Answered step by step

Verified Expert Solution

Question

1 Approved Answer

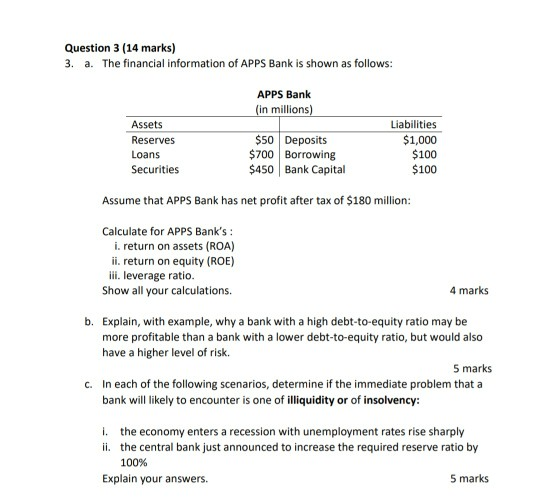

Question 3 (14 marks) 3. a. The financial information of APPS Bank is shown as follows: APPS Bank (in millions) Assets Reserves Loans Securities $50

Question 3 (14 marks) 3. a. The financial information of APPS Bank is shown as follows: APPS Bank (in millions) Assets Reserves Loans Securities $50 Deposits $700 Borrowing $450 Bank Capital Liabilities $1,000 $100 $100 Assume that APPS Bank has net profit after tax of $180 million: Calculate for APPS Bank's: i. return on assets (ROA) ii. return on equity (ROE) iii. leverage ratio. Show all your calculations. 4 marks b. Explain, with example, why a bank with a high debt-to-equity ratio may be more profitable than a bank with a lower debt-to-equity ratio, but would also have a higher level of risk. 5 marks c. In each of the following scenarios, determine if the immediate problem that a bank will likely to encounter is one of illiquidity or of insolvency: I. the economy enters a recession with unemployment rates rise sharply ii. the central bank just announced to increase the required reserve ratio by 100% Explain your answers. 5 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started