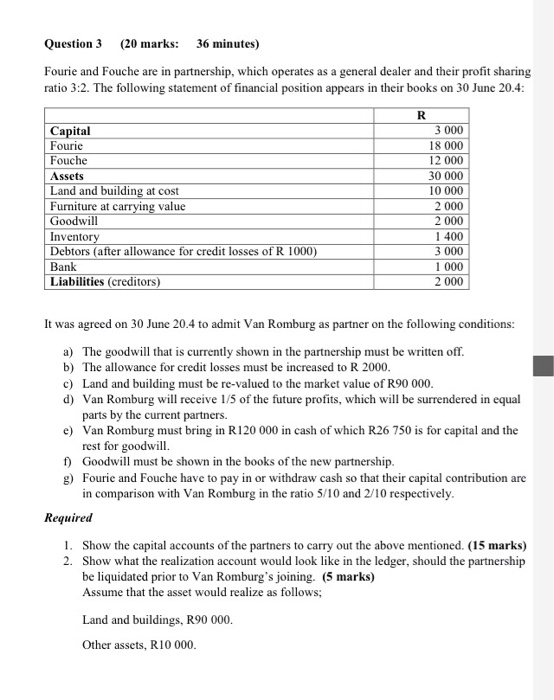

Question 3 (20 marks: 36 minutes) Fourie and Fouche are in partnership, which operates as a general dealer and their profit sharing ratio 3:2. The following statement of financial position appears in their books on 30 June 20.4 Capital Fourie Fouche Assets Land and building at cost Furniture at c Goodwill Invent Debtors (after allowance for credit losses of R 1000) Bank Liabilities (creditors) 3 000 18 000 12 000 30 000 10 000 2 000 2 000 1 400 3 000 1 000 2 000 value It was agreed on 30 June 20.4 to admit Van Romburg as partner on the following conditions: a) The goodwill that is currently shown in the partnership must be written off. b) The allowance for credit losses must be increased to R 2000 c) Land and building must be re-valued to the market value of R90 000 d) Van Romburg will receive 1/5 of the future profits, which will be surrendered in equal parts by the current partners. Van Romburg must bring in R120 000 in cash of which R26 750 is for capital and the rest for goodwill e) f) Goodwill must be shown in the books of the new partnership. g) Fourie and Fouche have to pay in or withdraw cash so that their capital contribution are in comparison with Van Romburg in the ratio 5/10 and 2/10 respectively Required 1. 2. Show the capital accounts of the partners to carry out the above mentioned. (15 marks) Show what the realization account would look like in the ledger, should the partnership be liquidated prior to Van Romburg's joining. (5 marks) Assume that the asset would realize as follows Land and buildings, R90 000. Other assets, R10 000 Question 3 (20 marks: 36 minutes) Fourie and Fouche are in partnership, which operates as a general dealer and their profit sharing ratio 3:2. The following statement of financial position appears in their books on 30 June 20.4 Capital Fourie Fouche Assets Land and building at cost Furniture at c Goodwill Invent Debtors (after allowance for credit losses of R 1000) Bank Liabilities (creditors) 3 000 18 000 12 000 30 000 10 000 2 000 2 000 1 400 3 000 1 000 2 000 value It was agreed on 30 June 20.4 to admit Van Romburg as partner on the following conditions: a) The goodwill that is currently shown in the partnership must be written off. b) The allowance for credit losses must be increased to R 2000 c) Land and building must be re-valued to the market value of R90 000 d) Van Romburg will receive 1/5 of the future profits, which will be surrendered in equal parts by the current partners. Van Romburg must bring in R120 000 in cash of which R26 750 is for capital and the rest for goodwill e) f) Goodwill must be shown in the books of the new partnership. g) Fourie and Fouche have to pay in or withdraw cash so that their capital contribution are in comparison with Van Romburg in the ratio 5/10 and 2/10 respectively Required 1. 2. Show the capital accounts of the partners to carry out the above mentioned. (15 marks) Show what the realization account would look like in the ledger, should the partnership be liquidated prior to Van Romburg's joining. (5 marks) Assume that the asset would realize as follows Land and buildings, R90 000. Other assets, R10 000