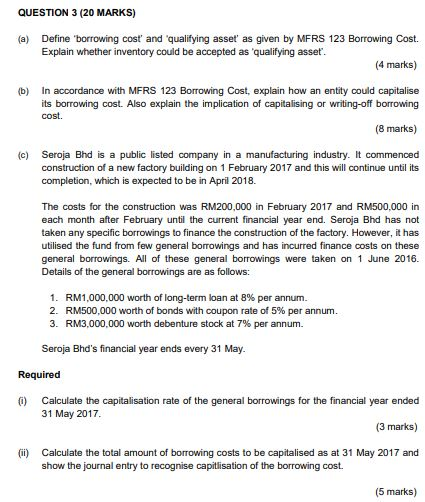

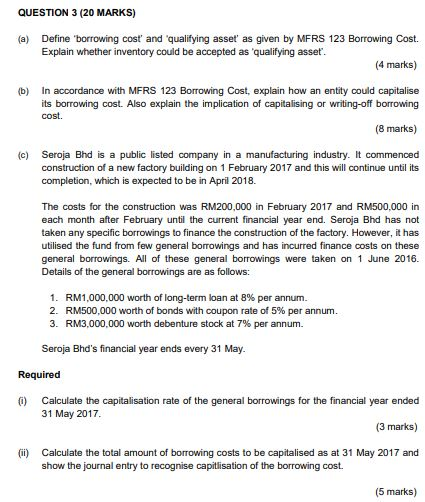

QUESTION 3 (20 MARKS) (a) Define 'borrowing cost and qualifying asset' as given by MFRS 123 Borrowing Cost. Explain whether inventory could be accepted as 'qualifying asset". (4 marks) b) In accordance with MFRS 123 Borrowing Cost, explain how an entity could capitalise its borrowing cost. Also explain the implication of capitalising or writing-off borrowing cost. (8 marks) (c) Seroja Bhd is a public listed company in a manufacturing industry. It commenced construction of a new factory building on 1 February 2017 and this will continue until its completion, which is expected to be in April 2018. The costs for the construction was RM200,000 in February 2017 and RM500,000 in each month after February until the current financial year end. Seroja Bhd has not taken any specific borrowings to finance the construction of the factory. However, it has utilised the fund from few general borrowings and has incurred finance costs on these general borrowings. All of these general borrowings were taken on 1 June 2016 Details of the general borrowings are as follows: 1. RM1,000,000 worth of long-term loan at 8% per annum. 2. RM500,000 worth of bonds with coupon rate of 5% per annum. 3. RM3,000,000 worth debenture stock at 7% per annum. Seroja Bhd's financial year ends every 31 May. Required 0 Calculate the capitalisation rate of the general borrowings for the financial year ended 31 May 2017 (3 marks) (ii) Calculate the total amount of borrowing costs to be capitalised as at 31 May 2017 and show the journal entry to recognise capitlisation of the borrowing cost. (5 marks) QUESTION 3 (20 MARKS) (a) Define 'borrowing cost and qualifying asset' as given by MFRS 123 Borrowing Cost. Explain whether inventory could be accepted as 'qualifying asset". (4 marks) b) In accordance with MFRS 123 Borrowing Cost, explain how an entity could capitalise its borrowing cost. Also explain the implication of capitalising or writing-off borrowing cost. (8 marks) (c) Seroja Bhd is a public listed company in a manufacturing industry. It commenced construction of a new factory building on 1 February 2017 and this will continue until its completion, which is expected to be in April 2018. The costs for the construction was RM200,000 in February 2017 and RM500,000 in each month after February until the current financial year end. Seroja Bhd has not taken any specific borrowings to finance the construction of the factory. However, it has utilised the fund from few general borrowings and has incurred finance costs on these general borrowings. All of these general borrowings were taken on 1 June 2016 Details of the general borrowings are as follows: 1. RM1,000,000 worth of long-term loan at 8% per annum. 2. RM500,000 worth of bonds with coupon rate of 5% per annum. 3. RM3,000,000 worth debenture stock at 7% per annum. Seroja Bhd's financial year ends every 31 May. Required 0 Calculate the capitalisation rate of the general borrowings for the financial year ended 31 May 2017 (3 marks) (ii) Calculate the total amount of borrowing costs to be capitalised as at 31 May 2017 and show the journal entry to recognise capitlisation of the borrowing cost