Answered step by step

Verified Expert Solution

Question

1 Approved Answer

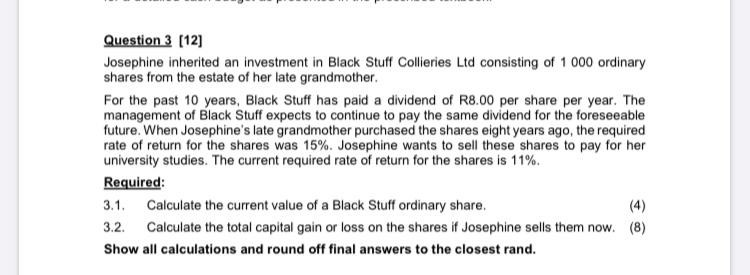

Question 3 (12) Josephine inherited an investment in Black Stuff Collieries Ltd consisting of 1 000 ordinary shares from the estate of her late grandmother.

Question 3 (12) Josephine inherited an investment in Black Stuff Collieries Ltd consisting of 1 000 ordinary shares from the estate of her late grandmother. For the past 10 years, Black Stuff has paid a dividend of R8.00 per share per year. The management of Black Stuff expects to continue to pay the same dividend for the foreseeable future. When Josephine's late grandmother purchased the shares eight years ago, the required rate of return for the shares was 15%. Josephine wants to sell these shares to pay for her university studies. The current required rate of return for the shares is 11%. Required: 3.1. Calculate the current value of a Black Stuff ordinary share, 3.2. Calculate the total capital gain or loss on the shares if Josephine sells them now. (8) Show all calculations and round off final answers to the closest rand

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started