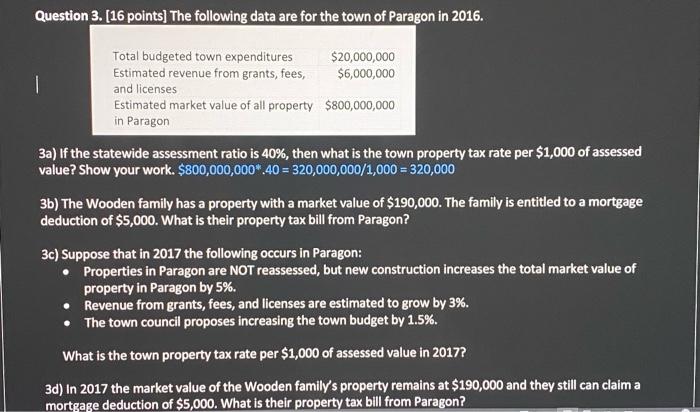

Question 3. (16 points) The following data are for the town of Paragon in 2016. Total budgeted town expenditures $20,000,000 Estimated revenue from grants, fees, $6,000,000 and licenses Estimated market value of all property $800,000,000 in Paragon 3a) If the statewide assessment ratio is 40%, then what is the town property tax rate per $1,000 of assessed value? Show your work. $800,000,000*.40 = 320,000,000/1,000 = 320,000 3b) The Wooden family has a property with a market value of $190,000. The family is entitled to a mortgage deduction of $5,000. What is their property tax bill from Paragon? 3c) Suppose that in 2017 the following occurs in Paragon: Properties in Paragon are NOT reassessed, but new construction increases the total market value of property in Paragon by 5%. Revenue from grants, fees, and licenses are estimated to grow by 3%. The town council proposes increasing the town budget by 1.5%. What is the town property tax rate per $1,000 of assessed value in 2017? 3d) In 2017 the market value of the Wooden family's property remains at $190,000 and they still can claim a mortgage deduction of $5,000. What is their property tax bill from Paragon? Question 3. (16 points) The following data are for the town of Paragon in 2016. Total budgeted town expenditures $20,000,000 Estimated revenue from grants, fees, $6,000,000 and licenses Estimated market value of all property $800,000,000 in Paragon 3a) If the statewide assessment ratio is 40%, then what is the town property tax rate per $1,000 of assessed value? Show your work. $800,000,000*.40 = 320,000,000/1,000 = 320,000 3b) The Wooden family has a property with a market value of $190,000. The family is entitled to a mortgage deduction of $5,000. What is their property tax bill from Paragon? 3c) Suppose that in 2017 the following occurs in Paragon: Properties in Paragon are NOT reassessed, but new construction increases the total market value of property in Paragon by 5%. Revenue from grants, fees, and licenses are estimated to grow by 3%. The town council proposes increasing the town budget by 1.5%. What is the town property tax rate per $1,000 of assessed value in 2017? 3d) In 2017 the market value of the Wooden family's property remains at $190,000 and they still can claim a mortgage deduction of $5,000. What is their property tax bill from Paragon