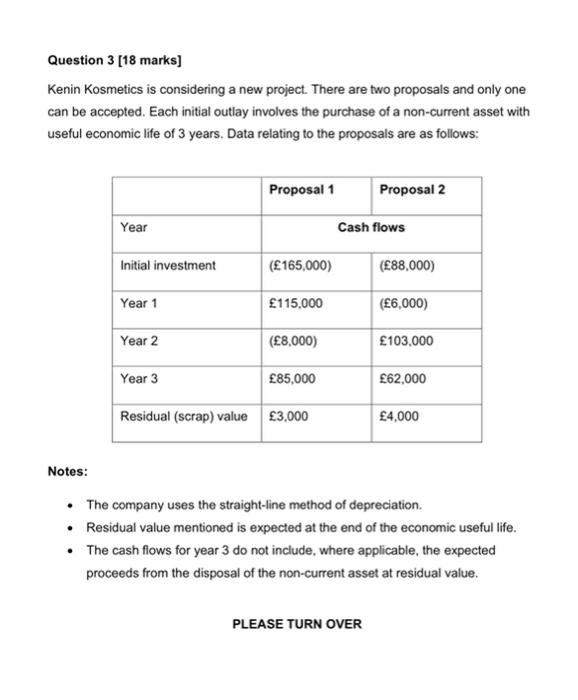

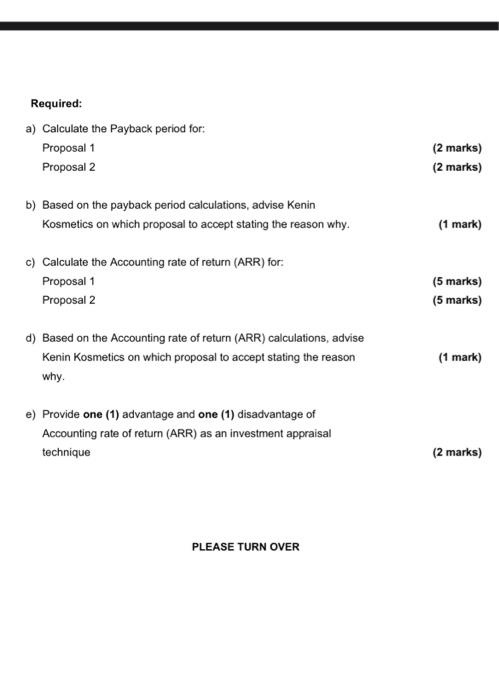

Question 3 18 marks) Kenia Kosmetics is considering a new project. There are proposals and only one can be copied Each na utay involves the purchase of a non-current use economie e of years Datating to the proposals Proposal Proposal Year Cashflows Inainvester 165.000 E88,000) C115.000 Year 2 E8.000 100.000 Years 5.000 Reidare 3.000 14.000 Notes: The company were straight-thod of depreciation Residual value mentioned is expected at the end of the economiche . The cash flows for year I do not include, where applicatie. the expected proceeds from the disposal of the non-cumente dal va PLEASE TURN OVER CINTOC.de Required: a) Calculate the Payback period for Proposal Proposal 2 2. by Based on the payback period calculations, advee Kenn Kosmetics on which proposal to otherson why Cate Accounting of ratum (ARS) for Proposal Proposal 2 mark 15 mars d) Band on the Accounting rate of Articulations in Konin Kometics on which proposal to contingeremo wy (1 Provide one (1) advantage and one (1) disadvantage of Accounting rate of (ARRI sche Question 3 18 mars Konin Kosmetics considering new project. There are proprie and only one can be compted. Each tutay involves the purchase of a non-com seconomic ife of 3 years Data relating to the proposals are as follows Proposal Proposal Year Iniment Cashflows 165.000 8.000 115.000 16.000 0.0001 100.000 Yeart Year 2 Yews 85.000 262.000 Residual scrap van 3.000 14.000 Notes: . The company uses the right in method of depreciation Residus value mentioned is expected at the end of the economie The cash flows for year do not include, where applicable the expected proceeds from he disposal of the non-cuentes PLEASE TURN OVER CINTO OY, Usty tone Required a) Catet e Payback period for Proposal Proposal b) Based on the payback period calculations de Konin Kosmetica on which peopolo accepe stating the man why mark c) Catoire Accounting rate of retum (ARRO Proposal Proposal mark Based on the Accounting rate of motions Kanin Komuti on which proposal to accept stafing heromon why Provide one (1) advantage and one (adiantage of Accounting rate of retum (ARRI as an investments tech am Question 3 [18 marks] Kenin Kosmetics is considering a new project. There are two proposals and only one can be accepted. Each initial outlay involves the purchase of a non-current asset with useful economic life of 3 years. Data relating to the proposals are as follows: Proposal 1 Proposal 2 Year Cash flows Initial investment (165,000) (88,000) Year 1 115,000 (6,000) Year 2 (8,000) 103,000 Year 3 85,000 62,000 Residual (scrap) value 3,000 4,000 Notes: The company uses the straight-line method of depreciation. Residual value mentioned is expected at the end of the economic useful life. The cash flows for year 3 do not include, where applicable, the expected proceeds from the disposal of the non-current asset at residual value. PLEASE TURN OVER Required: a) Calculate the Payback period for: Proposal 1 Proposal 2 (2 marks) (2 marks) b) Based on the payback period calculations, advise Kenin Kosmetics on which proposal to accept stating the reason why. (1 mark) c) Calculate the Accounting rate of return (ARR) for Proposal 1 Proposal 2 (5 marks) (5 marks) d) Based on the Accounting rate of return (ARR) calculations, advise Kenin Kosmetics on which proposal to accept stating the reason why. (1 mark) e) Provide one (1) advantage and one (1) disadvantage of Accounting rate of return (ARR) as an investment appraisal technique (2 marks) PLEASE TURN OVER