Cycle Ltd, produces bicycles in two divisions. Division Frame produces the frame for the bicycle while Division Assemble then add components to the frame

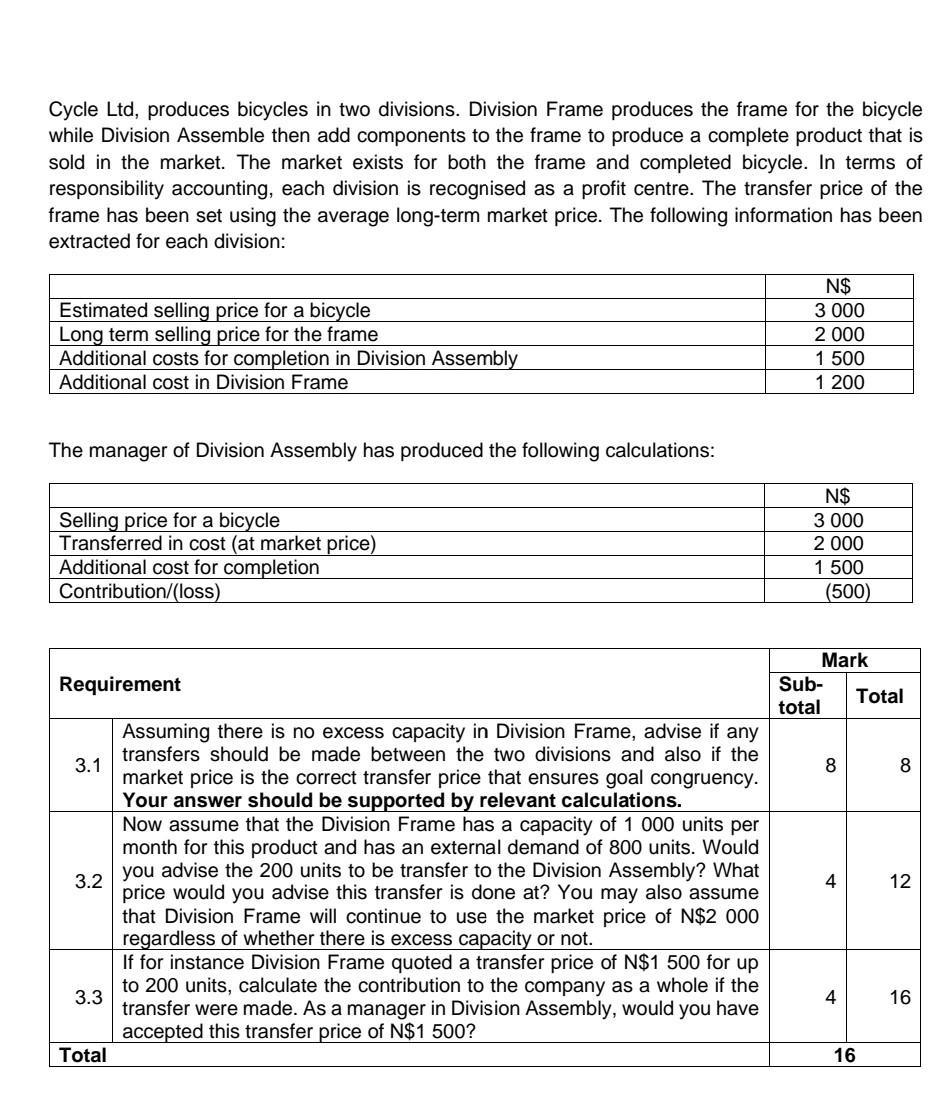

Cycle Ltd, produces bicycles in two divisions. Division Frame produces the frame for the bicycle while Division Assemble then add components to the frame to produce a complete product that is sold in the market. The market exists for both the frame and completed bicycle. In terms of responsibility accounting, each division is recognised as a profit centre. The transfer price of the frame has been set using the average long-term market price. The following information has been extracted for each division: Estimated selling price for a bicycle Long term selling price for the frame Additional costs for completion in Division Assembly Additional cost in Division Frame The manager of Division Assembly has produced the following calculations: Selling price for a bicycle Transferred in cost (at market price) Additional cost for completion Contribution/(loss) Requirement Assuming there is no excess capacity in Division Frame, advise if any transfers should be made between the two divisions and also if the market price is the correct transfer price that ensures goal congruency. Your answer should be supported by relevant calculations. Now assume that the Division Frame has a capacity of 1 000 units per month for this product and has an external demand of 800 units. Would 3.2 you advise the 200 units to be transfer to the Division Assembly? What price would you advise this transfer is done at? You may also assume that Division Frame will continue to use the market price of N$2 000 regardless of whether there is excess capacity or not. 3.3 If for instance Division Frame quoted a transfer price of N$1 500 for up to 200 units, calculate the contribution to the company as a whole if the transfer were made. As a manager in Division Assembly, would you have accepted this transfer price of N$1 500? 3.1 Total N$ 3 000 2 000 1 500 1 200 N$ 3 000 2 000 1 500 (500) Mark Sub- total 8 4 4 Total 16 8 12 16

Step by Step Solution

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

31 Transfers with No Excess Capacity in Division Frame In this scenario the transfer price for the f...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started