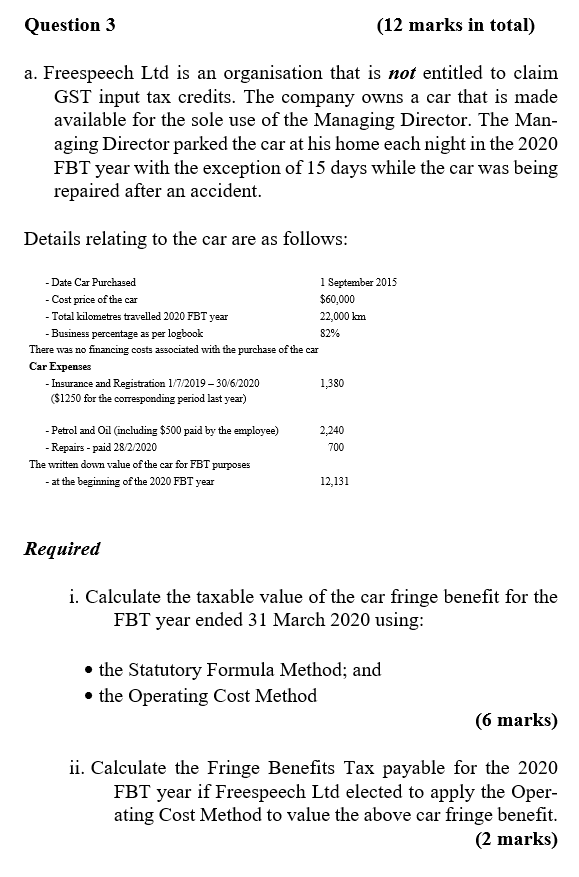

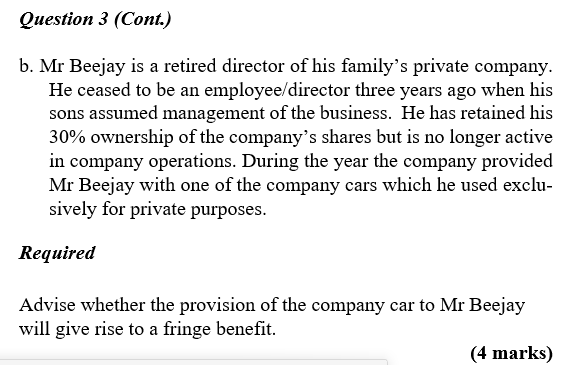

Question 3 (12 marks in total) a. Freespeech Ltd is an organisation that is not entitled to claim GST input tax credits. The company owns a car that is made available for the sole use of the Managing Director. The Man- aging Director parked the car at his home each night in the 2020 FBT year with the exception of 15 days while the car was being repaired after an accident. Details relating to the car are as follows: - -Date Car Purchased 1 September 2015 - Cost price of the car $60,000 - Total kilometres travelled 2020 FBT year 22,000 km - Business percentage as per logbook 82% There was no financing costs associated with the purchase of the car Car Expenses - Insurance and Registration 1/7/2019 - 30/6/2020 1,380 ($1250 for the corresponding period last year) 2,240 700 - Petrol and Oil (including $500 paid by the employee) - Repairs - paid 28/2/2020 The written down value of the car for FBT purposes - at the beginning of the 2020 FBT year 12,131 Required i. Calculate the taxable value of the car fringe benefit for the FBT year ended 31 March 2020 using: the Statutory Formula Method; and the Operating Cost Method (6 marks) ii. Calculate the Fringe Benefits Tax payable for the 2020 FBT year if Freespeech Ltd elected to apply the Oper- ating Cost Method to value the above car fringe benefit. (2 marks) Question 3 (Cont.) b. Mr Beejay is a retired director of his family's private company. He ceased to be an employee/director three years ago when his sons assumed management of the business. He has retained his 30% ownership of the company's shares but is no longer active in company operations. During the year the company provided Mr Beejay with one of the company cars which he used exclu- sively for private purposes. Required Advise whether the provision of the company car to Mr Beejay will give rise to a fringe benefit. (4 marks) Question 3 (12 marks in total) a. Freespeech Ltd is an organisation that is not entitled to claim GST input tax credits. The company owns a car that is made available for the sole use of the Managing Director. The Man- aging Director parked the car at his home each night in the 2020 FBT year with the exception of 15 days while the car was being repaired after an accident. Details relating to the car are as follows: - -Date Car Purchased 1 September 2015 - Cost price of the car $60,000 - Total kilometres travelled 2020 FBT year 22,000 km - Business percentage as per logbook 82% There was no financing costs associated with the purchase of the car Car Expenses - Insurance and Registration 1/7/2019 - 30/6/2020 1,380 ($1250 for the corresponding period last year) 2,240 700 - Petrol and Oil (including $500 paid by the employee) - Repairs - paid 28/2/2020 The written down value of the car for FBT purposes - at the beginning of the 2020 FBT year 12,131 Required i. Calculate the taxable value of the car fringe benefit for the FBT year ended 31 March 2020 using: the Statutory Formula Method; and the Operating Cost Method (6 marks) ii. Calculate the Fringe Benefits Tax payable for the 2020 FBT year if Freespeech Ltd elected to apply the Oper- ating Cost Method to value the above car fringe benefit. (2 marks) Question 3 (Cont.) b. Mr Beejay is a retired director of his family's private company. He ceased to be an employee/director three years ago when his sons assumed management of the business. He has retained his 30% ownership of the company's shares but is no longer active in company operations. During the year the company provided Mr Beejay with one of the company cars which he used exclu- sively for private purposes. Required Advise whether the provision of the company car to Mr Beejay will give rise to a fringe benefit. (4 marks)