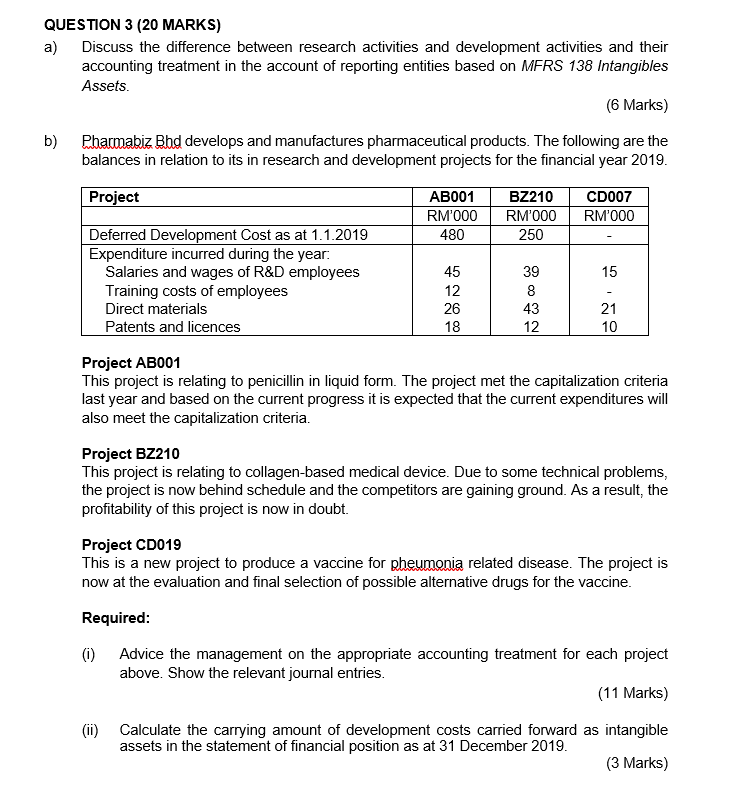

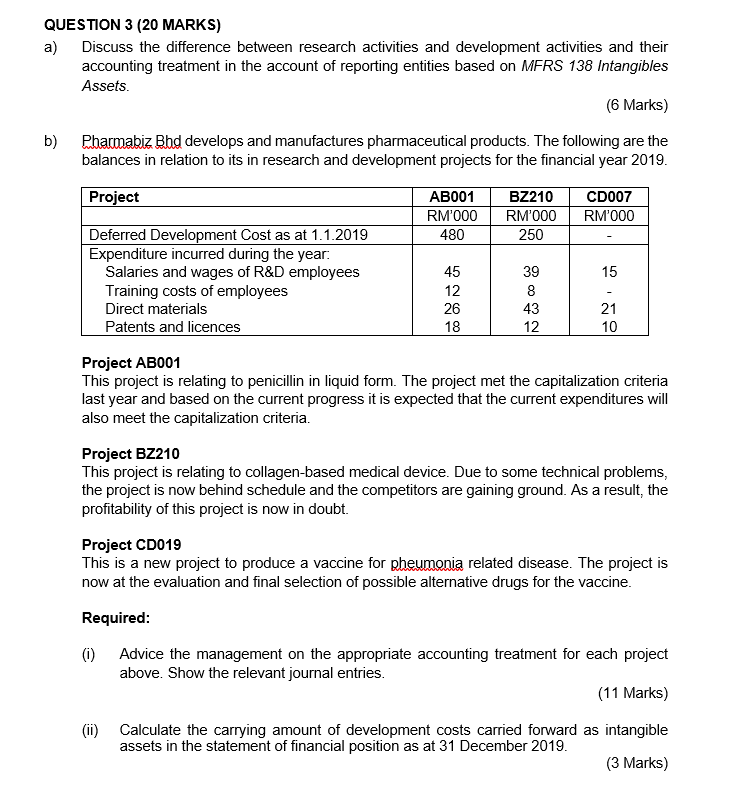

QUESTION 3 (20 MARKS) a) Discuss the difference between research activities and development activities and their accounting treatment in the account of reporting entities based on MERS 138 Intangibles Assets. (6 Marks) b) Pharmabiz Bhd develops and manufactures pharmaceutical products. The following are the balances in relation to its in research and development projects for the financial year 2019. Project AB001 RM'000 480 BZ210 RM'000 250 CD007 RM'000 15 Deferred Development Cost as at 1.1.2019 Expenditure incurred during the year. Salaries and wages of R&D employees Training costs of employees Direct materials Patents and licences 45 12 26 18 39 8 43 12 21 10 Project AB001 This project is relating to penicillin in liquid form. The project met the capitalization criteria last year and based on the current progress it is expected that the current expenditures will also meet the capitalization criteria. Project BZ210 This project is relating to collagen-based medical device. Due to some technical problems, the project is now behind schedule and the competitors are gaining ground. As a result, the profitability of this project is now in doubt. Project CD019 This is a new project to produce a vaccine for pheumonia related disease. The project is now at the evaluation and final selection of possible alternative drugs for the vaccine. Required: (i) Advice the management on the appropriate accounting treatment for each project above. Show the relevant journal entries. (11 Marks) (ii) Calculate the carrying amount of development costs carried forward as intangible assets in the statement of financial position as at 31 December 2019. (3 Marks) QUESTION 3 (20 MARKS) a) Discuss the difference between research activities and development activities and their accounting treatment in the account of reporting entities based on MERS 138 Intangibles Assets. (6 Marks) b) Pharmabiz Bhd develops and manufactures pharmaceutical products. The following are the balances in relation to its in research and development projects for the financial year 2019. Project AB001 RM'000 480 BZ210 RM'000 250 CD007 RM'000 15 Deferred Development Cost as at 1.1.2019 Expenditure incurred during the year. Salaries and wages of R&D employees Training costs of employees Direct materials Patents and licences 45 12 26 18 39 8 43 12 21 10 Project AB001 This project is relating to penicillin in liquid form. The project met the capitalization criteria last year and based on the current progress it is expected that the current expenditures will also meet the capitalization criteria. Project BZ210 This project is relating to collagen-based medical device. Due to some technical problems, the project is now behind schedule and the competitors are gaining ground. As a result, the profitability of this project is now in doubt. Project CD019 This is a new project to produce a vaccine for pheumonia related disease. The project is now at the evaluation and final selection of possible alternative drugs for the vaccine. Required: (i) Advice the management on the appropriate accounting treatment for each project above. Show the relevant journal entries. (11 Marks) (ii) Calculate the carrying amount of development costs carried forward as intangible assets in the statement of financial position as at 31 December 2019