 1997 You must refer to relevant legislation and o se la in your answer Question 3 (10 Marks) Medidocs Ltd is a multinational non-resident company and currently headquartered in Missouri, with support and development centres located Worldwide. The company specializes in software and services for communications, media dae and financial services providers and digital enterprises. In 2018-2019 financial year Medidocs Ltd earned: $50,000 in interest income from investments it had in the UK $30,000 in dividends received from an Australian company in which it had a minor shareholding. $45.000 in income from the sale of goods to an Australian company. The negotiations in relation to the sale of goods all took place in Australia with contracts being signed in Australia and delivery of the goods by Medidocs Ltd in Australia, $37,000 in rental income from a property it owned in Poland the property was rented to an Australian company that was carrying on a business in Poland Required: Advise Medidocs Ltd what amount should trng to account as assessable income in accordance with s 6-5 of the Income Tax Assessment Act 1997 You must refer to relevant legislation and o se la in your