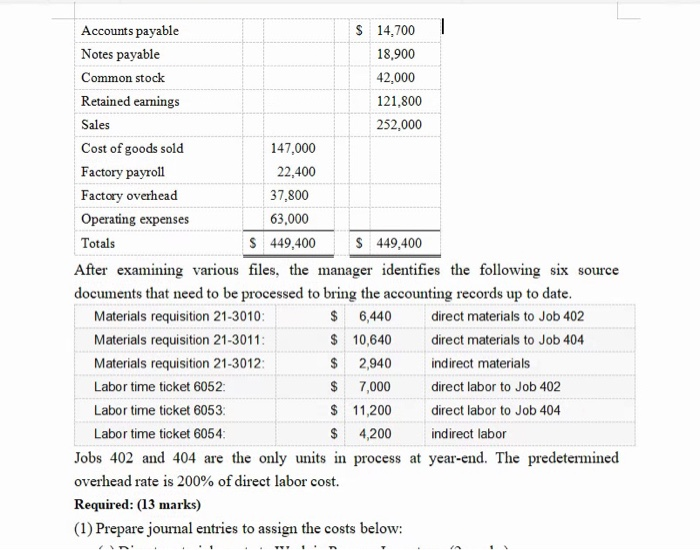

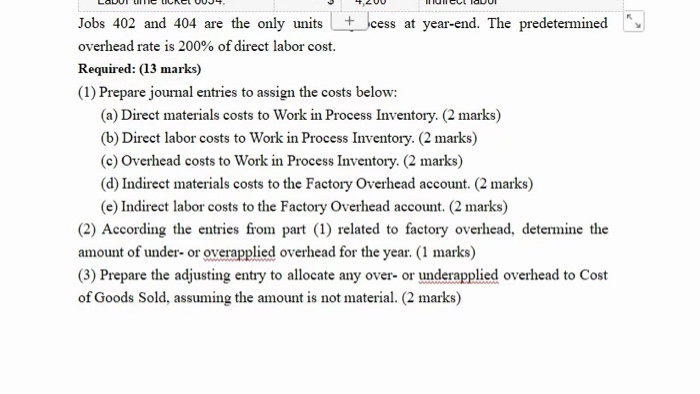

Question 3 (13 marks) Bergamo Bay Co. uses enterprise resource planning (ERP) system to combine the business activities with accounting activities. ERP system provides an integrated and continuously updated view of core business processes. The system can track business resources, i.e. cash, raw materials, etc., and shares data across various departments (manufacturing, purchasing, sales, accounting, etc.), and various stakeholders of the company. The system also can provide timely information and report to variable users within the company. On December 31, 2019 ERP system generated the following trial balance. The company's manager knows something is wrong with the trial balance because it does not show any balance for Work in Process Inventory but does show a balane story Payroll and Factory Overhead account. 67% Debit Credit Cash 136K's $ 67,200 Accounts receivable 58,800 Raw materials inventory 36,400 Work in process inventory 0 Finished goods inventory 12,600 Prepaid rent 4,200 0.2K15 Accounts payable $ 14,700 Notes payable 18,900 Common stock 42,000 Retained earnings 121,800 Sales 252,000 Cost of goods sold 147,000 Factory payroll 22,400 Factory overhead 37,800 Operating expenses 63,000 Totals $ 449,400 $ 449,400 After examining various files, the manager identifies the following six source documents that need to be processed to bring the accounting records up to date. Materials requisition 21-3010: $ 6,440 direct materials to Job 402 Materials requisition 21-3011: $ 10,640 direct materials to Job 404 Materials requisition 21-3012: $ 2,940 indirect materials Labor time ticket 6052 $ 7,000 direct labor to Job 402 Labor time ticket 6053 $ 11,200 direct labor to Job 404 Labor time ticket 6054 $ 4,200 indirect labor Jobs 402 and 404 are the only units in process at year-end. The predetermined overhead rate is 200% of direct labor cost. Required: (13 marks) (1) Prepare journal entries to assign the costs below: Jobs 402 and 404 are the only units +_cess at year-end. The predetermined overhead rate is 200% of direct labor cost. Required: (13 marks) (1) Prepare journal entries to assign the costs below: (a) Direct materials costs to Work in Process Inventory. (2 marks) (b) Direct labor costs to Work in Process Inventory. (2 marks) (c) Overhead costs to Work in Process Inventory. (2 marks) (d) Indirect materials costs to the Factory Overhead account. (2 marks) (e) Indirect labor costs to the Factory Overhead account. (2 marks) (2) According the entries from part (1) related to factory overhead, determine the amount of under-or overapplied overhead for the year. (1 marks) (3) Prepare the adjusting entry to allocate any over- or underapplied overhead to Cost of Goods Sold, assuming the amount is not material. (2 marks)