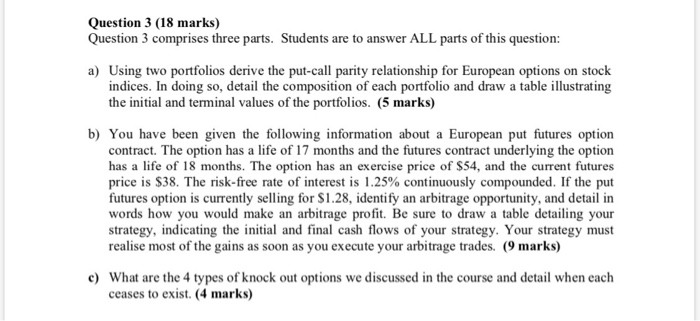

Question 3 (18 marks) Question 3 comprises three parts. Students are to answer ALL parts of this question: a) Using two portfolios derive the put-call parity relationship for European options on stock indices. In doing so, detail the composition of each portfolio and draw a table illustrating the initial and terminal values of the portfolios. (5 marks) b) You have been given the following information about a European put futures option contract. The option has a life of 17 months and the futures contract underlying the option has a life of 18 months. The option has an exercise price of $54, and the current futures price is $38. The risk-free rate of interest is 1.25% continuously compounded. If the put futures option is currently selling for $1.28, identify an arbitrage opportunity, and detail in words how you would make an arbitrage profit. Be sure to draw a table detailing your strategy, indicating the initial and final cash flows of your strategy. Your strategy must realise most of the gains as soon as you execute your arbitrage trades. (9 marks) c) What are the 4 types of knock out options we discussed in the course and detail when each ceases to exist. (4 marks) Question 3 (18 marks) Question 3 comprises three parts. Students are to answer ALL parts of this question: a) Using two portfolios derive the put-call parity relationship for European options on stock indices. In doing so, detail the composition of each portfolio and draw a table illustrating the initial and terminal values of the portfolios. (5 marks) b) You have been given the following information about a European put futures option contract. The option has a life of 17 months and the futures contract underlying the option has a life of 18 months. The option has an exercise price of $54, and the current futures price is $38. The risk-free rate of interest is 1.25% continuously compounded. If the put futures option is currently selling for $1.28, identify an arbitrage opportunity, and detail in words how you would make an arbitrage profit. Be sure to draw a table detailing your strategy, indicating the initial and final cash flows of your strategy. Your strategy must realise most of the gains as soon as you execute your arbitrage trades. (9 marks) c) What are the 4 types of knock out options we discussed in the course and detail when each ceases to exist. (4 marks)