Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 3 (16 marks) Gymtrak is a local manufacturer of sports equipment. The entity's current year ended on 31 December 2022. The following information relates

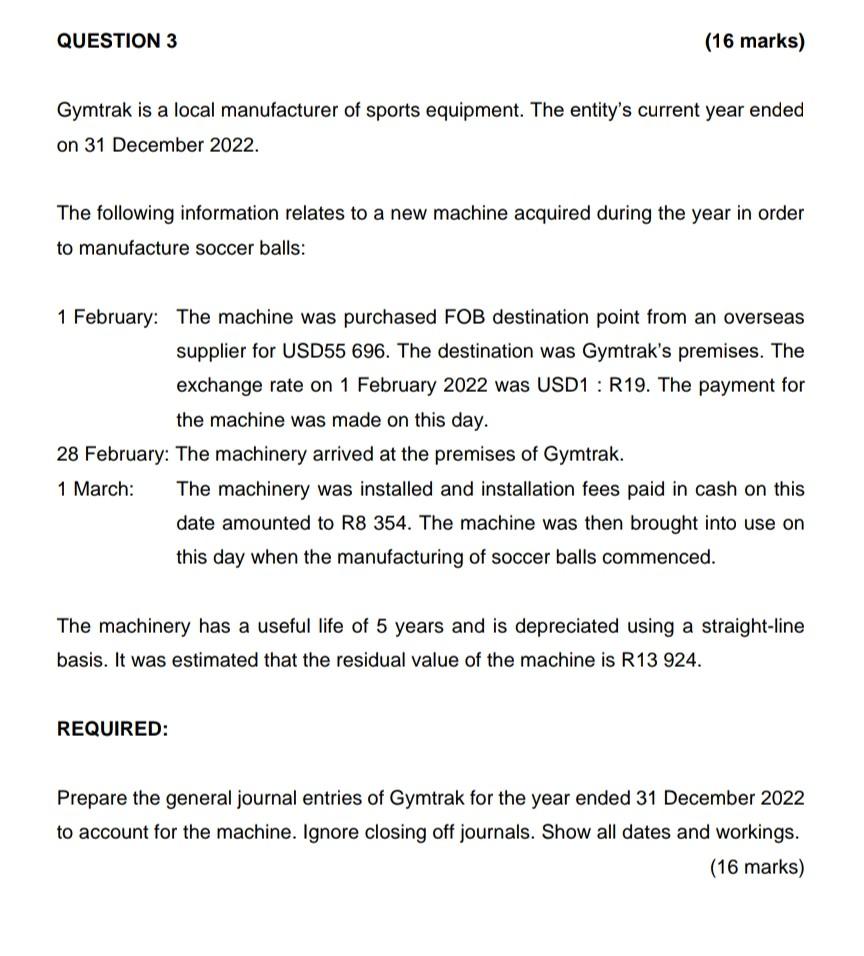

QUESTION 3 (16 marks) Gymtrak is a local manufacturer of sports equipment. The entity's current year ended on 31 December 2022. The following information relates to a new machine acquired during the year in order to manufacture soccer balls: 1 February: The machine was purchased FOB destination point from an overseas supplier for USD55 696. The destination was Gymtrak's premises. The exchange rate on 1 February 2022 was USD1: R19. The payment for the machine was made on this day. 28 February: The machinery arrived at the premises of Gymtrak. 1 March: The machinery was installed and installation fees paid in cash on this date amounted to R8 354. The machine was then brought into use on this day when the manufacturing of soccer balls commenced. The machinery has a useful life of 5 years and is depreciated using a straight-line basis. It was estimated that the residual value of the machine is R13 924 . REQUIRED: Prepare the general journal entries of Gymtrak for the year ended 31 December 2022 to account for the machine. Ignore closing off journals. Show all dates and workings. (16 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started