Answered step by step

Verified Expert Solution

Question

1 Approved Answer

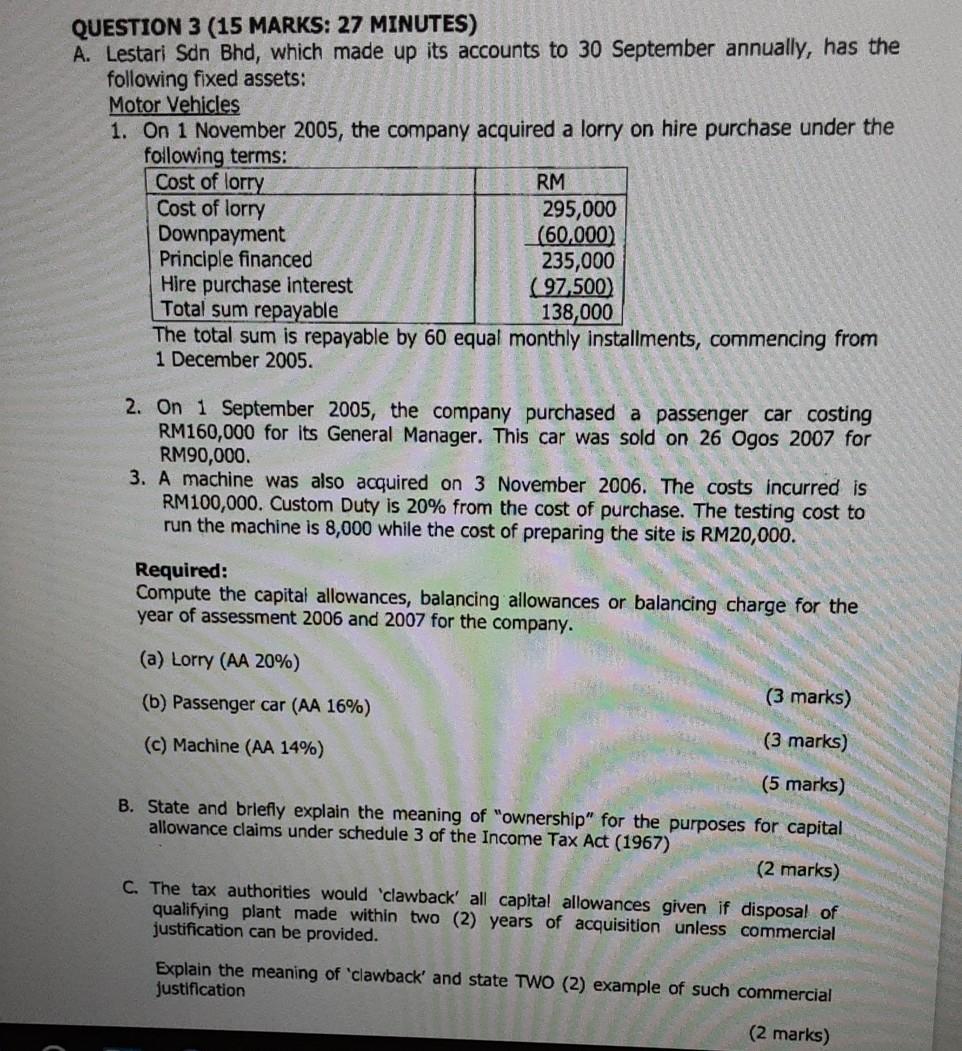

QUESTION 3 (15 MARKS: 27 MINUTES) A. Lestari Sdn Bhd, which made up its accounts to 30 September annually, has the following fixed assets: Motor

QUESTION 3 (15 MARKS: 27 MINUTES) A. Lestari Sdn Bhd, which made up its accounts to 30 September annually, has the following fixed assets: Motor Vehicles 1. On 1 November 2005, the company acquired a lorry on hire purchase under the following terms: Cost of lorry RM Cost of lorry 295,000 Downpayment (60,000) Principle financed 235,000 Hire purchase interest ( 97,500) Total sum repayable 138,000 The total sum is repayable by 60 equal monthly installments, commencing from 1 December 2005. 2. On 1 September 2005, the company purchased a passenger car costing RM160,000 for its General Manager. This car was sold on 26 Ogos 2007 for RM90,000 3. A machine was also acquired on 3 November 2006. The costs incurred is RM100,000. Custom Duty is 20% from the cost of purchase. The testing cost to run the machine is 8,000 while the cost of preparing the site is RM20,000. Required: Compute the capital allowances, balancing allowances or balancing charge for the year of assessment 2006 and 2007 for the company. (a) Lorry (AA 20%) (b) Passenger car (AA 16%) (3 marks) (c) Machine (AA 14%) (3 marks) (5 marks) B. State and briefly explain the meaning of "ownership" for the purposes for capital allowance claims under schedule 3 of the Income Tax Act (1967) (2 marks) C. The tax authorities would clawback' all capital allowances given if disposal of qualifying plant made within two (2) years of acquisition unless commercial justification can be provided. Explain the meaning of clawback' and state TWO (2) example of such commercial justification (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started