Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 (12 marks) A project has an initial investment of $270,000 for fixed equipment. The fixed equipment will be depreciated on a straight-line basis

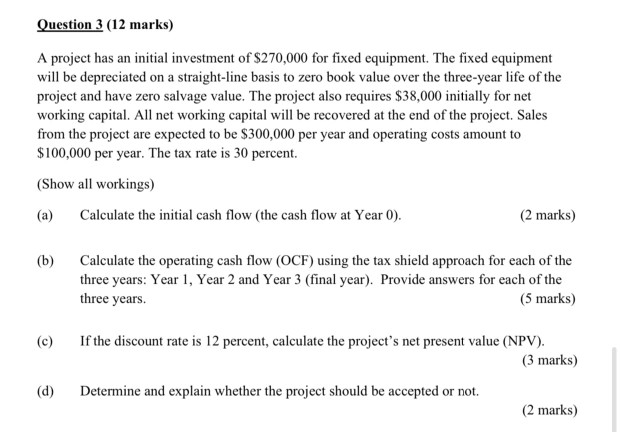

Question 3 (12 marks) A project has an initial investment of $270,000 for fixed equipment. The fixed equipment will be depreciated on a straight-line basis to zero book value over the three-year life of the project and have zero salvage value. The project also requires $38,000 initially for net working capital. All net working capital will be recovered at the end of the project. Sales from the project are expected to be $300,000 per year and operating costs amount to $100,000 per year. The tax rate is 30 percent. (Show all workings) (a) Calculate the initial cash flow (the cash flow at Year O). (2 marks) (b) Calculate the operating cash flow (OCF) using the tax shield approach for each of the three years: Year 1, Year 2 and Year 3 (final year). Provide answers for each of the three years. (5 marks) (c) If the discount rate is 12 percent, calculate the project's net present value (NPV). (3 marks) (d) Determine and explain whether the project should be accepted or not. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started