Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 3 (15 marks) You have been recently appointed as an Analyst at Ethos Private Equity, you have been given the task to value the

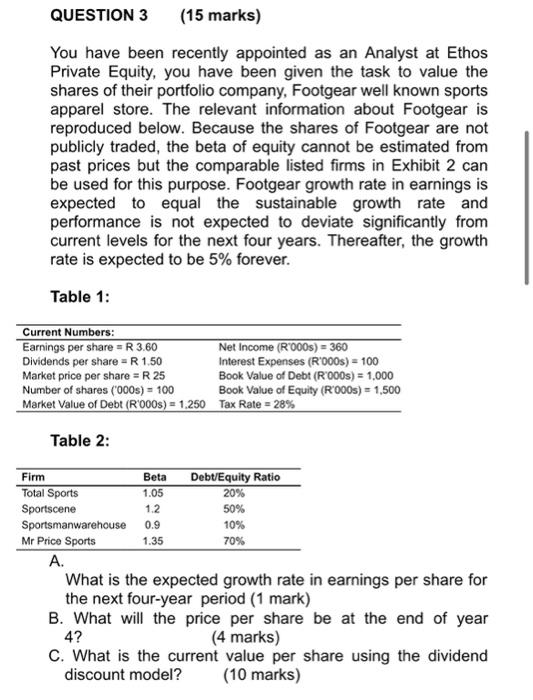

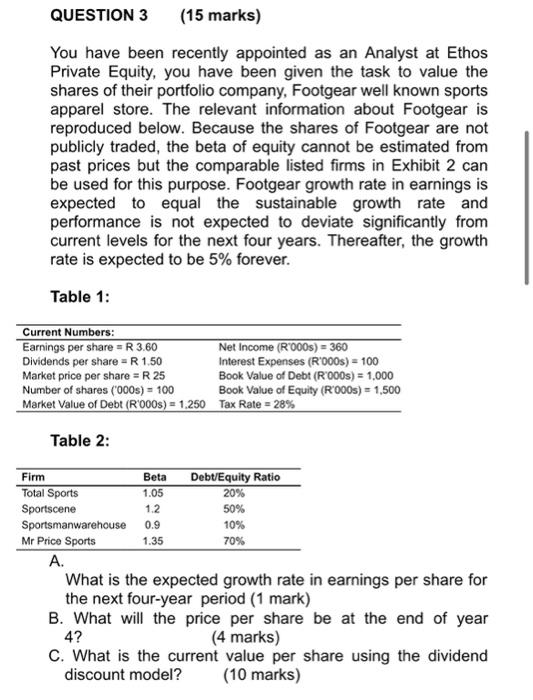

QUESTION 3 (15 marks) You have been recently appointed as an Analyst at Ethos Private Equity, you have been given the task to value the shares of their portfolio company, Footgear well known sports apparel store. The relevant information about Footgear is reproduced below. Because the shares of Footgear are not publicly traded, the beta of equity cannot be estimated from past prices but the comparable listed firms in Exhibit 2 can be used for this purpose. Footgear growth rate in earnings is expected to equal the sustainable growth rate and performance is not expected to deviate significantly from current levels for the next four years. Thereafter, the growth rate is expected to be 5% forever. Table 1: Current Numbers: Earnings per share = R 3.60 Net Income (R"000s) = 360 Dividends per share = R1,50 Interest Expenses (R'000s) = 100 Market price per share = R 25 Book Value of Debt (R 000s) = 1,000 Number of shares ('000) = 100 Book Value of Equity (R000) = 1,500 Market value of Debt (R0008) = 1.250 Tax Rate = 28% Table 2: Beta 1.05 Firm Total Sports Sportscene Sportsmanwarehouse Mr Price Sports DebtEquity Ratio 20% 50% 1.2 10% 0.9 1.35 70% A. What is the expected growth rate in earnings per share for the next four-year period (1 mark) B. What will the price per share be at the end of year (4 marks) C. What is the current value per share using the dividend discount model? (10 marks) 4

QUESTION 3 (15 marks) You have been recently appointed as an Analyst at Ethos Private Equity, you have been given the task to value the shares of their portfolio company, Footgear well known sports apparel store. The relevant information about Footgear is reproduced below. Because the shares of Footgear are not publicly traded, the beta of equity cannot be estimated from past prices but the comparable listed firms in Exhibit 2 can be used for this purpose. Footgear growth rate in earnings is expected to equal the sustainable growth rate and performance is not expected to deviate significantly from current levels for the next four years. Thereafter, the growth rate is expected to be 5% forever. Table 1: Current Numbers: Earnings per share = R 3.60 Net Income (R"000s) = 360 Dividends per share = R1,50 Interest Expenses (R'000s) = 100 Market price per share = R 25 Book Value of Debt (R 000s) = 1,000 Number of shares ('000) = 100 Book Value of Equity (R000) = 1,500 Market value of Debt (R0008) = 1.250 Tax Rate = 28% Table 2: Beta 1.05 Firm Total Sports Sportscene Sportsmanwarehouse Mr Price Sports DebtEquity Ratio 20% 50% 1.2 10% 0.9 1.35 70% A. What is the expected growth rate in earnings per share for the next four-year period (1 mark) B. What will the price per share be at the end of year (4 marks) C. What is the current value per share using the dividend discount model? (10 marks) 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started