Answered step by step

Verified Expert Solution

Question

1 Approved Answer

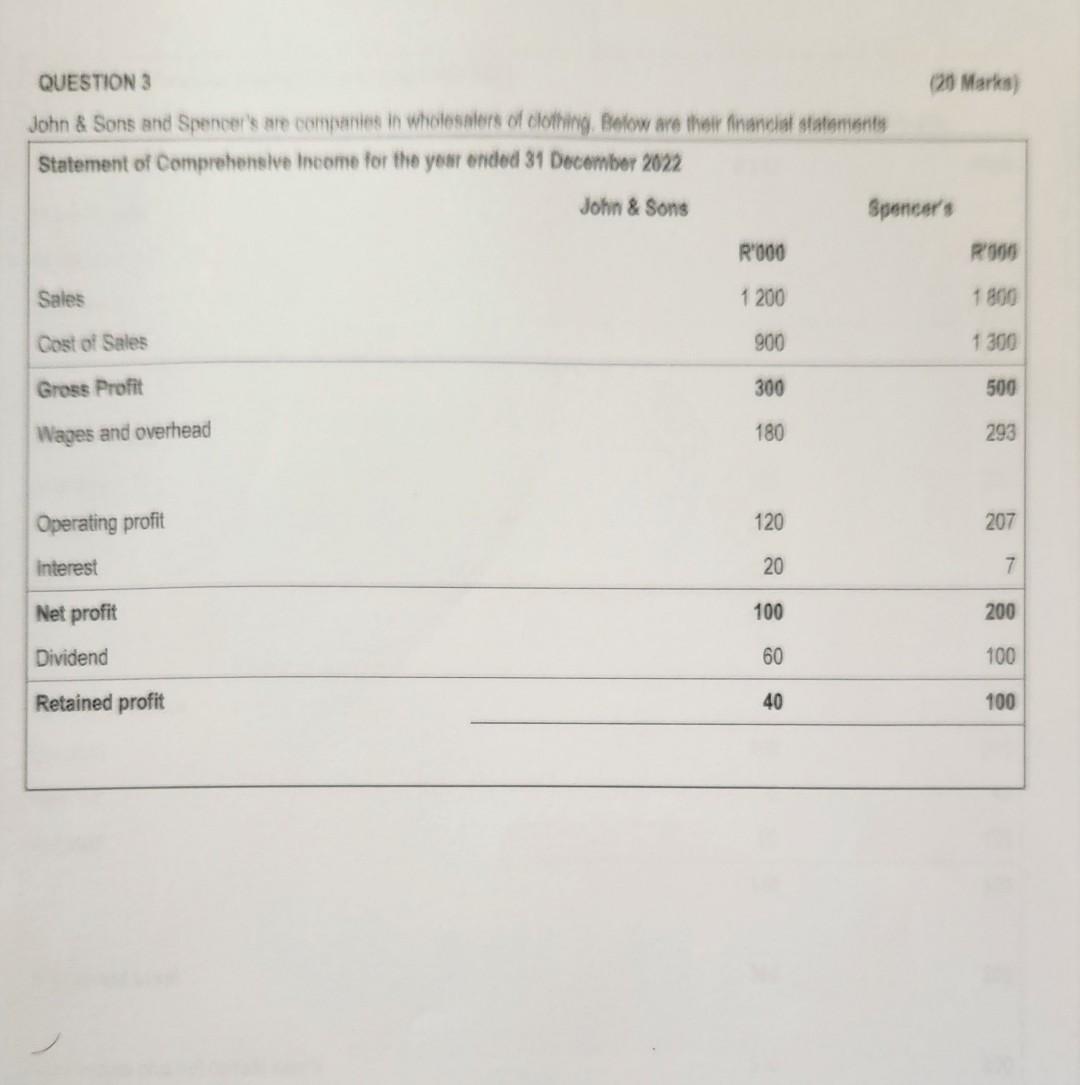

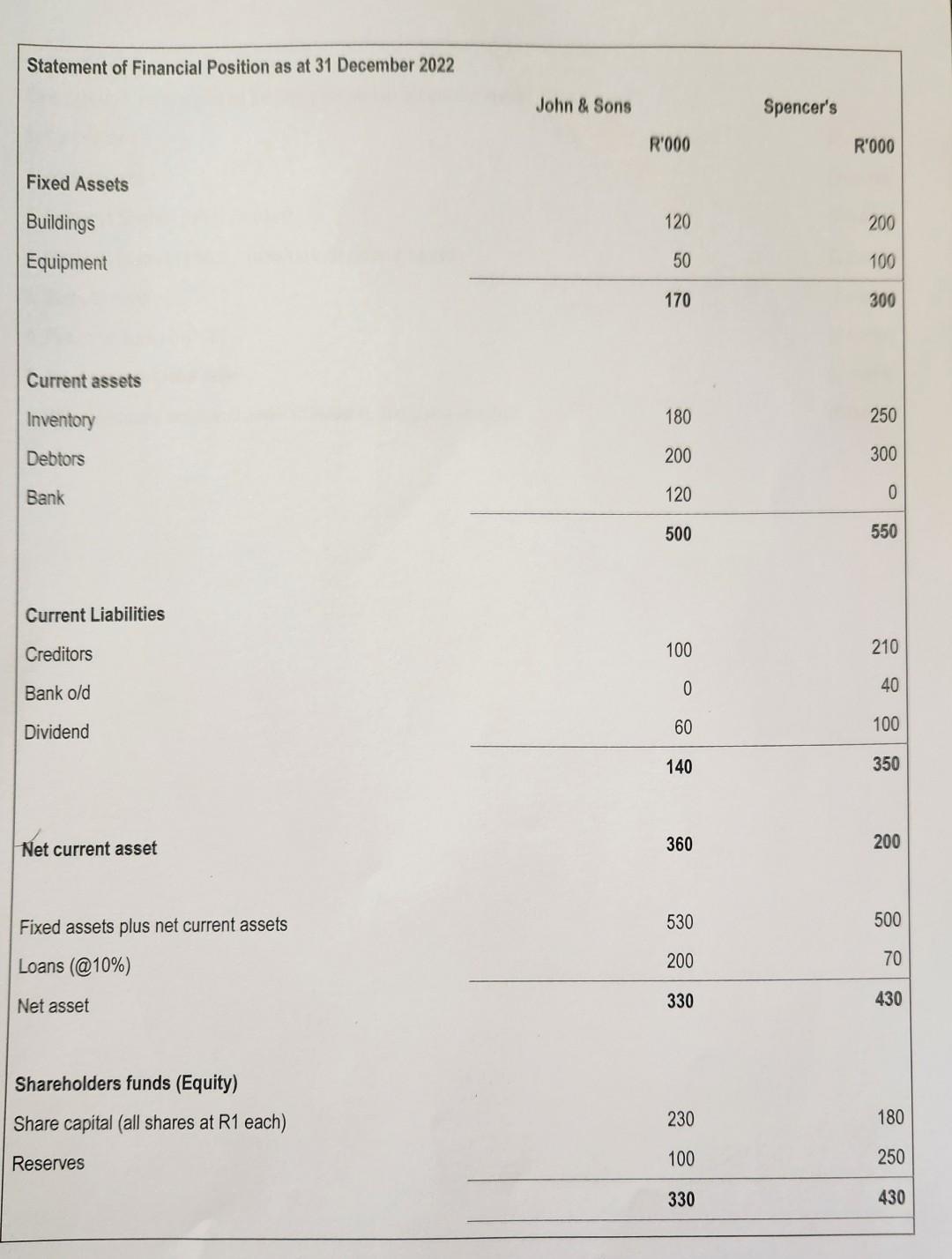

QUESTION 3 (20) Marka) begin{tabular}{|c|c|c|} hline multicolumn{3}{|c|}{ Statement of Financial Position as at 31 December 2022} hline & R000 & R000 hline multicolumn{3}{|l|}{

QUESTION 3 (20) Marka) \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ Statement of Financial Position as at 31 December 2022} \\ \hline & R000 & R000 \\ \hline \multicolumn{3}{|l|}{ Fixed Assets } \\ \hline Buildings & 120 & 200 \\ \hline \multirow[t]{2}{*}{ Equipment } & 50 & 100 \\ \hline & 170 & 300 \\ \hline \multicolumn{3}{|l|}{ Current assets } \\ \hline Inventory & 180 & 250 \\ \hline Debtors & 200 & 300 \\ \hline \multirow[t]{2}{*}{ Bank } & 120 & 0 \\ \hline & 500 & 550 \\ \hline \multicolumn{3}{|l|}{ Current Liabilities } \\ \hline Creditors & 100 & 210 \\ \hline Bank o/d & 0 & 40 \\ \hline \multirow[t]{2}{*}{ Dividend } & 60 & 100 \\ \hline & 140 & 350 \\ \hline Net current asset & 360 & 200 \\ \hline Fixed assets plus net current assets & 530 & 500 \\ \hline Loans (@10\%) & 200 & 70 \\ \hline Net asset & 330 & 430 \\ \hline \multicolumn{3}{|l|}{ Shareholders funds (Equity) } \\ \hline Share capital (all shares at R1 each) & 230 & 180 \\ \hline \multirow[t]{2}{*}{ Reserves } & 100 & 250 \\ \hline & 330 & 430 \\ \hline \end{tabular} Required Calculate and briefly report on the ratios for the two companies above: 1. Current ratio 2. Acid test ratio 3. Debtors collection period (in days) 4. Creditors payment period - (Use the cost of sales figure) 5. Stock turnover 6. Return on equity (ROCE) 7. Asset turnover (Total assets) 8. Which company would you prefer to invest in, and give a reason

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started