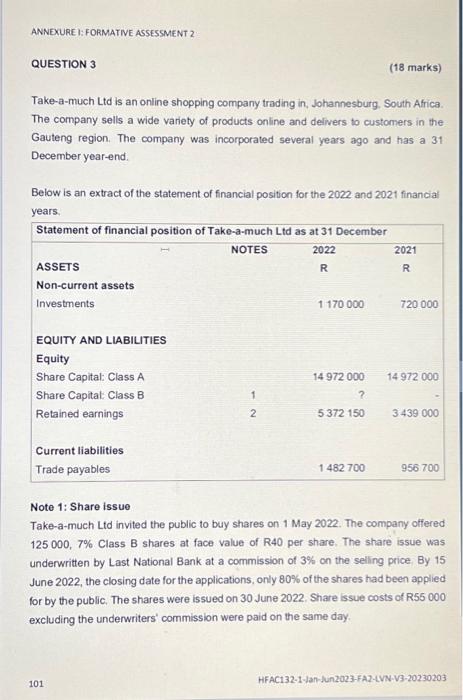

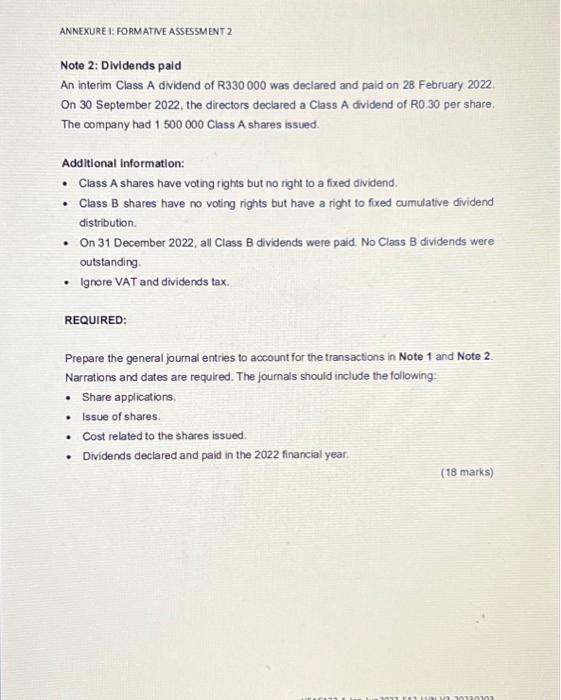

QUESTION 3 (18 marks) Take-a-much Ltd is an online shopping company trading in, Johannesburg. South Africa. The company sells a wide variety of products online and delivers to customers in the Gauteng region. The company was incorporated several years ago and has a 31 December year-end. Below is an extract of the statement of financial position for the 2022 and 2021 financial vasars Note 1: Share issue Take-a-much Ltd invited the public to buy shares on 1 May 2022. The company offered 125000,7% Class B shares at face value of R40 per share. The share issue was underwritten by Last National Bank at a commission of 3% on the selling price. By 15 June 2022, the closing date for the applications, only 80% of the shares had been applied for by the public. The shares were issued on 30 June 2022. Share issue costs of R55000 excluding the underwriters' commission were paid on the same day. Additional information: - Class A shares have voting rights but no right to a fixed dividend. - Class B shares have no voting rights but have a right to fixed cumulative dividend distribution. - On 31 December 2022, all Class B dividends were paid. No Class B dividends were outstanding. - Ignore VAT and dividends tax. REQUIRED: Prepare the general journal entries to account for the transactions in Note 1 and Note 2. Narrations and dates are required. The journals should include the following - Share applications. - Issue of shares. - Cost related to the shares issued. - Dividends declared and paid in the 2022 financial year. (18 marks) QUESTION 3 (18 marks) Take-a-much Ltd is an online shopping company trading in, Johannesburg. South Africa. The company sells a wide variety of products online and delivers to customers in the Gauteng region. The company was incorporated several years ago and has a 31 December year-end. Below is an extract of the statement of financial position for the 2022 and 2021 financial vasars Note 1: Share issue Take-a-much Ltd invited the public to buy shares on 1 May 2022. The company offered 125000,7% Class B shares at face value of R40 per share. The share issue was underwritten by Last National Bank at a commission of 3% on the selling price. By 15 June 2022, the closing date for the applications, only 80% of the shares had been applied for by the public. The shares were issued on 30 June 2022. Share issue costs of R55000 excluding the underwriters' commission were paid on the same day. Additional information: - Class A shares have voting rights but no right to a fixed dividend. - Class B shares have no voting rights but have a right to fixed cumulative dividend distribution. - On 31 December 2022, all Class B dividends were paid. No Class B dividends were outstanding. - Ignore VAT and dividends tax. REQUIRED: Prepare the general journal entries to account for the transactions in Note 1 and Note 2. Narrations and dates are required. The journals should include the following - Share applications. - Issue of shares. - Cost related to the shares issued. - Dividends declared and paid in the 2022 financial year. (18 marks)